The world population is growing fast. However, the nations in Japan, South Korea, Europe, Russia and the US are shrinking rapidly. China is the last man standing, its working-age population, those who consume and produce the most, started to contract years ago.

For more information on the topic see the comprehensive analysis in the latest issue of Gefira Bulletin (#20).

While mainstream economists believe all cultures are the same, history tells a different story. There is no second China, and Africa’s population can double or quadruple. History teaches us that this continent will not contribute significantly to the growth of the global economy. A shrinking population in itself does not negatively affect the wealth of a nation; however, it is detrimental to the global financial and banking system. To understand how the demographic winter will put an end to economic growth forever, we have to look at China’s urbanisation.

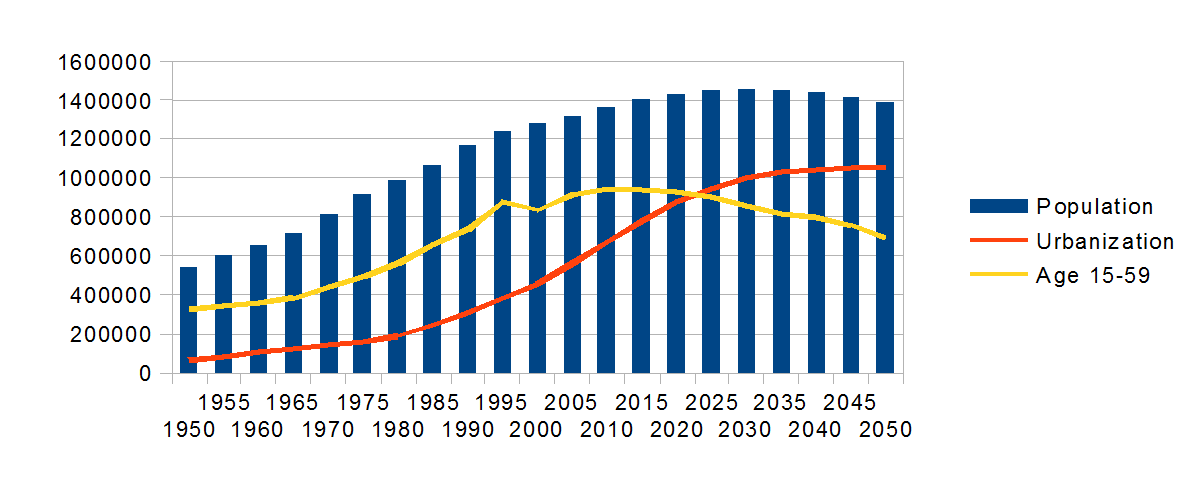

The Middle Kingdom’s urbanization is the fastest-growing in the world. 40 years ago city dwellers made up 20%, while in 2010 – 50% of the citizens. If this fast pace continues, in 2030 almost 70% of the population will live in urban areas.1)Urban Population at Mid-Year by Major Area, Region and Country, 1950-2050, United Nations.

