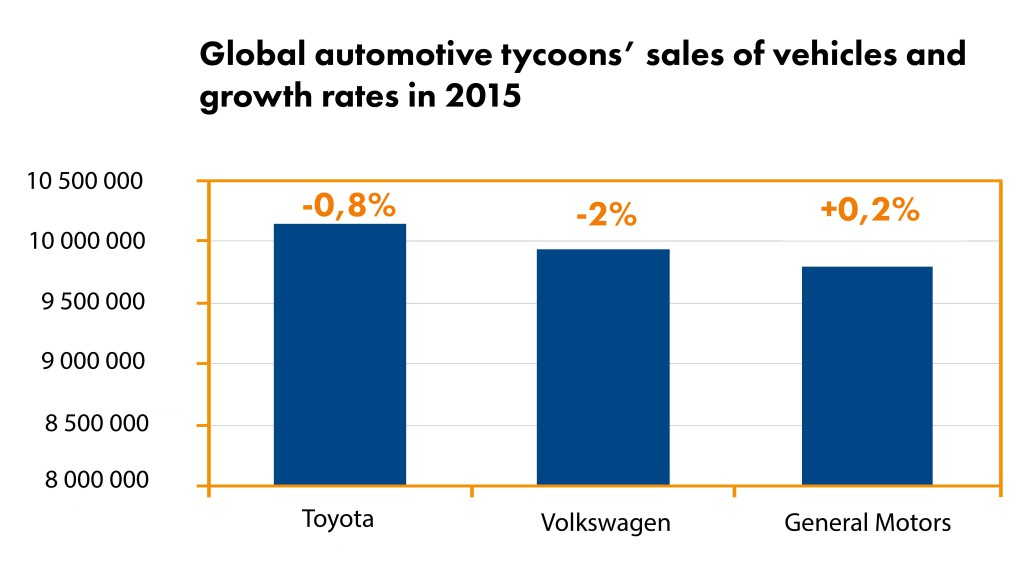

About 90 million cars were sold in 2015, roughly one-third of them drove out from the factories of three automotive giants: Toyota, Volkswagen, and General Motors. The brands belonging to these companies constitute also the major part of the Chinese market, the biggest car market in the world, where 21 million passenger vehicles were sold in 2015. But as we know, Chinese economy may be in trouble soon or even already is. So it is crucial to know how much Toyota, VW and GM are exposed to China’s possible turmoil.

About 90 million cars were sold in 2015, roughly one-third of them drove out from the factories of three automotive giants: Toyota, Volkswagen, and General Motors. The brands belonging to these companies constitute also the major part of the Chinese market, the biggest car market in the world, where 21 million passenger vehicles were sold in 2015. But as we know, Chinese economy may be in trouble soon or even already is. So it is crucial to know how much Toyota, VW and GM are exposed to China’s possible turmoil.

China’s growth in car sales slowed in 2015 to 7,3%, down from 10% in 2014 and 16% in 20131. The Chinese slowdown is visible even in the automotive market which is struggling with high overcapacity. More about this problem and possible consequences of changes in the automotive industry will be published in the February issue of Gefira Anticipation Bulletin, available on this website.

