Alarms about the threat of war in Transnistria, have been repeatedly sounded in recent days by government officials and media in Transnistria, as well as the de facto state’s main sponsor, Russia.Two weeks ago Ukraine canceled the agreement that allowed Russia to supply its roughly 1,500 troops stationed in Transnistria through Ukrainian territory. Source Eurasianet

Author: The Board

In response to claims that Turkey would be conducting a cross-border military operation in Syria, the Turkish foreign minister said any necessary announcements about the issue would be made after the National Security Council (MGK) meeting, which will be held June 29. Source Hurriyet Daily

This week 11.3 million European citizens will discover that their Euro’s have disappeared overnight as a part of Europe’s Banking system collapse. Not only private banks in Greece are unable to cope with the situation but also a part of the European System of Central Banks has stopped functioning.

The fallout will not be restricted to direct loses but also include indirect loses due to political upheaval.

The Greek debt of around 370 Billion Euro’s is primarily held by institutions as the IMF (10%), Euro-Area Governments (62%) and (8%) by the ECB.

16% is probably held by private investors like Japonic Partners and Paulson & Co.

The direct loses of banks outside of Greece are limited, however the indirect damage will be tremendous. Investors and bankers will discover that the public and political support for the European Financial Stability Facility (EFSF) has been evaporate.

The indirect fallout will be immense and could trigger a worldwide financial and political crisis.

Capping off eight days of negotiations, Warner Bros. has won a bidding war for Houses of Deceit, a book by BuzzFeed investigative reporter Ken Bensinger that is being seen as the definitive account of American FIFA exec Chuck Blazer and his role in the corruption scandal. Source The Hollywood Reporter

Countries in the Gulf Cooperation Council (GCC) region, including the UAE and Saudi Arabia, stand to lose $240 billion in hard-earned assets in 2015 if oil prices will remain at low levels, or average at $55 per barrel, for the rest of the year, an economist at a local bank said. Source Gulf News

Legal and diplomatic obstacles to deploying Canadian military trainers in Ukraine have largely been cleared away.

Near the Polish border roughly 200 combat instructors will set up shop in the coming weeks. Both the U.S. and Britain have been at the training grounds, running hundreds of Ukrainian national guardsmen through military courses. Source The Star

China’s banking regulator said on Friday that it will permit the establishment of more privately-owned banks and allow foreign investors to participate in the reform process to help shore up the state-dominated financial sector. Source Reuters

Some say the world in between 1991 and 2022 was a unipolar world, while prior to that time it had been a two-polar world, and after 2022 it has again become a two- if not or multi-polar world. Wrong. We have always had a bi-polar world and this bipolarity has always been viewed religiously. Surprised?

The world has always been divided – politically speaking – into us and them, into the in-group and the out-group, and – religiously speaking – the world has always been arranged along the axis of heaven and hell, Olympus and Hades, God and Satan. In the antiquity it was Greece and the rest of the world – the barbarians. Then it was the Roman Empire and the rest of the world – the barbarians. Then it was Christianity and the rest of the world – the pagans, the heathens. Starting with the the Enlightenment it was civilization against savages and cannibals. Today it is democracy against autocracy, despotism, fascism – you name it.

It has always been arranged along this religious axis: Mount Olympus, seat of the gods, the seat of those who are always right; at the foot of Olympus flocks of divine servants (quasi saints), demigods or heroes. And then, vertically opposite Olympus we have Hades or Hell, with Satan and his helpers – lesser devils or demons. In between we have the earth’s nations that are torn between the two.

Yes, you guessed it right. From the West’s perspective Washington is Olympus while the successive presidents are incarnations of Zeus, God himself, holding up a torch of all virtues with which they try to illuminate the world. Zeus is accompanied by helpmates – assistants – smaller gods and demigods or – to use Christian terminology – (patron) saints who are assigned diverse tasks. These are all the countries that make up the collective West: Europe, Canada, Australia and New Zealand. Smaller gods, demigods or saints are not by any means equal in their clout and leverage: unquestionably France or the United Kingdom are higher up in the celestial hierarchy than Poland or Bulgaria. And there are – mind you! – individual nations that spend time in purgatory, individuals – nations – countries – that aspire to be admitted in the celestial circles but need yet to be cleansed of their sins. Serbia might be regarded as such an entity or Georgia.

Then we have hell, hades, the underworld of evil, wickedness and what not. Russia is present-day Satan while China impersonates Mephistopheles, with Belarus, North Korea, Iran and some others being assigned the roles of smaller princes of darkness, demons or moral counterparts of demigods or saints. The world is really arranged along the lines of this simple axial design of plus and minus, of good and evil, of the good ones and the bad ones, of saints and demons.

No need to add those who are viewed through the Western lens as demons and devils have an entirely opposite perspective in which the positive and the negative poles are reversed, in which the alleged Satan is God and the alleged God is Satan. There can be no reconciliation between the two. It is a struggle for life and death, a conflict of cosmic dimensions, with no compromise possible, no give-and-take attitude, with no middle ground. The feud is as cosmic as cosmic can be. There can be no rapprochement between God and Satan.

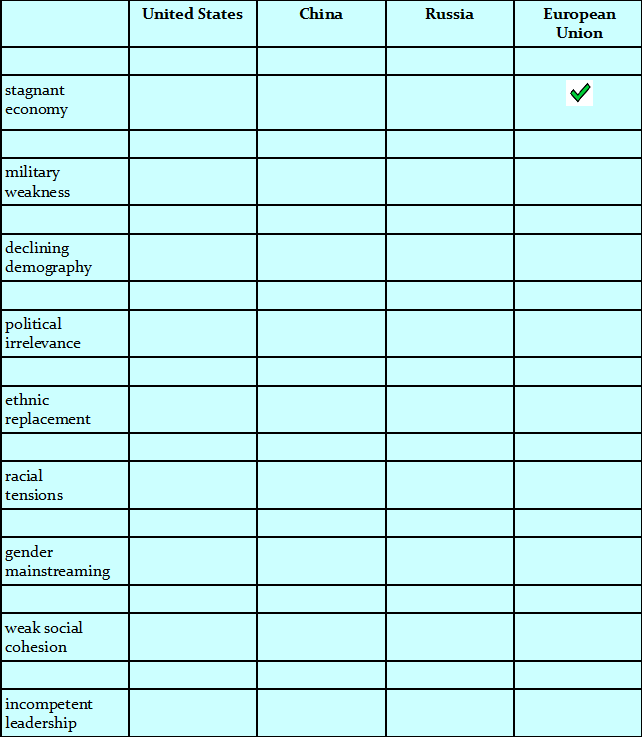

Rather than being presented with the data or an opinion of an expert or a pundit, we invite you to make your own evaluation of the state of the affairs. Drawing on your knowledge, tick off the boxes wherever you see fit and arrive at your own conclusions.

– What would you say about the entity that has gathered the largest number of ticks?

– What would you say about the entity that has gathered the smallest number of ticks?

Let us know.

In case you were wondering, a political entity may be ill-served by the international law once it becomes a signatory to it. In the power struggle that has always taken place and continues to take place, also the most noble ideas – like the introduction of international law – are wielded in the hands of politicians as weapons. You need to be on your guard also – or especially – when you are asked to agree to a piece of legal text to be later bound by it. Take the provision that makes culpable the party which begins a military aggression. Is that an irreproachable provision? At the face of it, we tend to answer approvingly. Yes, aggressors need to be condemned and need to be prevented from acting. Consequently, signatories to such a provision tend to think that this piece of legislations will serve them right. Not by any means!