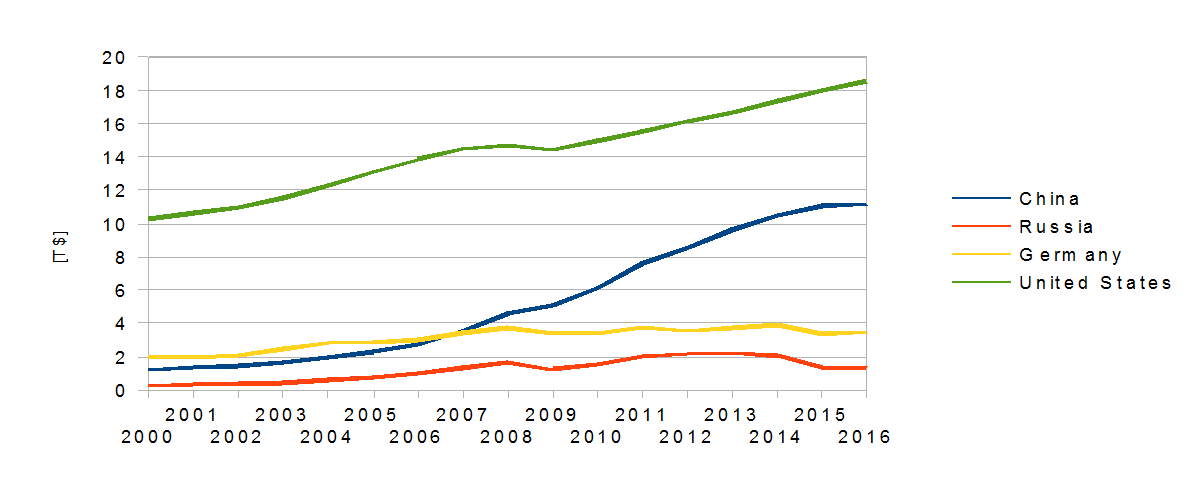

Rapid urbanization translates into the development of the construction sector. In 2000 real estate investments accounted for 2%, in 2011 – 6%, and in 2015 between 15% and 20% of GDP,2)Idle Home Builders Hold China’s Economy Back, The New York Times 2015-06-11.which was not lost on the Chinese government. Beijing has begun to pump more money into infrastructure. Between 2011 and 2013, China used more concrete than the United States for the entire twentieth century.3)China Used More Concrete In Three Years Than The US In 100 Years, Gizmodo 2015-02-23.The fast-progressing construction business has brought about the emergence of empty neighborhoods (like in the many-million city of Zhengzhou) and even whole towns (like Ordos-Kangbashi, where in 2010 90% of flats did not have tenants). Despite the rapid growth in housing supply, there was no fall in demand for it. Quite the contrary: the expectation of ever-rising prices stimulated (and continues to stimulate) investment in real estate. The purchase of a flat has become a form of capital accumulation, which explains why at present 32% of Chinese families own at least one uninhabited apartment.4)Chinese consumers lean on housing market as wages flounder, Financial Times 2017-10-19. Chart 1. GDP of China, Russia, Germany and United States 2000-2016. Source: World Bank

Chart 1. GDP of China, Russia, Germany and United States 2000-2016. Source: World Bank

For some time now economists have tried to make prognoses when the speculative bubble, which is growing as a result of the increasing prices of Chinese real estate, will burst. It should be noted, however, that house-building with all related businesses and services has a significant impact on the overall economy as it generates 25-30% of GDP. To prevent such an important branch of the economy from collapsing, the government is applying restrictions on the purchase of flats (like the variable requirements for credit taking or the limit on interest rates), all of which is aimed at controlling housing prices, or in other words, keeping the bubble from bursting. Chart 2. China: population, urbanization and working age (15-59) 1950-2050.

Chart 2. China: population, urbanization and working age (15-59) 1950-2050.

However, it is not the real estate market in China that is the biggest threat to its economy, but rather unfavorable demographic phenomena. Although the population is still growing, it is noticeable that since 2015 the number of working age people has been shrinking. This process will hold and in 2050 almost 700 million Chinese (ie 50%) will have to be provided for by working people. In 2023 the number of people in urban areas will already be double that of working age people (see graph above).5)Life expectancy at birth, total (years) China, World Bank.

For more information on the topic see the comprehensive analysis in the 20th number of the Gefira Bulletin.

To read Gefira Financial Research full analyses and economic forecast: Subscribe to the Gefira Financial Bulletin and receive the next ten numbers complete with free access to our archive for just 225 euros or 250 dollars

OR

In the Gefira bulletin, gives a coherent vision of the time ahead from a macroeconomic perspective, and we provide investment suggestions.

At our Website, we have articles from our research team in the Gefira Financial bulletin we give a comprehensive explanation of the coming world. We focus primarily on economic, investment and economic strategic subjects. We focus on 2020 as the financial breaking point.

We focus on:

- Cryptocurrencies;

- The worldwide accumulation of empty real estate;

- Global tectonic shifts in demographics;

- Energy security.

The Gefira Financial Bulletin is a private briefing paper on the current economic events for investors and generally the business community. It is accompanied by our website, where you will find articles on social issues.

The Gefira research team is the only one that is acutely aware of the importance of the current unprecedented demographic changes not seen before in all of history.

The Gefira research team elaborates its anticipation, drawing on:

- an extensive knowledge of finance and banking;

- a comprehensive understanding of geopolitics and history;

- detailed data analyses of millions of records;

- computer-aided simulations.

| 1. | ↑ | Urban Population at Mid-Year by Major Area, Region and Country, 1950-2050, United Nations. |

| 2. | ↑ | Idle Home Builders Hold China’s Economy Back, The New York Times 2015-06-11. |

| 3. | ↑ | China Used More Concrete In Three Years Than The US In 100 Years, Gizmodo 2015-02-23. |

| 4. | ↑ | Chinese consumers lean on housing market as wages flounder, Financial Times 2017-10-19. |

| 5. | ↑ | Life expectancy at birth, total (years) China, World Bank. |