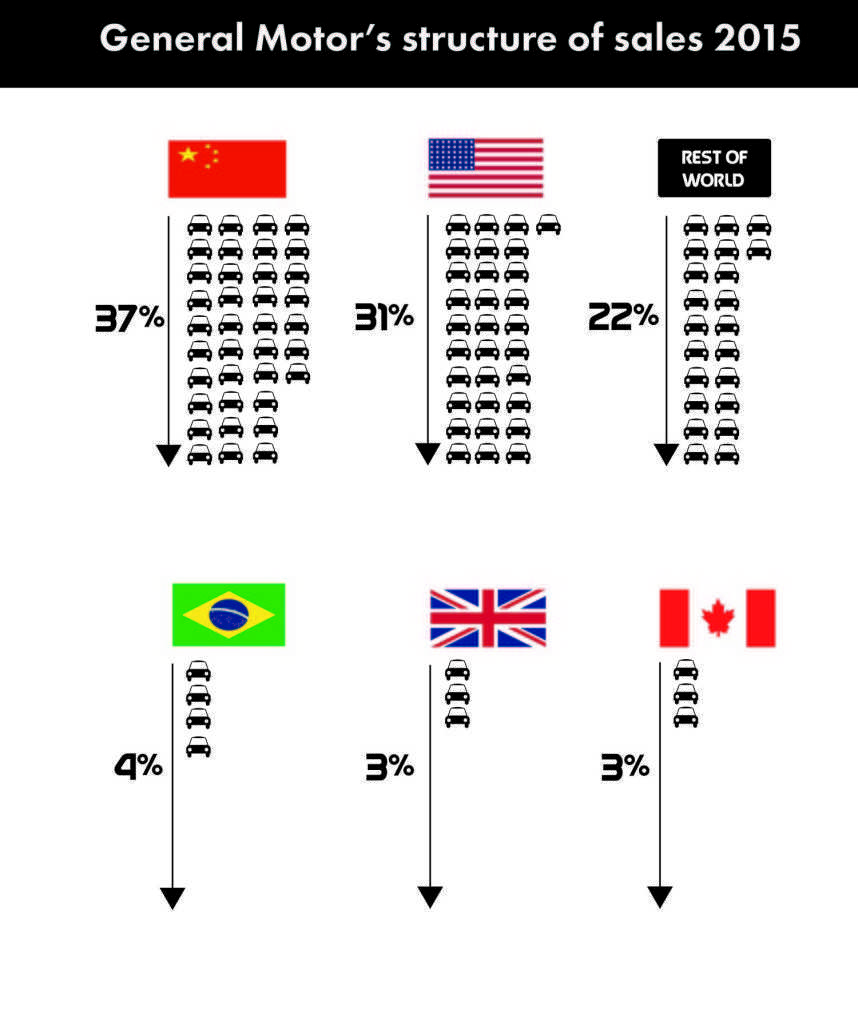

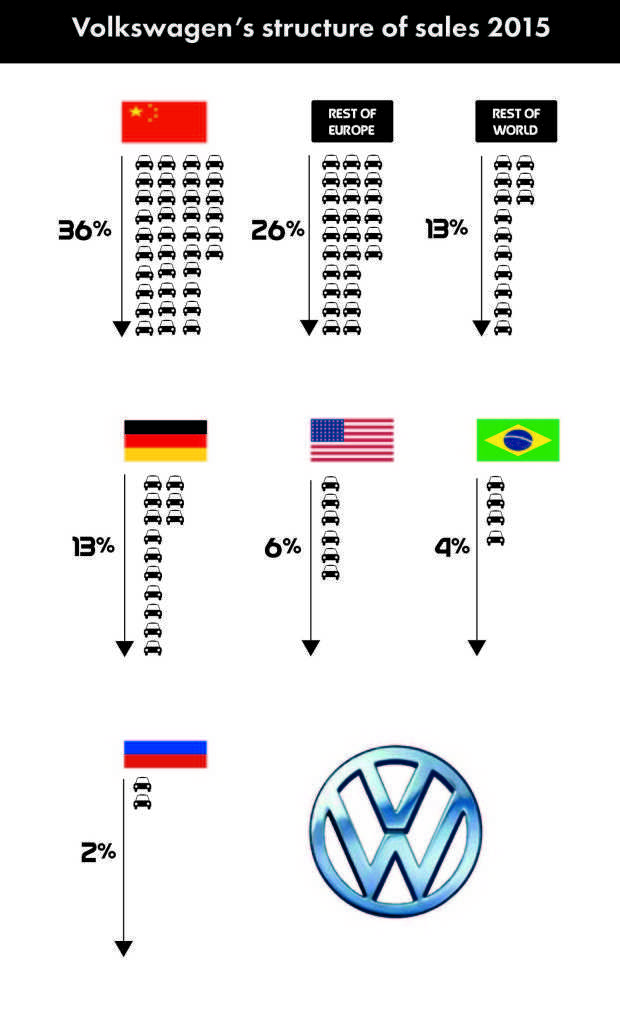

Judging by the data disclosed by the companies, China makes the biggest market for GM. The Detroit-based manufacturer sells there 37% of its yearly production. The second most important market for GM is its home market, the USA (31%), which sets a new record in sales (17,5 milion) because of not eternal car loan boom. Volkswagen’s structure of sales is not less vulnerable. The whole of struggling Europe accounts for 39% of the German tycoon’s sales, with 36% being made in China. Moreover, markets like Russia and Brazil, being already in recession, are also an important destination of automotive production, not only for VW.