One of the signatories may figure out the following: we can carry out attack after attack and so long as it is no physical – military attack – we are not going to be labelled as aggressor, while the other party is going to sustain political and economic or social losses. Thus, such attacks are carried out by one party to the detriment of the other party. Party A begins poking Party B in the eye, in the stomach, in the arm, Party A launches verbal attacks and only waits for Party B to either patiently accept such blows and sustain further losses or punch back. In either case Party A is holding the winning hand. It either continues tormenting its opponent, or provokes the opponent into pouncing back, in which case the opponent is internationally recognized as an aggressor. A nice legal trap.

Picture to yourself an ordinary circumstance: you intend to behave in a peaceful manner but someone keeps verbally abusing you, keeps ridiculing you and poking you now and again. We all understand: even if your patience and self-control equals that of an angel, sooner or later (some sooner, some later) you will punch back, and that’s it: you become an aggressor!

A wise man said: war ought not to be blamed on the one who began it, but on the one who made it unavoidable.

The economy is overheated. Or perhaps underheated? Efficiently networked or shackled by fragile supply chains? How can you not lose in a trade war and how can you make money in a conventional war? But only effectively and in the spirit of ESG (taking into consideration environmental, social, government facets). We will be saved by technology, the educated proclaim. Artificial intelligence will destroy us, proclaim the apostles of mainstream wisdom.

In 2024, for the first time in human history, elections will be held in 76 countries with more than half the world’s population, including eight of the ten most populous countries in the world: India, the United States, Indonesia, Pakistan, Brazil, Bangladesh, Russia and Mexico. Every second adult on our globe will be taking politicians to task for the way they have governed in a time of decline, inflation, bloody conflict and widespread disinformation. In place of the shocks that tested the maturity of the political class, more black swans are sure to appear. There has been a pandemic, there is a war in Europe and, to make the end of 2023 even more stark, there is the eruption of a dormant volcano of savagery in the Middle East. The smaller, smouldering armed conflicts that have been going on for years are no longer noticed because they are no longer on our holiday or business agenda. On the other hand, we suppress the threat of war either unintentionally or deliberately.

It will be a year brimming with surprises, in which more than 4 billion voters worldwide will dance to the tune of the new media. Never before has social media been better placed to politically dominate such a large public sphere and supplant the authority of traditional mass media. This seemingly most democratic form of direct contact with the electorate has simultaneously become fuel for manipulation, disinformation, panic and the stigmatisation of opponents. Opinion leaders on Twitter now have infinitely more power to reach and mobilise the electorate than the dinosaurs of old-fashioned campaigning methods. Unverified sources of knowledge, non-existent opinion leaders, ubiquitous fake news driven by the vast capabilities of artificial intelligence…

On Europe’s socio-political radar, the boats of another violent wave of migration can be seen. The EU is supposedly testing new instruments to send people back to where they came from. However, they will prove to be as ineffective as all the previous ones. You don’t have to be a fortune teller to predict this. The EU’s external borders should be impermeable to migrants and solidarity regulations will only deepen the divide between Western and Eastern Europe because coherent Eastern European countries with their traditional societies did not and do not want immigrants.

The countries where elections will be held in 2024 generate more than half of global GDP. This is where the partners and customers who supply us create, produce and employ: with components, raw materials, food, services and expertise. And this is precisely where the economic systems will have to drift to the right or left. And you, as an entrepreneur, have to ask yourself the question: do you prefer a free market that leans to the right or to the left?

Whether we like it or not, we are living in interesting times.

The text might as well be titled China and the USSR or India and the USSR or, or, or. You will soon know why.

The nation of Kurds numbers some 40 million people of which an estimated 14-15 million live in Turkey (10 million – in Iran, 6 million – in Iraq and 2 million – in Syria). Turkey’s overall population amounts to 85 million, so Kurds make up a fifth of it. What’s even more important, they occupy an area in Turkey that is all-Kurdish (just as is the case in corresponding regions in neighbouring Iran, Iraq and Syria). Kurds, therefore, ought to have their own national state, an independent state, carved out of the pieces of territory inhabited by them in the four countries aforementioned. Why, the United Nations pursues the principle of the self-determination of nations (ha! ha! – when did you last hear about a dependent nation being able to win independence in keeping with this principle that is enshrined by the United Nations?) Understandably, none of the countries that have large Kurdish minorities has any intention to even theoretically consider ceding a part of their territory to the nation of Kurds and letting them have their own independent state. Why understandably?

Kurdish-inhabited areas in the Middle East (Wikipedia)

Because in politics and generally among people it does not pay to be magnanimous, to be friendly, to be evangelically meek. If the meek shall possess the earth, then maybe in afterlife. Case in point? The USSR.

After four decades of the Cold War, the formidable Soviet Union, an empire that everyone reckoned with and respected if not feared, that empire surrendered to the West, its opponent, almost unconditionally, just like the Third Reich in 1945, with this significant difference, however, that the Soviet Union showed good will without being shelled into Stone Age and thus compelled to lay down its arms. The capitulation was complete:

[1] the military block of the USSR’s satellite states was dissolved;

[2] the economic union of the USSR’s satellite states was disbanded;

[3] the Marxist-Leninist ideology – the driving force behind Soviet policy-making – was abandoned entirely and condemned;

[4] the Union of the Soviet Socialist Republics was disunited, disassembled (though a referendum held prior to that event showed that the majority of the USSR citizens did not want it) and new independent states emerged;

[5] capitalism was invited to all former socialist countries and replaced socialist economy;

[6] the Soviet past was in the years to come savaged in the media, lambasted in the educational system and bad-mouthed in the entertainment;

[7] post-Soviet elites bent over backwards to please their Western partners;

[8] almost everything of value was privatized, which is another phrase to say: sold to Western companies.

Good will and meekness. Yet, to paraphrase Saint Paul, the wages of good will and meekness is death. In return for their good will and meekness the Russians received:

[1] economic chaos;

[2] domestic terrorism and wars with national minorities;

[3] the ever-growing expansion of NATO, encircling their territory;

[4] refusal to be accepted to NATO;

[5] refusal to be accepted as equal partners in a world united from Lisbon to Vladivostok, as proposed by Russia’s president;

[6] an inimical Ukraine (apart from the inimical Poland, the Baltic States, Romania and the ever belligerent Caucasus), a Ukraine which was reeducated to hate all things Russian, trained to fight a war against Russia, encouraged to kill Russians (the fourteen(!) thousand in the Donbass region in the years 2014-2022, the fifty or so incinerated in Sevastopol, to name just two cases);

[7] the ongoing proxy war with the West.

Consider the last point. Rather than holding the whole territory of Ukraine with its 50 million(!) people (such was Ukraine’s population in 1991), its agriculture and industry, now Russians must fight them or else the anaconda’s stranglehold around them would soon deprive them of their last breath.

Back to Turkey. Why should Turkey let go of its Kurds, China – of its Uyghurs? Why should India disintegrate into the many states that it is made up of? Why show good will and meekness? The wages of good will and meekness is death. Such must be the inference that the ruling elites of the said countries must have arrived at. Imagine China giving up on Tibet and Uyghurs or Turkey letting go of its Kurds and maybe Armenians… Beijing would soon have a proxy war in its backyard against Tibet or Uyghurs (both supported by the United States), while Turkey – a war against Kurds and Armenians (supported by Iran or Syria).

