The order of the current problems laid down below is random. Hard to say which factor will be the next catalyst. Maybe all or several at the same time? Decide for yourself.

1. Unresolved political conflicts. Ask yourself: which conflicts have been finally resolved since the 2007 crisis? In the Middle East? In the Balkans? In the former Soviet Union? (in Ukraine, the proxy war of the EU against Russia?) In Afghanistan, Pakistan, Libya? In Sudan? There is no end to this list. The UNO, NATO, the international coalitions for the “defence of human rights” or interventions of the major powers for the defence of their own interests in a region (e.g. Russia and the USA in Syria) only bring more unrest and destabilization in the individual regions and cost the Western world pots of money. Aggressive foreign policy by the great powers and threats to geopolitics will continue to put a massive strain on the world’s economy and pose a risk to investors.

2. The most powerful countries in the world have been arming themselves for years. World military spending increased by 2.6 percent last year to around $1.82 trillion – a new high since 1988. The mainstream media, unlike in the sixties of the last century, are reluctant to talk about the new Cold War because they are fully engaged in creating the delusion of a united, peaceful humanity.

3. Since its inception, Marxism has been an ideology that has not inscribed itself as anything positive in the history of any country. Because of Marxist ideas, more than 100 million people died in Europe in the 20th century (according to the calculations of the French historian Stéphane Courtois).1)200 Jahre Marx, 100 Millionen Tote, Weltwoche 2018-05-08.The Western elites remain untouched by this and continue to pay homage to the fathers of destruction,2)EU chief Juncker celebrates Karl Marx’s birthday paid by Chinese communists, Gefira 2018-05-11.using their language, their ideas, speaking of internationalism, equality of all peoples and races, unification of all nations, support for the poor, who are supposed to reach the same level as the rich, support for the people who disregard the genuine values of Western civilization (LGBT and the new letters constantly being added). Citizens of EU countries and others who do not believe in the harmfulness of such ideology should rather take to heart the latest communist miracle – Venezuela. Otherwise they will soon be painfully confronted with the consequences of the immigration policy, the green lie, the wrong social policy, which does not care about just redistribution of wealth and the whole wrong foreign and energy policy of the left-green scene. Even now, the middle and lower classes in France, Italy and other countries are suffering because of the left-green ideology that for years has been causing their purchasing power and standard of living to fall (see Yellow Vests).

4. The people who have been a major force for the development of the modern world for 200 years, the white people in Europe,3)Bis 2080 werden die Italiener eine Minderheit im eigenen Land sein, Gefira 2018-01-18; Bis zum Jahrhundertende werden 22 Millionen Deutsche übrig bleiben, Gefira #22.America, Russia and South Africa, and the indigenous peoples of the most creative nations in Asia – Japan and South Korea – are shrinking. The new patents, scientific discoveries and industrial innovations will not come from Africa or Southeast Asia; the immigrants will, without, however, exerting a positive influence on the development of Western thought.

5. Many countries are replenishing their gold reserves. Especially China, Russia and Turkey. All three countries will become independent of the dollar in the near future. They must be able to defend the value of their currencies in the event of the next conflict, which is why they are increasing their reserves of the yellow metal. As the next crisis approaches, the price of gold also rises.

6. Cryptocurrencies are gaining in importance as safe havens; large corporations (Facebook and Amazon) and states (Venezuela) are also creating new cryptocurrencies, which can be interpreted as distrust of the existing financial system, which may soon collapse.4)Warum wir in einer finanziellen Bredouille landen werden, Gefira #23.

7. The mountain of debt is growing all over the world, the indebtedness of individual countries and their citizens has long since exceeded the criteria set by the IMF and other institutions. Example: “Japan’s national debt is 236.4% of GDP. This means that the entire Japanese economy would have to work for 2364 years in order to completely transfer the proceeds to the creditors of the Japanese state in order to pay off the national debt.”5)Liste der Länder nach Staatsschuldenquote, Wikipedia.While according to the euro convergence criteria the debt should not exceed 60% of GDP, in 2017 the national debt of Greece was 181.8% and that of Italy – 131.8%. The economic crisis in Southern Europe did not end; it was only swept under the carpet for a short time. The global banking system is so closely networked and filled with opaque financial products – even more so than during the 2007 crisis – in which over-indebtedness is hidden that now a small collapse, for example in the Italian banking sector, will drag everyone into the abyss.

