Gold price in euros hit the three years high at 1220 euro/oz last week. Gold price in dollars, euros, and British pounds increased while that expressed in the yen did not change that much. The June IMF shows that central banks are still adding gold to their reserves, Especially the Russian and Chinese Central Banks, which are adding gold on a monthly basis. And it just happens so that these two countries are the most powerful adversaries of the United States.

Since the 2008 financial crisis, geopolitical tensions have built up dramatically. The three focal flashpoints are:

- the South Chinese Sea;

- Russian border areas;

- the Middle East.

The US, under the leadership of Nobel Peace Prize laureate President Obama, is playing a significant role in all these tree conflicts. Washington is the most formidable power spending as much on the military as the entire GDP of Argentina. The US can only finance its military role because the world accepts its paper dollars created out of thin air. In 1971, during the Vietnam war, President Nixon abandoned the gold standard, and so the Vietnam conflict became the first large-scale US military operation paid by fiat paper money.1)The end of the Bretton Woods System (1972–81); IMFAt present the euro is the only currency that challenges the US dollar as the reserve currency. While the euro crisis is raging, the euro area trade balance is increasing steadily, boosting the demand for euros.

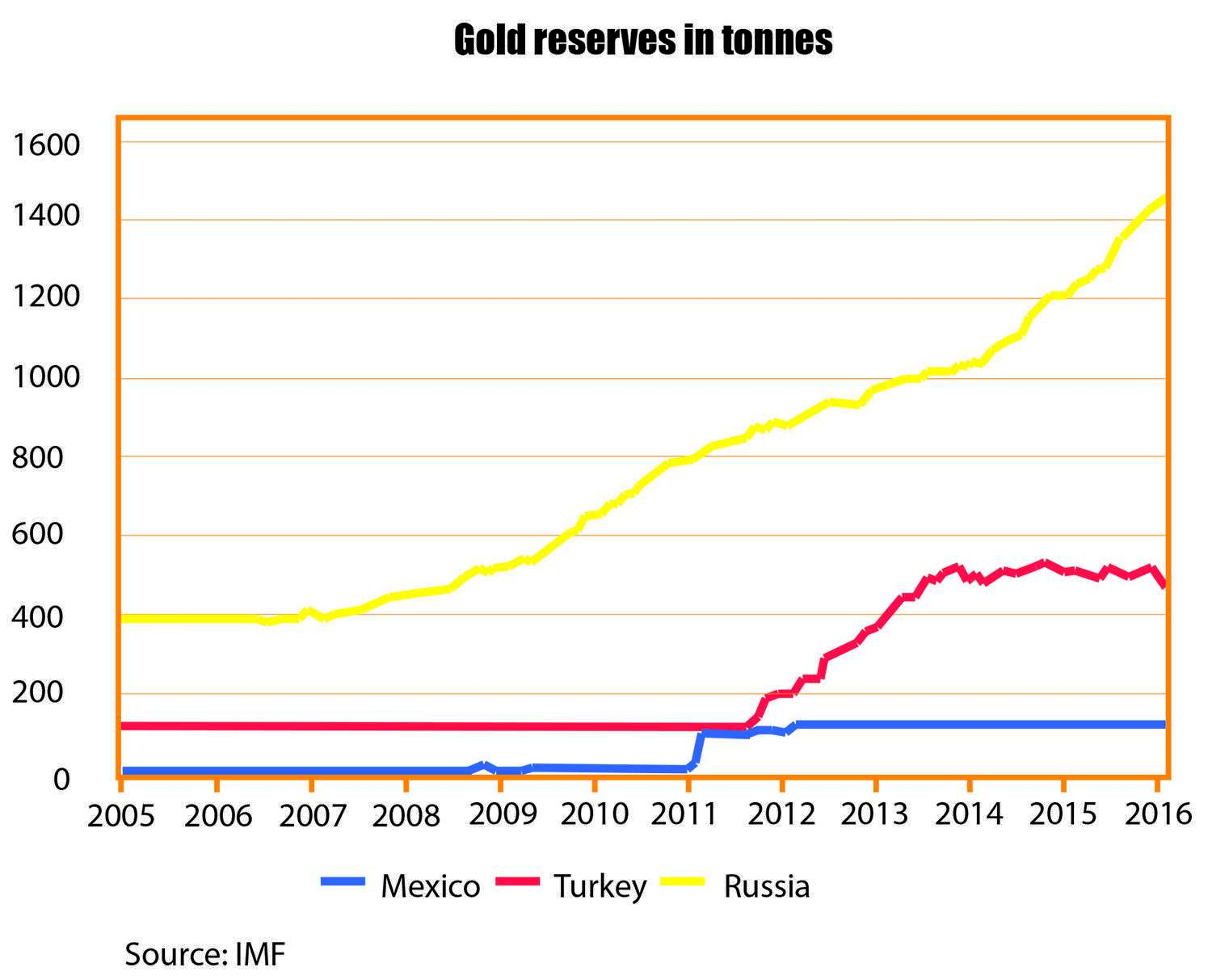

Given the heightened geopolitical tension, it is no wonder that Turkey, Russia, and China are trying to move away from the dollar and euro by increasing their gold holdings. China and Russia also happen to be the first and third largest gold producers.2)List of countries by gold production Wikipedia.Russia produces 400 tons of gold a year, and contributed 50% of its own production, 208 tons, to its International Reserves in 2015.

Russia’s reserves are the fifth largest; the country has increased its gold holding steadily up to 15% of its total reserves since 2011. In absolute terms, China’s gold holding is 1788 tons, i.e. bigger than that of Russia, but it is about 2% of the country’s overall reserves. China has only been submitting its reserve data to the IMF since June 2015, which is the reason why it is unclear how much the amount of its gold holding has changed over the past five years. Since June 2015 China has been adding on average 15 tons of gold a month to its international reserves. In 2015 the renminbi became the world’s reserve currency in its own right.3)IMF Approves Reserve-Currency Status for China’s Yuan, Bloomberg 2015-11-13.However, it has a long way to go before it becomes a serious contender to the US dollar or the euro. Hence, gold is going to remain a preferred commodity for countries that want to rely less on the US and its currency.

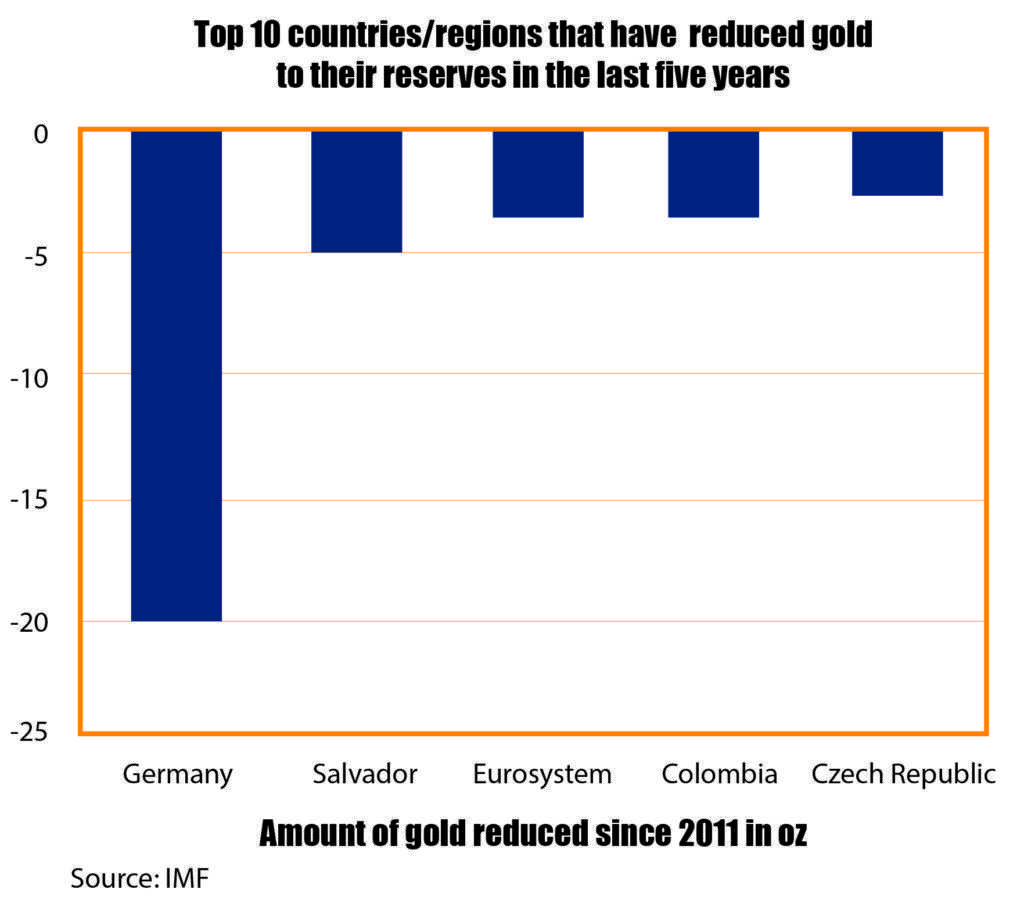

For five years no central bank has sold a significant part of its gold holdings. Germany is the country that has reduced its gold holding the most because it is selling a part of this precious metal to its citizens. The IMF data clearly show that gold is playing an important geopolitical role, so it comes as no surprise that the countries that do not follow the Western powers’ party line are steadily increasing their gold reserves and thus strengthening their independence.

References

| 1. | ↑ | The end of the Bretton Woods System (1972–81); IMF |

| 2. | ↑ | List of countries by gold production Wikipedia. |

| 3. | ↑ | IMF Approves Reserve-Currency Status for China’s Yuan, Bloomberg 2015-11-13. |

![in the last five years (China excluded]](https://gefira.org/wp-content/uploads/2016/06/in-the-last-five-years-China-excluded.jpg)

2 comments on “Gefira Gold Report”

What moves the price of gold day to day beyond what is mentioned above? USD, Interest rates?

What is your price target?

There are three main reasons

ETF funds are buying now at record levels. These funds are/were owned by Soro’s and their likes. They have an incentive to sell ETF’s without buying gold, as one should expect. If enough investors are bought in these funds, they probably try to crash the market again as we saw in 2012. These people do not have any morality and do not care to screw their clients.

Russia and China want to get rid of the US dollar. We expect these countries try to prevent a collapse in the gold price. Because they are the largest gold producers they, have some power.

People with money in China, Russia, US and Europe are looking for “store of values”, they are buying houses (real estate) in the major cities in the West as if it were bullions. The 500 Euro note has become an uncertainty as we explained in our bulletin. People flee in negative yielding bonds. We expect that that gold is also in the basket.

Import in India seems down.

We expect turbulence in Europe and the US will increase. Germany is now the principal power in Europe; Chancellor Merkel has a track record that she mishandle every crisis.

There is a new banking crisis brewing with Deutsche Bank and the Italian banks. We expect Merkel will act when things are completely out of control.

With the election of Clinton war with Russia is inevitable.

We do hold physical gold but also look at other less obvious assets. We expect gold will increase steadily in price, but we are cautious. Especially the ETF’s are dangerous.

In the Gefira we looked at Venezuelans bond and Russian Oil companies. In september we will also look at the security industry now Europe’s immigration problem seems unsolvable.