The West have taught everyone a good lesson: be strong and expand, never give up or else. And remember: the wages of good will and meekness is death.

Putin’s Valdai speech of 5th October, 2023

On 5th October, 2023, Russia’s President Vladimir Putin delivered a speech during a conference of the the 20th convention of the International Discussion Club held in Sochi. His words dealt with the ongoing political events and trends, without however naming names or making a reference to Ukraine. Russia’s president made a pronouncement concerning the West’s ideology and Russia’s stance on it or Russia’s response. The speech may be divided into the part criticizing the West and the part that lays down Moscow’s view of the world politics.

Here’s the anti-Western content:

The Western world, the notion that for all intents and purposes amounts to the Anglophere, in the opinion of the Russian leader and most likely of the Russian ruling elites has a track record of always seeking to dominate the globe, of always wanting to run the show by means of imposing on the other countries rules and principles that they are expected to abide by or else those rules and principles are brought to them with a bludgeon.

The West is always in need of an enemy, a foe, a rogue state because an external enemy serves the purpose of explaining to the populace the internal problems, and because an external, formidable enemy rallies the citizens of a country around their leader or leaders.

The West is run by the elites that do not pursue the interests of their nations; rather, in their self-aggrandizement they are ready to risk the welfare of their nations in an attempt to win dominance in this or other point on the globe.

The West defines an enemy as anyone – a state, country, nation, leader, political entity – who does not wish to follow the West’s dictate, who is not submissive enough, who does not acquiesce to being bossed around, who does not sign on to the idea that there is one global central power and global values to be observed.

President Vladimir Putin then went on to expound the world view represented by the Russian authorities.

First, there is no one civilization engulfing the globe: rather, there are many civilizations, none of them better or worse than the others, and they all deserve to be recognized and respected. Consequently, there are no universal rules to be observed by all humanity, nor can there be a political concept of a global world.

Second, international problems ought not to be solved by a selected group of political dominant entities; nor should they be approached and tackled by all nations: rather, they ought to be discussed and solved by those concerned.

Third, nations should break with this idea imposed by the West of pursuing bloc politics. Nations have their own, individual, separate interests. There are no bloc interests or the so-called bloc interests boil down to being the interests of the bloc’s hegemon.

Fourth. Russia seeks no territorial expansion (that was the only direct reference – although without naming the country – in the speech to the ongoing war in Ukraine); Russia is the largest country on planet earth and for years to come will be busy developing and managing the vast swaths of land in Siberia.

You recognize this fragment, don’t you? Suppose a king is about to go to war against another king. Won’t he first sit down and consider whether he is able with ten thousand men to oppose the one coming against him with twenty thousand? If he is not able, he will send a delegation while the other is still a long way off and will ask for terms of peace. At the outbreak of the hostilities, Ukrainians were very much aware of the proportion of the opposing forces, and so they were willing to negotiate. Such talks even began in Turkey but – lo and behold – Kiev received a command to back out. Now the hostilities are slowly nearing its second year and the number of casualties is rising. More than four hundred thousand (FOUR HUNDRED THOUSAND) Ukrainians are said to have lost their life, but despite these horrible losses and despite the ten thousand being played off against the twenty thousand – to adduce the introductory parable – the war continues and there is no sign of it coming to an end. Why? Do Ukrainians really think they can beat the Russian bear? Do Ukrainians really think they can regain lost territories? Do Ukraine’s Western supporters and guardians really think Ukraine can win and regain its lost territories? Anyone in his right senses cannot believe that, especially high-ranking officials, whether in Ukraine or in the West, because they have all the data and, consequently, they know that ten thousand is fighting a losing battle against twenty thousand. If they know it – assuming we are dealing with people in their rights senses – then why is this war being prolonged?

The war is being prolonged for three reasons, two of which are rather familiar to the reader. One purpose in having this war go on is to weaken Russia as much as possible, to keep it engaged in a conflict, to make Russian president less and less popular among Russians and – maybe? – have the Russian people topple him down. A highly unlikely event, considering the highest approval rates that Vladimir Putin gets as compared to all the other leaders around the globe (Western leaders are credited with less than 50% of approval). The other reason is to deplete American stockpiles of arms so as to have a pretext to replenish them i.e. so that the industrial military complex can have new government lucrative commissions for the production of replacement equipment. There is yet a third important reason why the war – a proxy-war between the United States and Russia – is being prolonged.

Up to February 14, 2022, American troops had carried out military operations or – simply put – outright wars and interventions in very many places of the world, and nowhere did they encounter an enemy to be reckoned with. Whether it was Iraq or Yugoslavia, America’s opponent was significantly weaker, smaller, and usually politically isolated. It is in Ukraine that the American military are encountering an opponent that is a match. It is not only the type and quality of the advanced weaponry that the Russians use, but also the strategy and the tactics that they employ. Americans want to learn about their rival (enemy) as much as possible from the warfare. Ukraine is their laboratory, a military area where a war game is conducted, a war game for real with this precious exception that no American soldier gets killed (save for mercenaries, but that’s a different story). Americans have their advisors there on the ground, they have American mercenaries i.e. American active duty soldiers in disguise, while obliging Ukrainians provide the Pentagon with any and all intel. The war in Ukraine is a huge opportunity to study the Russian army in action. It is a huge opportunity to make Russians reveal the most secret, the most advanced of their weapons. Wars being wars, a hope arises that some of the most advanced types weapons might be intercepted. The reader might recall how the British received the whole V-2 ballistic missile that landed in marshes in occupied Poland and was retrieved, disassembled and documented by the Polish Home Army and then sent in pieces to the United Kingdom by means of a Dakota that flew from southern Italy to Poland and back.

Ukraine cannot win this war, just as ten thousand cannot prevail over twenty thousand. Nor can the collective West win it. Still, the United States can keep one of its global rivals militarily engaged (for more information, see the geopolitical ideas developed by RAND in 61 Gefira Feb 2022), study the Russian strategy and tactics and hope for intercepting as many items of Russian military technology as it is possible. That is why Ukrainians must die.

What if the USSR continued to exist? First, in A.D. 2023 it would not be the same USSR as in A.D. 1989, still less so as in A.D. 1960 or earlier. Everything evolves, so would the USSR and it would have continued to evolve, to change. Consider China, for that matter. The Soviet Union would have been capitalist in all but name with a strong say on the part of the government and the communist(?) party. Since Gorbachev, we would not have had simpletons as leaders like Nikita Khrushchev in the Kremlin. Rather, refined individuals like the said Gorbachev or present-day Putin: i.e. educated men with good manners.

Having said which, let us think about the world A.D. 2023 with the still existing USSR. What would have happened between 1991 (the year of the dissolution of the Soviet Union) and 2023? or – still better, still more relevant – what would not have happened between 1991 and 2023?

1 The Warsaw Pact would have continued to exist, which by itself and in itself means that NATO would not have expanded to central and eastern Europe; which in turn means that no conflict would have been in the making as we can observe it today.