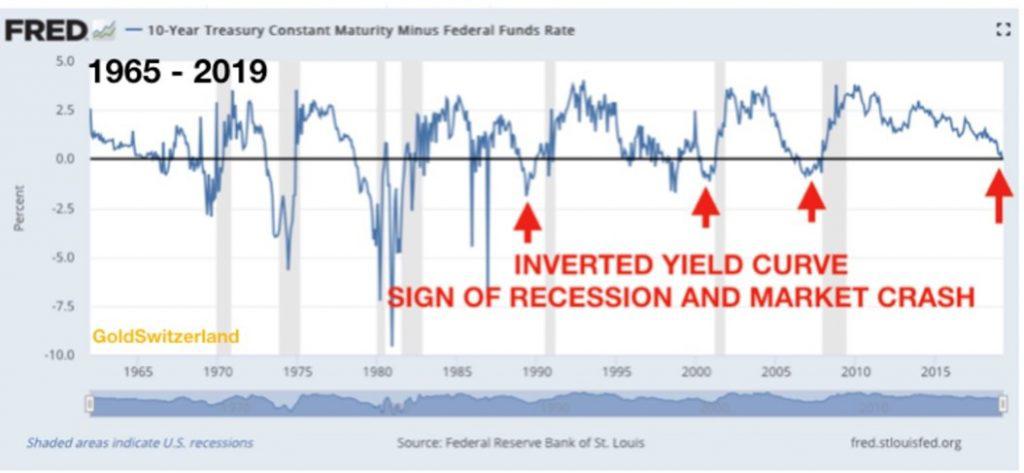

8. A prelude to recession is also the so-called yield curve, which shows the ratio between interest rates on bonds with short and long maturities. At present, the yield curve of US government bonds is inverted, i.e. short-term interest rates rise above long-term, which is considered by economic experts to be one of the safest indicators of future economic weakness.

9. While the stock markets are in euphoria, there are being published the worst indicators of economic activity for years (PMI).6)Enslavement of people through debt is a perfect enslavement, Gefira 2019-06-28.They are doing particularly badly recently in Asia and Australia. South Korean exports have been recognised for years as another early indicator of economic trends and, as they are also falling, this points at least to a recession in world trade.

10. The environment has long since reached the limits of its capacity. For 20 or 30 years, the dirtiest, most polluting, resource- and people-destroying industry has been consistently relocated to emerging countries and the Third World. Now these countries are standing up and no longer want to be trash cans and cheap producers on the planet. In 2016, the EU shipped 1.6 million tons of garbage to the largest People’s Republic of Asia, and now the government in Beijing no longer wants to take over the garbage dumps from the West.7)China will Europas Müll nicht mehr, Tagesschau 2018-04-18.The environmental problems in China will affect entire value chains all over the world.

11. The world’s water reserves are shrinking. Global freshwater consumption will increase by 300% in the next 30 years. In the year 2025, 3.1 billion people will be affected by water shortages.8)Fakten zur globalen Wasserversorgung, WIR – Water Is Right.The battle for water is the background to many political and ethnic conflicts (see Israel and Palestine, Sudan and other African countries). Global warming has been affecting agricultural production in Europe, Russia, Brazil and the USA for years. As a result, the prices of food and tap water are rising, which in the long run will lead to protests and conflicts. In Detroit alone, the cost of unpaid water bills was 89 million dollars by 2014.9)Wie Millionen Amerikaner ohne Wasser leben, Süddeutsche 2017-11-13.

12. The ECB and the Central Bank of Japan have reached the limits of their stimuli. They are left with only tricks, such as the introduction of the minus interest rate,10)Gläserne Bürger, Minuszinsen und andere verrückte Ideen der Wirtschaftsexperten, Gefira 2017-12-15.which will ruin pensioners’ savings. Why is Mario Draghi talking about lower interest rates and other ECB stimuli now that the European economy is supposedly flourishing? Is he feeling the coming crisis?

13. It’s not about being clairvoyants. It’s about learning from history. What does the record of economic cycles show us? An amazing fact. We are in the middle of the longest economic boom in history. Is it not wishful thinking that it will continue for a long time to come?

References

| 1. | ↑ | 200 Jahre Marx, 100 Millionen Tote, Weltwoche 2018-05-08. |

| 2. | ↑ | EU chief Juncker celebrates Karl Marx’s birthday paid by Chinese communists, Gefira 2018-05-11. |

| 3. | ↑ | Bis 2080 werden die Italiener eine Minderheit im eigenen Land sein, Gefira 2018-01-18; Bis zum Jahrhundertende werden 22 Millionen Deutsche übrig bleiben, Gefira #22. |

| 4. | ↑ | Warum wir in einer finanziellen Bredouille landen werden, Gefira #23. |

| 5. | ↑ | Liste der Länder nach Staatsschuldenquote, Wikipedia. |

| 6. | ↑ | Enslavement of people through debt is a perfect enslavement, Gefira 2019-06-28. |

| 7. | ↑ | China will Europas Müll nicht mehr, Tagesschau 2018-04-18. |

| 8. | ↑ | Fakten zur globalen Wasserversorgung, WIR – Water Is Right. |

| 9. | ↑ | Wie Millionen Amerikaner ohne Wasser leben, Süddeutsche 2017-11-13. |

| 10. | ↑ | Gläserne Bürger, Minuszinsen und andere verrückte Ideen der Wirtschaftsexperten, Gefira 2017-12-15. |

3 comments on “State of the Globe: 13 Facts: why the next crisis is inevitable”

You’ve left one more option out: corporate feudalism, or no major wars but takeover of the world by top corporations, which has already taken place.

Social credit system, robotic surveillance, The Matrix corpses of men who’d never let go, etc. It is coming soon.

las fuertes compras de china desde el año 2000 y el grand aumento desde el 2008 junto con Rusia y ahora los bancos centrales comprando oro, desde que el banco internacional de pagos publico el 29 de marzo la adquisición de oro por los bancos.

un seguimiento del oro nos anticipara acontecimientos.

add 13 facts why the next crisis can be avoided and your article is perfect. quality naturalism, does anyone real ly pay for this crap?