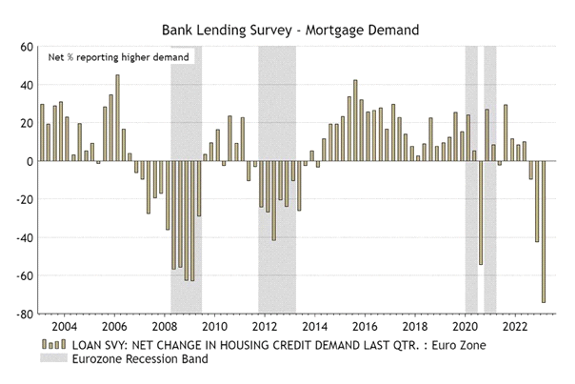

The mortgage volume in Europe has collapsed. Buyers can no longer finance themselves with loans at the level of previous years due to the significantly higher interest rates. And yet the ECB has not yet spoken its last word on tightening monetary policy. Raising interest rates further will neither stop inflation nor prevent the collapse on the real estate market. The ECB is helpless in the face of the changes in the world energy market and is in a tight spot. That the first peak of inflation is behind us does not mean that the reasons for persistent inflation have disappeared. Gefira have warned several times about the real estate market, especially in China (where omens for the storm last year included the fall of Evergarde). Now, unfortunately, our scenario is materialising. The graph speaks louder than words: