Description

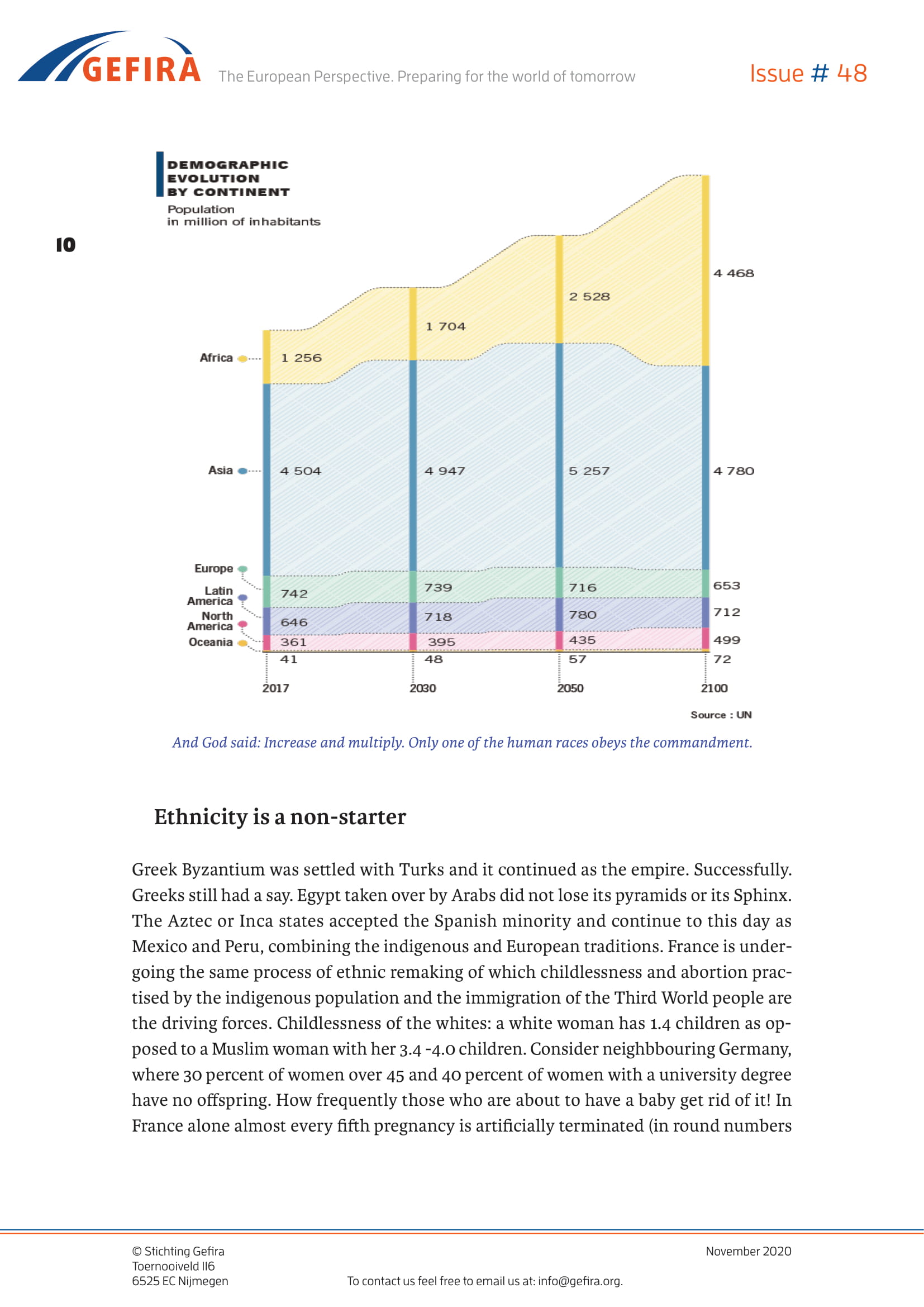

The November issue of Gefira takes a closer look at France’s changing ethnic composition which already translates into the country’s economy, its welfare system, the cohesiveness of society, internal tensions and problems of “systemic racism” unknown to any previous generations. The knowledge of the racial makeup is barred from an average inquirer; yet, what one man wants to hide, the other is certain to uncover in one way or another. Thus, though the French law forbids tallying the racial, ethnic or religious percentage of the Republic’s citizenry, the number of Muslim names and especially the sickle cell disease testing which is administered to risk – i.e. Third World – population cohorts not to mention everyday experience – the visual survey of the inhabitants of towns and cities plus sportsmen representing France – provide factual information in this respect. Besides, the European Union – and France is one of the two pillars of it – makes no bones about it: resettlement from the Third World to Europe ranks among its most ambitious projects and as such it is well under way. Unless the current course is reversed, France’s as well as Germany’s, Great Britain’s or Sweden’s destinies are sealed. Beyond 2050 the Western world is going to be a part of the Third World with its population resembling that of India or Mexico. The France of 2050 will be to the France of 1950 what the Turkish Empire was to the Byzantine Empire.

Similarly profound changes are taking place in the world of finances. Modern Money Theory is replacing both the Austrian School of Economics and the Keynesian economic principles. What does MMT advocate? It advocates money creation and spending without regard for the hitherto binding controls along with the non-observance of anything that classical economists held as canon rules. Hence quantitative easing and negative interest rates. Since money is no longer pegged to gold, everything is allowable. The be-all and end-all of the MMT approach is to maintain and possibly advance growth, that fetish of present-day economists. Such financial policy requires an ever stricter surveillance over the amount of money, which is going to be made easier by the introduction of digital money as the only means of exchange. We are in for it. One might be well-advised to already say goodbye to banknotes and coins. Everybody’s finances – for want of any other means by necessity handled in an electronic way – will be made plain to see for the masters of the world who will be able to gain an insight into our pecuniary settlements via powerful computer systems without leaving their offices. A carrot bought or sold in a village miles off the beaten track will not escape the notice of the powers that be unless… unless people revert to barter. What a world to live in!

Reviews

There are no reviews yet.