2 Yugoslavia would have continued to exist, and even if it had somehow disintegrated, then peacefully. Certainly, there would have been no bombing of Yugoslavia by West, no civil war, no show trials in the Hague, no murdering of Slobodan Milošević in prison.

3 There would have been no wars in Chechnya: thousands of lives would have been saved.

4 No worldwide covid-occasioned freezing of the world activities would have been feasible. Most probably, the powers that be – those who prepared the covid dress rehearsal (before who knows what?) – would not have even considered imposing that ill-famed worldwide curfew with all others attendant restrictions.

5 All central European countries would still have been part of the “European Union of the East” i.e. the Comecon. The Western European union would not have expanded to the east.

6 Most remarkable: Ukraine would have remained the second most important republic of the Soviet Union. As such:

[a] in 2023, it would have approximately 50 million inhabitants as opposed to the estimated 25 or so million at present;

[b] it would have been highly industrialized; no need for people to flood Europe in search of employment;

[c] 400 thousand Ukrainian men would not have been killed, tens of thousands would not have been maimed or become amputees;

[d] Ukrainian cites, towns and villages would have remained unscathed;

[e] the Ukrainian Soviet Socialist Republic would still possess the Donbass and Crimea.

7 The Baltic States would not have been depopulated as they are now.

8 The managers of the world in the West would not have dropped their masks and would not have:

[a] accelerated the ethnic replacement; and

[b] enforced homosexuality on people at large.

Why? Because during the existence of the Soviet Union both sides tried to convince their own societies and the societies in the opposite political bloc that their system was better, more attractive, more humane. Surely, the open propaganda of homosexuality with all attendant phenomena like encouraging teenagers to take hormone blockers or change their biological sex would have been moderated or even deactivated; surely, the Western managers of the world would not have wanted to show to the central Europeans and the citizens of the Soviet Union how much they despise their own Western nations and how much they want to replace them with aliens.

9 Muammar Qaddafi would not have been toppled; no influx to Europe of people from Africa would have occurred.

10 Most probably Germany would not have been re-united. The existence of East Germany would have influenced the policy-making of Western Germany; since by 2023 travel restrictions would certainly have been loosened, Western Germans might have been able to move to East Germany in an attempt to flee the homosexual propaganda and the ethnic replacement if these had been executed as they are today. Notice that Alternative for Germany is especially popular in the former German Democratic Republic. How much more would it have been popular if that republic had persisted?

11 The Comecon (the eastern version of the EEC or the European Economic Community, the predecessor to the European Union) would have evolved into a rivalry counterpart of the EEC (a miniature of today’s BRICS?), which would have been a healthy phenomenon: rather than having a monopolist as regards the economic, political and societal model, we would now have two European models of civilizational development, vying with each other and not letting each other degenerate into something that we can now see in the European Union.

What do you say to all of the above? True or false? Notice how many lives would have been saved in Yugoslavia and Ukraine. Notice how many able-bodied men would have served their respective countries with their hands and brains rather than with their corpses. Notice the continued immutability of state borders that we would have had up to now and the resultant peace. Correct me if I’m wrong.

It is amazing how similar the outcomes of World War I and the Cold War are. Indeed, how similar the military and political realities are.

Let’s simplify the picture: In World War I, it was Germany and Austria-Hungary against the West (with Russia falling out of the picture toward the end of the war). It was the German world (Germany was almost 100% ethnically German, while in the Habsburg monarchy the German element was in the minority but still dominated the whole country) against France and the Anglophere, i.e. the United Kingdom, the United States and Canada.

During the Cold War it was the Soviet Union and its satellites against the West, again mainly the Anglosphere. The Soviet Union corresponded in this comparison to Germany in that it was basically a Russian state (including Russian-speaking Ukrainians and Belorussians), while the countries of the Warsaw Pact corresponded to the Austria-Hungary or Dual Monarchy.

The two political and military camps – the German dominated Europe as opposed to the West, and the Russian dominated Europe as opposed to the West – vied for dominance. The hostilities during World War One brought about the weakening of the German-dominated alliance juts as the peaceful rivalry during the times of the Cold War brought about the weakening of the Soviet or Russian dominated part of the world. Talks were brokered, the warring parties sat at the negotiating table and slowly but surely a peace deal was worked out: Germany trusted its military and political adversaries would settle the post-war relations in a chivalrous way; so did the Soviet Union with regard for the victorious Western world. What happened next?

In the case of Germany the West – especially France – inebriated with victory began to step up demands and multiply acts aimed at humiliating yesterday’s enemy; precisely the same happened in the aftermath of the Cold War: the West – especially the United States – inebriated with its victory over the Soviet Union began stepping up demands and humiliating Russia, the core of the former Soviet Union. After 1918, Germany was forced to pay enormous contribution to the victors, cede chunks of territory and generally subjugate itself to the diktat of yesterday’s enemies. After 1991, Russia as heir to the Soviet Union lost huge chunks of territory (Ukraine, Belarus, the Baltic States, the Caucasus and the central Asian republics) and experienced a financial and economic plunder comparable to what Germany had gone through after World War One. What was the result in both countries?

An economic crisis that played havoc with the cohesion of society and a lingering sense of being humiliated and cheated. Yes, cheated, because the winning nations went back on their promise of jointly creating a better, peaceful world and only sought dominance and exploitation. The ten or so years of the Weimar Republic and the ten or so years of the presidency of Boris Yeltsin have much in common: both states found themselves at the mercy of the winning powers, both states were immersed in economic and political crisis, and both nations felt disillusioned with democracy made by the West. The result?

The result was in either case roughly the same: in the early 1930s in Germany and in the early 2000s in Russia, a strong leader emerged and gained popular support: in either case the strong leaders succeeded in first alleviating and then eliminating the economic, social, and political crises, and in either case both strong leaders managed to slowly restore the international high standing of their respective countries. In either case, the West’s relentless drive to expand its dominance eventually entailed war.

For all the approximations, the similarities are striking, are they not?

The war in Ukraine has been going on for almost a year now. There is no doubt that it is a war between Russia and the West, between Russia and NATO, between Russia and the United States. There is also no doubt that Kiev, left to its own devices, would have long since been beaten and conquered and subjugated by Moscow. The constant supply of arms, financial loans and political support coming from the West means that Ukraine continues to fight, albeit not only with its own army, but also resorting to thousands of mercenaries from a variety of nationalities. Polish and British soldiers and officers are said to be operating in Ukrainian uniforms. The West has deployed all its authority, all its diplomatic and economic muscle, to sustain Ukraine’s resistance against Russia. Is it because anyone in Washington, London, Paris and Berlin or Kiev believes that Ukraine can win this war? Is it because anyone in Washington, London, Paris and Berlin or Kiev believes that Ukrainian troops will drive out Russian troops, that Ukraine will regain not only the four provinces that have been annexed to Russia, but also the Crimea? Is it because Moscow, having been repulsed and vanquished, will start paying compensation to Ukraine and the Russian leaders will stand before the international tribunal in The Hague like the former leaders of Yugoslavia and Serbia?