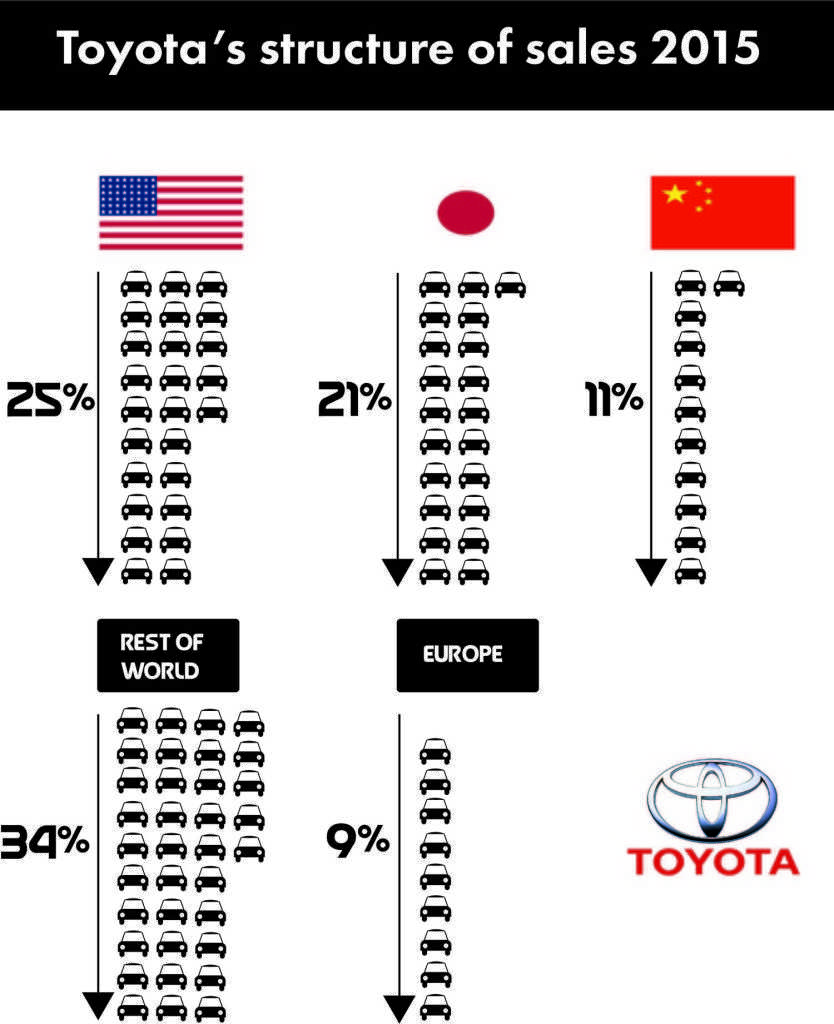

About three out of four globally produced cars are sold in four markets: China, USA, Europe and Japan. If we look at the sales structures alone, that of Toyota seems to be most healthy because neither of these economies absorbs more than 25% of Toyota’s production. The quantitative diversification of sales (in car units) does not tell us everything, though. Valuable sales structures might prove to be more important, but the income statements where more information on it could be gathered are yet to be published.

References:

- China Car Sales Growth Slows Further Source: The Wall Street Journal 2016-01-12