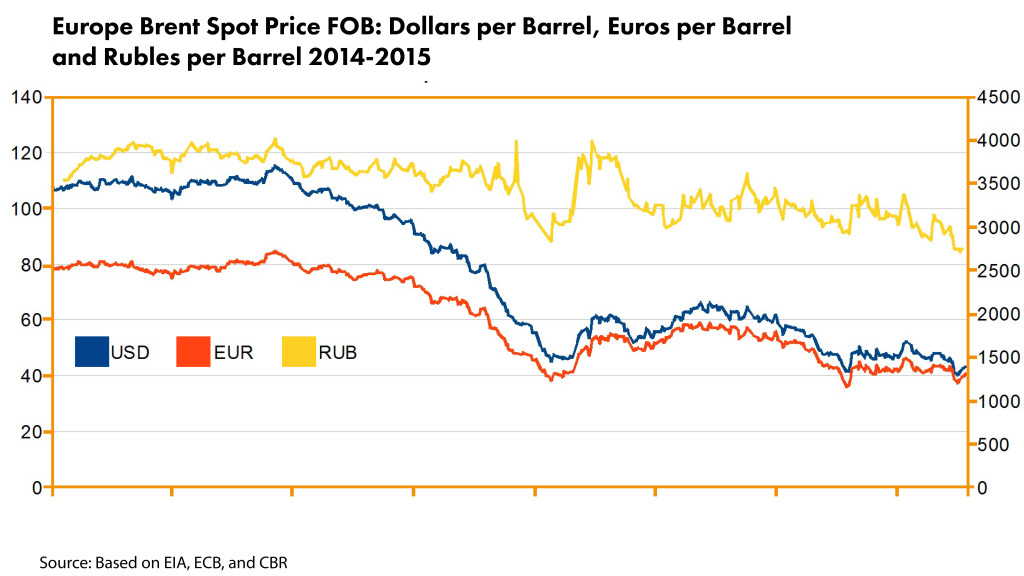

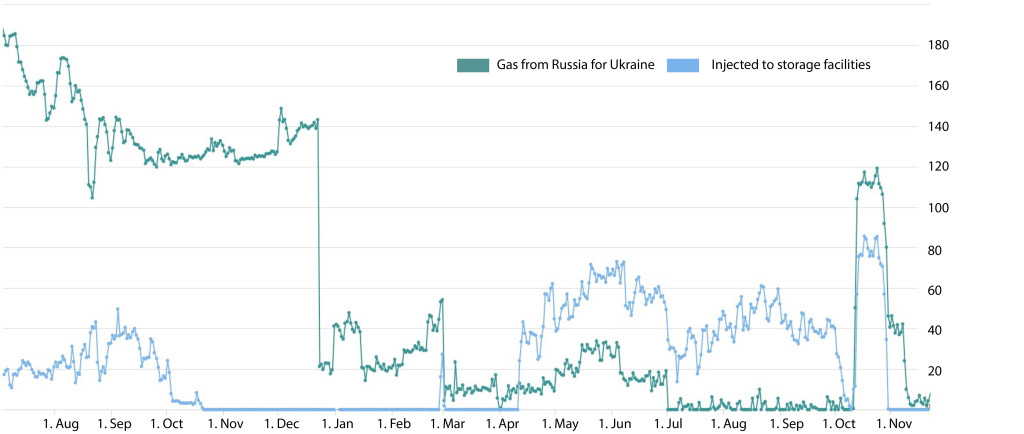

In retaliation for freezing Russian assets by the West, President Putin has signed a decree that enables Russian exporters of gas to demand rubles rather than dollars or euros. This is an interesting development in the war that is being waged between the West and Russia. The European Union depends to a very large extent on Russian gas. The efforts to create the green economy (they like to call it sustainable economy) are far from being completed. (To think of it: they have sought to put us on the green economy to spite Russia! Climate change was the bait for the gullible to join in.) Europe will need Russian gas (and oil). In order to buy it, it will need to have the Russian national currency. To acquire the Russian national currency, the West will be forced to trade dollars or euros for rubles at the Moscow stock exchange, thus raising international demand for the Russian currency and turning it into a means of international exchange. Sanctions work both ways.

On March 18, the Luzhniki Stadium gathered thousands of Russians in a patriotic rally, attended by various artists and the Russian president himself. Vladimir Putin delivered a speech in which – quoting the Gospel – he praised the efforts of the soldiers of the Russian Russian Federation fighting in Ukraine. A sea of waving Russia’s national white-blue-red flags dominated the scenery. The event was an eruption of patriotic feelings, something unknown in the West. If you think that the “regime” in Moscow is about to collapse or to be toppled, then think again.

Last month we saw the iPath S&P GSCI Crude Oil ETN (USA) making an unusual dive, doing completely the opposite of what it was designed to do. Exchange Traded Funds (ETF) and Exchange Traded Notes (ETN) are mainly designed to follow an index. To explain the basic principles of an ETF real quick, we take the AEX index as an example. The AEX is formed out of 25 funds each with their own weighing. The ETF issuer buys the shares of the companies according to their weighing in the AEX index. One is able to track the index pretty accurately this way. The ETF issuer buys it on a big scale and sells shares of their basket of AEX shares. The share that they are selling are called ETFs. The difference between an ETF and an ETN is the fact that the ETN is a note. The problem is the third party risk, with an ETN you’re facing the risk of the issuing party going bankrupt. If they do, the chances are that you will lose your money.

Last month we saw the iPath S&P GSCI Crude Oil ETN (USA) making an unusual dive, doing completely the opposite of what it was designed to do. Exchange Traded Funds (ETF) and Exchange Traded Notes (ETN) are mainly designed to follow an index. To explain the basic principles of an ETF real quick, we take the AEX index as an example. The AEX is formed out of 25 funds each with their own weighing. The ETF issuer buys the shares of the companies according to their weighing in the AEX index. One is able to track the index pretty accurately this way. The ETF issuer buys it on a big scale and sells shares of their basket of AEX shares. The share that they are selling are called ETFs. The difference between an ETF and an ETN is the fact that the ETN is a note. The problem is the third party risk, with an ETN you’re facing the risk of the issuing party going bankrupt. If they do, the chances are that you will lose your money.