Of course not! So why are they fighting this war? Why are Washington and London, Paris and Berlin encouraging Kiev to resist further? Why are Western governments subjecting millions of Ukrainians to death, starvation, cold and emigration? The answer is self-explanatory. Because if the war goes on as long as possible, then:

① Russia, a rival that the West dislikes (to put it mildly), will be weakened and bled to the maximum;

② Ukraine will incur as much debt and as many obligations to the West as possible, only to repay them for decades, i.e. to relinquish control over its own natural resources, production facilities and population (for how else can Kiev repay these gigantic obligations?); Continue reading

The mechanism is simple. The Hegemon has power. The Hegemon has power not only because it is economically powerful and because it has a powerful military force. The Hegemon has power also and perhaps above all because it has a mint where it mints the world’s coin. The Hegemon can therefore, for example, put too much money into circulation, i.e. create inflation, and since the whole world uses the Hegemon’s money in trade between countries, this inflation hits all the economies of the world! Inflation in the Hegemon translates into inflation in all the other political players. This is a political masterstroke!

We wanted to draw attention to yet another mechanism, equally efficient, equally cleverly devised. Here it is. The Hegemon looks around to select nations or states, anywhere on the globe, but especially those where there are various natural resources or developed industries. Having found a region of the world that the Hegemon would like to exploit, the Hegemon looks around for such two nations, two states or social groups that do not like each other very much. Never and nowhere in the world is this task difficult. All neighbourhoods are fraught with a long history of conflict: France-Germany, France-England, Germany-Poland, Hungary-Romania, Croatia-Serbia, Greece-Turkey, Poland-Russia, Poland-Ukraine, Ukraine-Russia… and these are just a handful of conflicts and just European ones! They all can be revived, they all can be fuelled and they all can be exploited. Religious and ideological divisions can also be skilfully manipualted: Catholic-Protestant, Catholic-Orthodox, Sunni-Shiite, believer-infidel, right-left, liberal-conservative, you name it.

States are governed by different people, not necessarily the wisest, not necessarily the most sensible, not necessarily the prudent. Since they are not the wisest or most prudent people, since they are people who have weaknesses and (often) burning ambitions, they can be skilfully controlled. This is precisely what the Hegemon does. The Hegemon seeks out individuals who have exuberant political ambitions and helps such individuals to take power in a country. The Hegemon selects people with a psychological profile that ensures they will be remotely controllable. The Hegemon can create compromising situations for such an individual or it can nurture such an individual: the Forum of Young Global(!) Leaders of the International Economic Forum or universities founded or financed by various NGOs are breeding grounds for such leaders.

Political dissidents from the countries of Central Europe before 1989, people who often emigrated to the West, acted in the West, received support from the West, these people were excellent material for the Western secret services. These services were able to pick and choose human tools, human puppets for their intelligence games and political manoeuvres, and these puppets usually did not even realise that they were someone else’s… tools. The awarding of scholarships to such people for study or research, or the granting of prizes in various fields, tied the beneficiaries to the centres that exercised power over them in an extremely strong and thus permanent manner. Who can resist an award, international recognition, acclaim, or interviews for CNN or the BBC? Continue reading

The most important central bank in the world, the US Federal Reserve (FED), recently presented its financial report, which shows that it had a substantial loss of USD 114 billion last year. Why such a large loss for the FED? To explain this, one should first distinguish between two aspects of the central bank’s activities.

Firstly, the FED holds large quantities of US bonds, which in turn yield interest. Of course, in this case, this interest is income for the central bank. It is worth noting that since the FED began buying bonds on a large scale in 2008, interest rates have also risen considerably

Secondly, the Federal Reserve allows commercial banks and various types of funds to hold money in an account at the central bank. At the same time, it pays a certain amount of interest on these funds, which depends primarily on the level of interest rates.

Well, between 2022 and 2023, there was a series of interest rate hikes in the US. Eventually, a level of 5.5% was reached. This meant that the FED had to pay 5.5% interest to banks and funds (and there were a lot of them) that wanted to keep their money in a central bank account.

So on the one hand, the Fed still held a similar amount of bonds in 2023, for which it received interest rates close to the 2022 level (i.e. much lower than this 5.5%). On the other hand, it had to pay much higher interest rates to commercial banks or money market funds. This resulted in the loss.

You may ask: What happens when a central bank suffers a loss? From a purely financial point of view: Nothing significant happens. It is assumed that this loss will be covered by future profits. In the context of a central bank, it is difficult to talk about bankruptcy, especially as central banks can create gigantic amounts of money under the current system.

Gefira is critical of the monetary policy of central banks, but for completely different reasons. No one from the central bankers is commenting on the following questions:

1) Is it fair that the central bank only rescued and wants to rescue selected financial institutions simply because they operate on a large scale?

2) Is it normal for these institutions (especially banks) to hold their reserves at the central bank and safely receive a few percent interest in return?

3) What’s more – is it fair that unprofitable companies are kept alive by the central bank printing money, which in turn makes it more difficult for new companies to enter the market?

4) Is it good for the economy that unprofitable zombie companies are kept afloat in this way, which otherwise – in the real free economy – should have gone bankrupt long ago?

In December last year, we wrote about Javier Milei – the recently elected President of Argentina. Now, with his recent speech in Davos, he has turned the bottom into the top.

To understand what happened and what Milei got himself into, you first need to comprehend what exactly the World Economic Forum (WEF) is and who makes it up. The WEF is the world’s elite: the CEOs of the world’s richest companies (only companies with billions in revenue are invited to the Forum), leading bankers and technology specialists, politicians, representatives of major business organizations, lobbyists, selected intellectuals, journalists and activists of all kinds. The WEF meetings are therefore full of people who use their connections and influence to try to steer the world in a direction that benefits them and not necessarily the majority of people. It’s about power and money, not about a better life for ordinary citizens.

The aforementioned elite meet every year in Davos to present their proposals on how they want to intervene in our lives. They negotiate agreements among themselves and exert pressure on the world’s most influential politicians. In the meantime, of course, there is a lot of empty talk and boring debates about the world’s social and economic problems. The founder of the forum is Klaus The-Great-Reset Schwab, who became known as an advocate of collectivism. He is credited with the famous saying: You will have nothing and be happy.

This is where Milei comes into play. In a place where the ideas of feminism, birth control and increased government intervention in the economy are supported year after year, where the foundations for Agenda 2030 and its associated eco-terrorism were laid, Milei looks the globalists in the eye and dismantles their propaganda simply and vividly by exposing the lies of the globalists.

In many of his interviews and speeches, Milei refers to the so-called culture war. In his view, the causes of Argentina’s decline are cultural problems and moral decay. Among other things, this gives rise to the deep belief that the state is the guarantor for the satisfaction of citizens’ needs. At the same time, the Argentinian president points out that state intervention is counterproductive, as it should only contribute to the opposite when trying to solve a problem.

Here we summarize the most important theses of his speech in Davos:

1. Capitalism creates prosperity and is moral

Socialism leads to impoverishment and is based on violence. Wherever socialism has been introduced, it has brought more harm than good.

“The West is in danger because it has opened itself up to socialist ideas. It was capitalism that liberated humanity from mass poverty and created unimaginable prosperity. (…) In the countries where we should be defending the values of the free market, private property and other institutions of libertarianism, parts of the political and economic establishment – some because of flaws in their theoretical approach, others out of a desire for power – are undermining the foundations of libertarianism by opening the door to socialism and potentially condemning us to poverty, misery and stagnation. It should never be forgotten that socialism is always and everywhere an impoverishing phenomenon that has failed in all countries where it has been tried. It has failed economically as well as socially and culturally. It has also contributed to the deaths of more than 100 million people.”

