For public finances to be healthy, the economy must be sick

The fiscal conservatism of Germany and the Netherlands clearly limits the growth potential of both countries. The 45% of economists and think tanks active in the AIECE research network consider the current monetary policy in the eurozone to be too restrictive, while only 25% consider it to be correct. In particular, the respondents pointed to the governments of Germany and the Netherlands as those that are only insufficiently supporting their economies. The budget deficit of these two countries will amount to 1.6% of GDP this year for the former and 2% of GDP for the latter. By way of comparison, the figure for Italy is expected to be 4.4% and for France 5.3%. At the same time, many countries are struggling with much higher inflation than those between the Rhine and Oder, for example. It’s like between an anvil and a hammer: either you spend less money on stimulating businesses, leading to a slowdown in the economy and ultimately to recession in the country (Germany, Netherlands), or you increase public debt and the budget deficit through excessive spending, pumping money into the economy, which brings inflation with it (Italy, France).

In 2023, it paid off to pursue an expansionary fiscal policy that avoided a recession. In terms of GDP, higher government spending in Italy and France replaced falling demand, leading to positive growth rates. Countries that cooled their fiscal policy achieved lower growth rates and in some cases paid for this with a recession (see the Netherlands, where GDP fell by 0.3% year-on-year according to the latest figures). Denmark stands out from this pattern, as it achieved growth of almost 2% despite its restrictive fiscal policy. However, it is worth noting that economic growth was boosted by the huge success of Novo Nordisk, the manufacturer of weight loss drugs. Without the pharmaceutical industry, GDP would probably only have grown slightly.

At the same time, it should be noted that the higher inflation in countries with a more expansive fiscal policy is due to the fact that government spending has had to react to cost shocks. For example, countries that are more susceptible to supply shocks due to a higher share of food and energy in the basket of goods have taken more comprehensive and longer-lasting shielding measures for ordinary consumers. However, the reversal of these measures is slow, which is also slowing down the disinflation process.

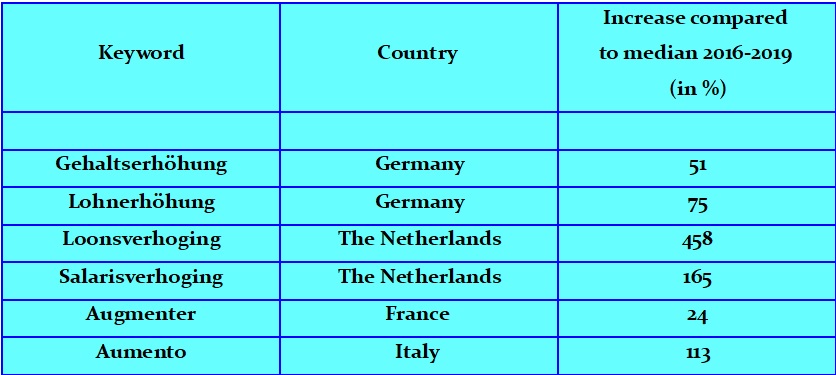

A new threat to inflation is the escalation of wage demands in the major EU economies. Figures from the European Central Bank (ECB) indicate that growth in collectively agreed wages was stable at just under 3% in the fourth quarter. At the same time, these figures are published with a considerable time lag and show a rather outdated picture that ignores the ongoing negotiations between employers and employees. A completely different picture emerges from the internet search data, where questions about pay rises are reaching historic highs in almost all major EU economies. For example, Dutch internet users are now twice as likely to search for terms relating to pay rises than in 2016-2019, i.e. before the pandemic. In such an environment, rapid disinflation is highly unlikely.

Quelle: Google Trends | Gehaltserhöhung = salary increase, Lohnerhöhung = wage increase, Loonsverhoging = wage increase, Salarisverhoging = salary increase, Augmenter = Increase, Aumento = increase

To summarize, the impact of fiscal policy in 2023 has proven to be quite intuitive and textbook, although it is worth noting that the consequences of some fiscal tools will also show up over a longer period than just a few quarters (e.g. investment, education spending, etc.). Countries that pursued expansionary fiscal policies had to accept higher inflation but managed to avoid recession, while governments that focused on central bank support had to accept recession/weaker growth but achieved lower inflation rates at the end of the year.