After the storming of the Capitol, there is now a big commotion on Wall Street. This time it is not the supporters of the Occupy Wall Street movement who are trying to storm the fortress of the financial world. It is small investors who are hurling a stone at the big funds.

Hedge funds – that’s what we’re talking about – are actively managed funds whose goal is to achieve the highest possible return regardless of market developments. This is achieved by hedging (hence their name) their shares, bonds, their investments in commodities, foreign exchange and other assets. Most of the time, funds hedge by buying what are called shorts on their investments. It works like this: they buy, for example, shares of a company within a longer period for a total of 1 billion dollars, usually when they are undervalued, which raises the price of those shares, which in turn attracts small investors. At this point the funds get rid of their shares and take a short position by borrowing the shares from an institutional investor like a pension fund and selling them on the market pushing the price down. To return the shares to the pension fund, they repurchase them at a lower price.

Because the price falls, the small investors lose their money and the funds in turn collect money because it sold the shares at a high price and recollect them at a lower price. Sometimes, however, they act the other way around, when they have “missed” an interesting “asset” that is largely owned by small investors. In such cases they start to sell borrowed stocks so that these small fish panic and get rid of their shares and the big sharks can take them over at lower prices. Not only pension funds but also other assets kept at broker accounts are borrowed to hedge funds without the knowledge of the owner, the pensioner or the retail investor. The whole mechanism is against the interest of the stock owner or pensioner, but generates some extra profit, in the form of a lending fee, for the custodian of the stocks.

The hedge funds have huge sums of money and so they can actually manipulate the price at will. What makes hedge funds risky is that they have little equity, and function largely through leverage (mostly from large investors or banks) on credit. In addition, hedge funds are often operated as offshore funds and are located in the Cayman Islands or Bermuda i.e. places where the financial sector is less regulated by law than elsewhere.

Hedge funds have been making negative headlines since at least 2007, since the financial crisis. One example can be FX Concepts, which managed over 14 billion dollars at its peak. Its CEO, John Taylor, bet against the euro and speculated so badly that in 2013 he had to declare bankruptcy. There are examples, though, showing that such funds can be so successful that they even win the financial battle against governments. This was the case in 1992, when George Soros bet on the weakness of the pound via his hedge fund and earned $1 billion in a single day, while the Bank of England ineffectively used billions in an attempt to to prop up the pound.1)So knackte George Soros die Bank of England, Godmade Trader 2016-06-22.

The worst thing about hedge funds is their short-selling. This involves selling an immense amount of securities, such as shares, on the stock market. The seller (the fund) speculates that there will be an oversupply and that prices will fall. The point is that the securities offered for sale are never owned by the seller; he merely borrows them. The oversupply he creates causes prices of the securities to fall. This was the mechanism underlying the bankruptcy of Lehman Brothers.

So is the market free? Are prices fair and in line with the fundamentals of the economy? Do share prices reflect how good a company is? Barely. One day the small investors started to fight back. This was made possible by the development of social media and apps. In the US, Reddit, an independent forum for small investors, and Robinhood, the provider of the app that allows people to invest in the stock market without paying fees, emerged. On 25 January 2021, the big fight broke out on Wall Street.

The small investors used the methods of their enemy, the hedge funds. They banded together via the social platform Reddit and began buying shares en masse in a company called Game Stop. Game Stop is a company in what appears to be a declining market, trading used computer games. It benefited from the Covid pandemic, something that most Wall Street analysts failed to notice. While Game Stop was shorted by hedge funds, its value rose during the pandemic. Playing against the sharks were also some well-known investors like Ryan Cohen, which drove Game Stop’s shares up.

Game Stop share price within the last 12 months.

The so-called short squeeze occurred. The hedge funds were forced to close their short positions (i.e. buy Game Stop shares), which boosted the share price even more. The small investors were joined by Elon Musk, who wittily tweeted “Gamestonk!”. (Game bombed with artillery fire!). On 26 January, Game Stop shares were the most traded in the world!

Source: Bloomberg

In fact, hedge funds that had previously been shorting Game Stop shares on a scale rarely seen (they purchased more shorts than the summary value of all shares) suffered heavy losses in the fight. And now came the unexpected: Robinhood blocked trades in Game Stop and in a flash became the number one enemy of small (mostly young) investors in the US. Robinhood was followed by larger online brokers like Interactive Brokers across the globe. A few tens of minutes after Robinhood’s decision, his ratings on Google dropped to one star. Google then strangely removed 120 000 negative ratings and comments. Now the app has 4 stars again. The small ones turned away from the traitor: the action “#Cancel Robinhood” began and the first lawsuits were filed with the court.

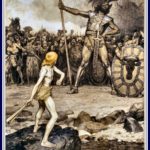

The comparison to the fight between David and Goliath may be outdated. The first stone against the wall – against the wall behind which bankers in New York entrenched themselves in order to carry out their machinations with derivatives in peace – fell and the small fry punched the bankers in the nose. The story may be just a curiosity from the financial world that everyone soon forgets, but it has a deeper political-social background and can only be the beginning of a radical change in the financial world. Many questions arise:

(i) Is Robinhood independent of Wall Street or just its child framed as a rebel with the sole aim of increasing volumes on the stock market (in any business, cash flow is paramount) to prolong the bull market as long as possible?

(ii) Didn’t Google behave like Twitter and Facebook in the case of Trump? As soon as something doesn’t suit its agenda, everything became blocked and deleted. Won’t this incite small investors even more when they see that their freedom on the internet is just an illusion?

(iii) The Occupy Wall Street movement had influential advocates from the beginning, such as Nancy Pelosi, Michael Bloomberg and economists Jeffrey Sachs and Joseph E. Stiglitz. So was it credible? Why did Elon Musk join small investors in the Game Stop case when his wealth is entrusted to the hands of the powerful on Wall Street via stocks? Why were there positive comments in the Wall Street Journal about Game Stop’s short squeezing? Are the small fish not being used to play any games between the sharks?

(iv) Also, aren’t hackers behind the Reddit users, like the Anonymous group, helping the Occupy Wall Street movement and causing even more turmoil in the markets in the future?

(v) The Occupy Wall Street movement carried out several Move-Your-Money actions in which citizens transferred their balances at commercial banks which had become unpopular due to the financial crises to accounts at cooperative banks. Won’t something similar happen again soon, but on a scale that will threaten the balance sheets of the big banks?

(vi) Isn’t the whole game-stop action a publicity show to encourage Americans, now sitting on cash through social transfers, to invest even more in the stock market while the powers-that-be forge us a next crisis and buy big-short on everything?

(vii) In a day, the dust will settle around Game Stop and its shares will fall. The small investors will run out of cash even though they are now playing against the market and buying other shorted shares of, for example, cinemas and entertainment companies. Will the pandemic, or rather the preventive measures against it, not be steered in the direction favourable to the hedge funds and the sharks?

(viii) Is the stock market a zero-sum game?

(ix) Are the fault lines in American society not too deep? Don’t the actions on Capitol Hill and around Game Stop reflect the diseased state of this nation?

(x) So what should one invest in?

Stop trading.

Or read the Gefira Bulletin and invest successfully in the face of reality.

[Featured picture: David and Goliath by Osmar Schindler (1869-1927), Wikipedia.]

References

| 1. | ↑ | So knackte George Soros die Bank of England, Godmade Trader 2016-06-22. |