So capitalism, rather than today’s Western neo-Marxism, is the way to abolish poverty.

2. Socialism is a repressive and unjust system:

“(…) Social justice is neither fair nor beneficial to society. Quite the opposite. It is an inherently unjust idea because it is based on force. It is unjust because the state is financed by taxes and taxes are levied by force. Or would any of you say that you pay taxes of your own free will? In other words, the state finances itself through coercion, and the higher the tax burden, the greater the coercion and the less the freedom. Advocates of social justice assume that the entire economy is a cake that can be shared. Yet, this cake did not fall from the sky. It is wealth created by what Israel Kirzner, for example, calls the process of market discovery. If there is no demand for the goods produced by a company, that company will fail if it does not adapt to the demands of the market. If it produces a good quality product at an attractive price, then it will be successful and produce more because the market is a process of discovery in which the capitalist finds the right direction in the course of his actions. If the state, however, punishes the capitalist for his success and blocks him in this discovery process (through excessive regulation, as in the EU – author’s note), it destroys his motivation, and the result is that he produces less and the pie shrinks, which damages society as a whole. By inhibiting these processes of discovery and making it difficult to adopt what has been discovered, collectivism inhibits the entrepreneur and prevents him from flourishing.”

3. The fight for women’s rights or nature conservation is just a pretext:

“When the socialists realized that the workers were not getting poorer under capitalism, but richer, they changed their strategy. Today, the class struggle between capitalists and workers has been replaced by alleged conflicts between men and women or between man and nature. It is claimed that to save the environment, population growth must be controlled; abortion is promoted”.

4. Public opinion is the result of decades of “brainwashing” in the direction desired by the elites:

“The neo-Marxists have changed public opinion in a long process of taking control of the media, the universities and even international organizations. As everyone here knows, the WEF is one of the latter. Socialist ideas must be fought frontally and vociferously.”

5. Socialists have more than one name:

“There are many varieties of socialism in the broadest sense. Socialists are not only those who call themselves socialists, but also social democrats, Christian democrats, communists, Keynesians, Nazis, nationalists and globalists. They all share a belief in regulation and the state”.

6. The real heroes are the entrepreneurs. The state, on the other hand, is only a threat to freedom:

“The real heroes of society are entrepreneurs. They are creators of wealth who can be proud of making profits by meeting the needs of others. They should not be allied with the state, not even through the WEF. The state is not the solution. The state is the problem. The state is a threat to freedom.”

Since Milei’s speech, the number of views of his video on the official WEF channel has exceeded half a million. Is that a lot? Just look at the other “great speakers” who have lagged far behind. The conversation with US Secretary of State Antony Blinken, for example, reached 56,000, the speech by EU Commission President Ursula von der Leyen 42,000, and the other speeches received even less attention. (As at the end of January 2024)

An interesting case is the speech by Spanish Prime Minister Pedro Sanchez, who, as the country’s extreme socialist leader – i.e. in complete opposition to Milei – made a staid appearance and barely reached 12,000 views. In his speech, he talks about everything and nothing. He mentions the current problems and challenges, but offers no solutions. The Spanish Prime Minister’s speech was preceded by congratulations on Spain’s strong economic growth, which the Prime Minister himself also boasted about. So let us quote here the conclusions of one of Spain’s leading independent economists, Daniel Lacalle, who summarizes it as follows: ‘The reality in which Spain finds itself today is different from the one presented by the Spanish government under Pedro Sanchez. The ruling socialists are using the same techniques that the Greek socialists resorted to at the end of the 1990s. Namely, they are increasing public spending and debt to hide the fact that investment and consumption in the country have stalled and exports are falling. Taxes are being increased because/although tax revenues have been falling in recent years. The choice between because and although in the last sentence reveals what you think about the right economic policy.

1% owns 50% of the world’s wealth and there are countries that want to change it. About geopolitical redistribution.

In 1974, the middle class had the highest share of world wealth. Today, it is at its lowest level in 100 years. Within the last 50 years, there has been a gigantic transfer of wealth from the working class to the class of society that owns assets. The latter, elitist stratum owns a disproportionate share of the wealth generated throughout the world and constantly increases it thanks to the central bankers who skillfully cause sometimes recession, sometimes revival of the economy through their interest rate policies and increase or decrease the money supply. These are the waves on which the great ones of the financial world surf and later eat caviar and drink champagne. You know it well that this elitist class is not sitting in Beijing, Jakarta, Rio or Moscow. It’s enough to name two cities and you already know who it’s really about: London and New York.

Erdoğan and the president of Brazil, leaders of ASEAN countries and comrade Xi – they all want to make their middle class bigger and stronger because they know it that the first industrial revolution, which lasted 150 (!) years, was possible only thanks to the creative and hard-working middle class. Therefore, they want to introduce their own monetary system, independent of Anglo-Saxon influences, which

(i) operates fairly,

(ii) is not dependent on a fiat currency like the dollar,

(iii) enables the middle class to accumulate wealth, and

(iv) does not serve to remove politically undesirables from the face of the earth through currency wars or military intervention. Suffice it to mention here how weak the Turkish lira is during Erdoğan’s tenure, or how Saddam Hussein fared because of the oil trade in euros, or Gaddafi because of the attempt to introduce the Pan-African currency, which was supposed to be based on gold.

The latter initiatives of countries seeking to free themselves from dollar domination – be it agreements between Russia and China, the BRICS initiative, agreements among ASEAN countries, and many others – all aim at creating some kind of common currency for these, as they are called in the West, “rapidly developing emerging economies.” This currency, however, should not be a fiat currency, such as the euro, but a currency based on tangible assets, thereby ensuring its purchasing power. It may be digital or classic – one thing is certain: its introduction will mean a huge war against the U.S. dollar. It will mean a war against the COMEX (USA) and LME (London) exchanges, where precious metal prices are now decided. And as we emphasized several times before in analyses in our bulletins: these prices have been suppressed and manipulated for decades by the so-called US bullion banks. So, the elitist class that owns the highest share of the world’s wealth may be in for a treat this September, when the BRICS group’s decisions are to be made. One possible scenario: the BRICS countries may, for example, buy countless futures contracts on precious metals and demand delivery of the physical commodity on the expiration date. Since it is common knowledge that COMEX and LME can physically back up perhaps only 20% of their transactions with physical reserves (the paper gold problem), there would be a collapse similar to the Nixon days.

So will the yuan or a whole new emerging market currency soon become a new world reserve currency? If you look at the chart below, you can see that nothing lasts forever and that the dollar’s days may be numbered.

Major reserve currencies since 1250

After the 2015 introduction of the common currency in Lithuania, much has changed. On the one hand, the euro positively influenced economic growth, as loans became cheaper, resulting in increasing exports and investments, on the other hand, the gap between rich and poor and between the level of living in the cities and in the countryside deepened. Until the beginning of the post-pandemic inflation, prices and salaries increased continuously in the Baltic country, but the latter mainly in the cities. Already between 2015-2019, prices increased by 10%, among others food by 6% and services by 22%. In the post-pandemic period, all Baltic countries are now among those with the highest inflation, with salaries, including those of the richer urbanites, unable to catch up with galloping food prices for a good two years. The ECB’s policy is not helping anyone. If one speaks to a Lithuanian or Latvian on this topic, one hears the following: I used to be able to often invite my girlfriend to the restaurant, now I can hardly afford it (a Latvian truck driver aged around 30). Prices have become European, salaries have not.

However, the argument with growth seems to be a bit misguided. Polish economy with its own currency is growing faster than that of Slovakia and Slovenia, which quickly adopted the euro. Since the introduction of the common currency in the PIGS countries, they systematically lose their growth rate compared to Germany. Contrary to the widespread complaints in the German media about Polish fiscal policy (and the hope that it would be “disciplined” after the introduction of the euro), public debt in Poland is keeping within limits – and this despite the policy of social transfers never seen before. In the euro zone, on the other hand, debt is exploding, despite various formal restrictions. This is true even for the countries that joined the euro without having a public debt problem. The debt has been created over time – precisely in this oh-so-fantastic union. This fact is illustrated in the following graph.

Source: Ameco

The culprit is the crazy idea that one monetary and fiscal policy should fit all countries like a universal recipe (one size fits all). One policy for 24 countries – that can’t work, like a 5 year plan for all Soviets, or one for the so very different regions of China. The same interest rate for the entire Eurozone cannot be effective. It leads to destabilizing and costly imbalances in individual member states, which subsequently spill over to the entire euro area, which cannot develop fast enough vis-à-vis the U.S. and China.

But what’s all the talk about? After all, it’s summer vacation and you want to relax. That’s when we recommend a vacation in Croatia – the latest to enjoy the benefits of the single currency. After the introduction of the euro this year, prices in the once cheap country rose to the level of Austria. The Austrian “Kronenzeitung” even compared the price level with Swiss health resorts. The Croatian newspaper “Slobodnaja Dalmacija” calculates that a kilo of cherries and figs now costs 8 euros – 10 percent more than a year ago. Wholesalers have to pay 5 euros for a kilo of pears, 3 euros for cucumbers and 5 euros for peaches. No wonder tourists are canceling their reservations in the country that depends on them the most in the whole EU (11% of GDP comes from them). Another local newspaper “Jutarnji list” points out the surprisingly high cost of daily rent of a deck chair. On the island of Hvar it costs €40, in Split €35 and in Dubrovnik €33. On Croatian social media, a video of an American tourist is very popular, where she aptly notes that the price of the service remained the same after the currency conversion from kuna to euro. The greed of (small) entrepreneurs is one downside of it all, the other is that the euro is actually always Teuro. So we wish you a nice vacation in Poland.

I can’t understand that. I would rather say: There should be a movement here and there under the prevailing circumstances, a kind of yellow vest against the bankers. But lo and behold, the anti-globalists protest against the “rulers” during the G7 summits, as if they don’t know who pulls the strings in G7. The bankers were, are and will be spared. Look at the history of the “Occupy Wall Street” movement, how it was mercilessly swept away by the rulers. You could say: like an oppositional movement in Russia, but in the middle of freedom-loving America. What does the dictatorship of the bankers look like at the moment? And what threats does it pose to us?

Mario Draghi. Remember his assurance that he would do everything to preserve the euro and its stability? Whatever the cost? This is what he said and did in fact, but at the expense of taxpayers. A more recent example: Jerome Powell, the head of the FED assured on June 21 of this year, in relation to the problems of cryptocurrencies in the U.S. market, made by rigorous actions of the FED and SEC against the platforms and banks dealing in this digital money, that he would do everything to preserve the dollar as the main reserve currency in the world. How much will this cost the American taxpayers? Hello, Mr. Powell! Have you lost touch with reality? The Saudis are renouncing U.S. guarantees and reconciling with Iran; China is trading with the yuan with its partners; The BRICS countries are banding together, looking to add new members, including perhaps France – who knows? And you, Mister Powell, together with your colleagues, want to introduce the digital dollar, called “FED-NOW”, sometime in July 2023 at any cost to show every country in the world who rules here? Pride always comes before a fall.

As always, the next crisis is carefully prepared. One day an article appears, for example in “Financial Times”, the other “qualitative” media follow the topic. Then comes the “crisis,” always like a bolt from the blue. What is the “Financial Times” writing now? That the Bundesbank is broke. And that’s true. But then they publish a counter-statement. After all, the “crisis” has to be baptized in the media at the right time. They have to wait until the bankers themselves (the owners of the leading media) will give a sign to the editors; Yes, you may write that now because all the rats have long since fled the sinking ship and the captain never existed.

Why would the Bundesbank need a bailout right now? Because it is, of course, too big to simply let it fall? Yes, of course. But the reason is too boring for the average citizen, so he ignores the facts, but as always only until the headlines sound the alarm or until the next “unexpected” tax increase comes along. It is about bonds, the world of the bankers, which hardly everyone understands and therefore fails as a small investor mostly because he invests against the current, by the way.

Super Mario, otherwise called “Cost what it may”, bought for years from the member banks of the ECB their government bonds so that they (especially his Italian home central bank) could service their debts. Thus, the over-indebted PISA countries did not become insolvent. But, wait, wasn’t that forbidden by the Maastricht Treaty? Yes, of course, but only if the bank in Frankfurt am Main had bought the debt directly from the states. The states, however, wisely sold their debts to the biggest bigwigs in the financial world, including the infamous funds like Black Rock. Thus, the ECB financed and continues to finance the private US money industry, which has done nothing to any EU citizen. These piles of the securities were hoarded in the bunker in Frankfurt and the great Italian banker had hoped that they would not lose value. But then inflation came, and his successor (remember: he himself did not) had to raise interest rates significantly. Since while prime rates were rising, fixed-income securities were losing value, it turned out that the bunker was full of toilet paper. Independent journalists (not those from the leading media) have calculated that the total loss of the EU monetary guardians could be as high as 500 billion euros. If the Bundesbank takes a stake in the ECB of about 10%, that’s already a small problem. But as a well-known German politician once said: Not all Germans believe in God, but they all believe in the Bundesbank. The euro will last forever. Maybe for 1000 years.

We have recently seen a significant increase in the price of gold, which today is approaching the mark of $ 2,000 per ounce. The appreciation we predicted in the recommendations of our bulletin was largely fueled by the liquidity crisis, which was only exacerbated by the expansion of the Federal Reserve’s balance sheet and a small rate hike (25 pts) by Jerome Powell and his colleagues. It is worth noting that the market was expecting a 50 basis point hike even before the Silicon Valley Bank problems.

The Fed’s head insists that the $297 billion increase in total assets is the result of a completely unique situation related to banks’ liquidity needs. What is crucial, however, is not the reason, but the fact that further substantial funds were created out of thin air – and this is directly related to another dose of fuel for inflation, which continues to show no signs of abating. So the risk of stagflation caused by an economic slump remains.

The last notable example of an exit from stagflation in the U.S. occurred in the 1970s. In response, Paul Volcker, then chairman of the Federal Reserve, raised interest rates above 19% to restore confidence in the economy. The positive real interest rates achieved at that time (with inflation at 13.5%) are out of reach for central bankers today.

An economic crisis will happen sooner or later for one reason or another. History simply shows that. The important question, however, is what methods will be available to central bankers when that crisis occurs (if we don’t already have it). In past decades, these were based primarily on lowering interest rates and expanding the money supply. However, the above measures are now being drastically curtailed because of their impact on the rise in inflation. A further rise in inflation would probably only prompt investors to withdraw their money from financial institutions in order to protect their capital elsewhere from the increasing loss of purchasing power. Such decisions would only lead to further liquidity problems. It also cannot be ruled out that the Fed will decide to raise interest rates further. These in turn would devalue the bonds held by banks, which would also deal a severe blow to the financial system. The impact is likely to be similar in both cases: either a liquidity crisis or inflation that is likely to spiral out of control sooner or later, or a combination of both. Janet Yellen and Jerome Powell thus seem to be caught between the hammer and the anvil, and their actions resemble those of an elephant in a china store.

Also worth mentioning is the recent news about the growing risk of a Deutsche Bank default. The banking crisis seems to be coming to a head, also in Europe. Even more important than the crisis itself, however, as already mentioned, seems to be the considerably limited room for maneuver of central bankers to counter it.

It is not inflation, nor the Fed, nor the NFP, and certainly not the hostilities in Ukraine that is attracting investors’ attention, but the major problem that the U.S. banking sector is beset with, rendering especially Silicon Valley Bank barely capable of making payments to its customers. All this reminds us of 2008, although there are no clear signs yet that we are on the verge of collapse.

SVB is a very specific bank in the US market. It is a bank that deals mainly with technology companies. Though it provides financial services to them, primarily it takes deposits from them. The bank participates in venture capital projects (venture capital), but it has also invested the surpluses in the US bond market or in MBS. The sharp rise in interest rates and the resulting significant revaluation of bonds resulted in a large financial loss in the bank’s portfolio, which is nothing unusual. In fact, this was something normal across the financial sector. However, this is where the peculiarities of SVB itself come into play. It is a bank that manages hundreds or even thousands of technology companies or start-ups. This sector, in turn, has been struggling for some time to catch its breath after the strong last 2 years. Companies have begun to slow their growth, look for savings and reach for capital from deposits. In order to get liquidity, SVB was forced to sell all liquid assets worth over $20 billion, incurring a loss of almost $2 billion! That’s a sizable hole in the bank’s balance sheet. At the same time, the bank announced an additional equity offering to close the gap, prompting investors to divest themselves of the bank’s shares. Yesterday (March 9, 2023), the shares plunged by as much as about 70%! These problems are still deepening today before the weekend, which is why some have already drawn parallels with 2008.

Of course, it’s important to remember that SVB and the tech industry are a specific sector and may have less overall impact on the overall stock market than the collapse of Lehman Brothers or the problems that occurred at Bear Stearns. The key question is whether this is just an isolated incident or a major problem across the industry.

It surely is a religion: the worship of the planet earth. No doubt about that. At the same time it is risible: a peninsula attached to a huge Asiatic continent wishes to make the global climate better and – as if the movement of waters and winds could be stopped at state borders – to make its own climate better. How? By banning the fossil fuels (which means: by banning the combustion engine), relying on renewable sources of energy and developing the CO2 market (you know, the market where you buy and sell CO2 quotas). You see, in the Middle Ages people would trade in relics: in the 21st century people trade in CO2! Isn’t that one thing alone a grand exploit that the European Union has pulled off?

No combustion-engine cars to be manufactured after 2030 plus net CO2 emissions by 2050! Why? For what purpose? Well, to save the planet, stupid! We all know that Mother Earth is suffocating and getting overheated (or overcooled, depending on the currently valid scientific version concerning the global climate); we all know that it is man-made. If you are not convinced, then look at the children: they know it! They know it for certain! That’s why they are protesting and begging you (if that is not enough: demanding of you) that you reconsider your life choices.

You know, it is not only the climate. We are all running out of water and food. What do you think will happen once water and food are in short supply? Famine? Y-e-e-e-s. Try hard to follow the thought where it leads. Imagine a global famine and water shortages. What do you think it will lead humanity to? Yes, bingo! To war! So, to prevent war over food and war over water from breaking out, the men and women (or the representatives of the other sixty or so recognized genders) who happen to be at the helm of the European Union do their best to spare us the bleak future. Yes, we will all pay for it: prices will shoot up, but then health, life and peace are invaluable. We will all willingly sacrifice our comfort and resign from the luxuries and pleasures of the flesh to… save the flesh.

Ursula von der Leyen (President of the European Commission or in plain English: the EU’s prime minister) and Frans Timmermans (Executive Vice-President of the European Commission or again in plain English: the EU’s deputy prime minister) along with all the Directorates-General (in plain English: ministries) indefatigably keep foisting upon us the magic phrases of European green deal, climate neutral Europe, reduction in emissions, clean transport, electric vehicles, sustainable (their beloved word!) houses, clean energy, renewable energy, protecting nature, a healthier future, support for vulnerable citizens (always the same!), and they assure us that all this is doable. Ursula von der Leyen says that she wants Europe to become the first climate-neutral continent in the world by 2050. She says verbatim: “I want Europe to become…”. You see? Occasionally, they let a word out here and there for all to hear: they want to enforce those changes, Ursula von der Leyen, Frans Timmermans, and company. Whenever they are on their guard, they say that it is the Europeans who want it, but when they are off their guard, they say as it is. Continue reading

In retaliation for freezing Russian assets by the West, President Putin has signed a decree that enables Russian exporters of gas to demand rubles rather than dollars or euros. This is an interesting development in the war that is being waged between the West and Russia. The European Union depends to a very large extent on Russian gas. The efforts to create the green economy (they like to call it sustainable economy) are far from being completed. (To think of it: they have sought to put us on the green economy to spite Russia! Climate change was the bait for the gullible to join in.) Europe will need Russian gas (and oil). In order to buy it, it will need to have the Russian national currency. To acquire the Russian national currency, the West will be forced to trade dollars or euros for rubles at the Moscow stock exchange, thus raising international demand for the Russian currency and turning it into a means of international exchange. Sanctions work both ways.

On March 18, the Luzhniki Stadium gathered thousands of Russians in a patriotic rally, attended by various artists and the Russian president himself. Vladimir Putin delivered a speech in which – quoting the Gospel – he praised the efforts of the soldiers of the Russian Russian Federation fighting in Ukraine. A sea of waving Russia’s national white-blue-red flags dominated the scenery. The event was an eruption of patriotic feelings, something unknown in the West. If you think that the “regime” in Moscow is about to collapse or to be toppled, then think again.

The answer is not easy. Bill Gross, the founder of Pimco and “king of government bonds”, predicts that the yield on US 10-year bonds will rise to 2% next year. This would mean the 3% loss for investors at the current inflation rate. The dynamics of demand and supply also point to the further fall in the prices of US government bonds (rise in yield). Today, the FED is buying 60% of all US bonds as part of its quantitative easing, but will soon have no choice but to reduce the scale of US bond purchases in the face of inflation. At the same time, China, Russia are massively dumping these debt securities. So should one invest in equities? Now, when their prices are shooting through the roof? After all, shares can turn out to be rubbish if companies’ profits don’t want to rise as they have in recent years. With today’s inflation, it’s not worth holding cash either. The situation is becoming dramatic.

If you want to learn more, if you are looking for tips for your investments, please read recommendations and warnings for investors in our bulletins.

President Vladimir Putin told Gazprom PJSC to turn to refilling European gas-storage facilities next month, signaling that long-awaited additional Russian supplies could be on the way. The move will “create a more favorable situation on the European energy market,” Putin said at a meeting broadcast on state television Wednesday. Source Al Jazeera