With oil price around 30 dollars per barrel, it seems obvious that the price can not go down much further. It looks like a no-brainer, price of oil will go up somewhere in the future.

With oil price around 30 dollars per barrel, it seems obvious that the price can not go down much further. It looks like a no-brainer, price of oil will go up somewhere in the future.

The so-called experts predict a sustainable oil price of 60 dollars or more somewhere between now and five years. Investing in oil at 30 dollars per barrel looks a guaranteed winning strategy. If oil price reached 60 dollars a barrel, your investment doubles in 5 years, returning an annual yield of 15%. This yield would even be much better if you can leverage your investment.

For that reason, many retail investors rush into oil ETFs and ETNs. In reality, it is a “guaranteed” losing strategy for retail investors and a gold mine for financial services companies who are eager to offer these products. Because ETFs returns a guaranteed profit for the issuer, regulators even allow financial services companies to offer unsecured products, the so-called ETNs, which are probably not able to pay out in case oil spikes. When oil price spikes, the only situation the long-term retail investor can make a good profit, we do not see how an ETN issuer is able to fulfill its obligation. An ETF issuer is supposed to hold the underlying oil. This can be in the form of a future or a barrel oil in a storage tank or be floating on a ship. If the price of the underlying spikes and ETF buyers want to cash their profits, the ETF issuer can cover his losses by selling the underlying. An ETN is virtually the same product as an ETF, but the issuer is not obliged to hold the underlying product.

Issuing ETFs are a guaranteed winning strategy for prudent financiers, for that reason regulators allow financial service companies to issue unsecured ETNs. The reason behind it is simple math. The value of a three-times leveraged ETF at 11 January, when oil price was about 31 dollar per barrel, lost 30% within a month while oil was still trading at 31 dollars. This strategy does not sound like a winning strategy. The decline in price is because the ETF is adjusted on a daily basis as oil goes up 10% the ETF will add 30% from 1dollar to 1.30 dollar; if oil falls back to 30 the next day the ETF will tumble to 0.95 dollar (27% of 1.30), for the full math see the example at the end of this article. The daily adjustment makes the product very unprofitable for long-term investors.

In modern finance, it all boils down to a simple rule: the loss of one person, retail investor, is the profit of the other, prudent financier. In modern economy, the investment profit of one person is the investment loss of another.

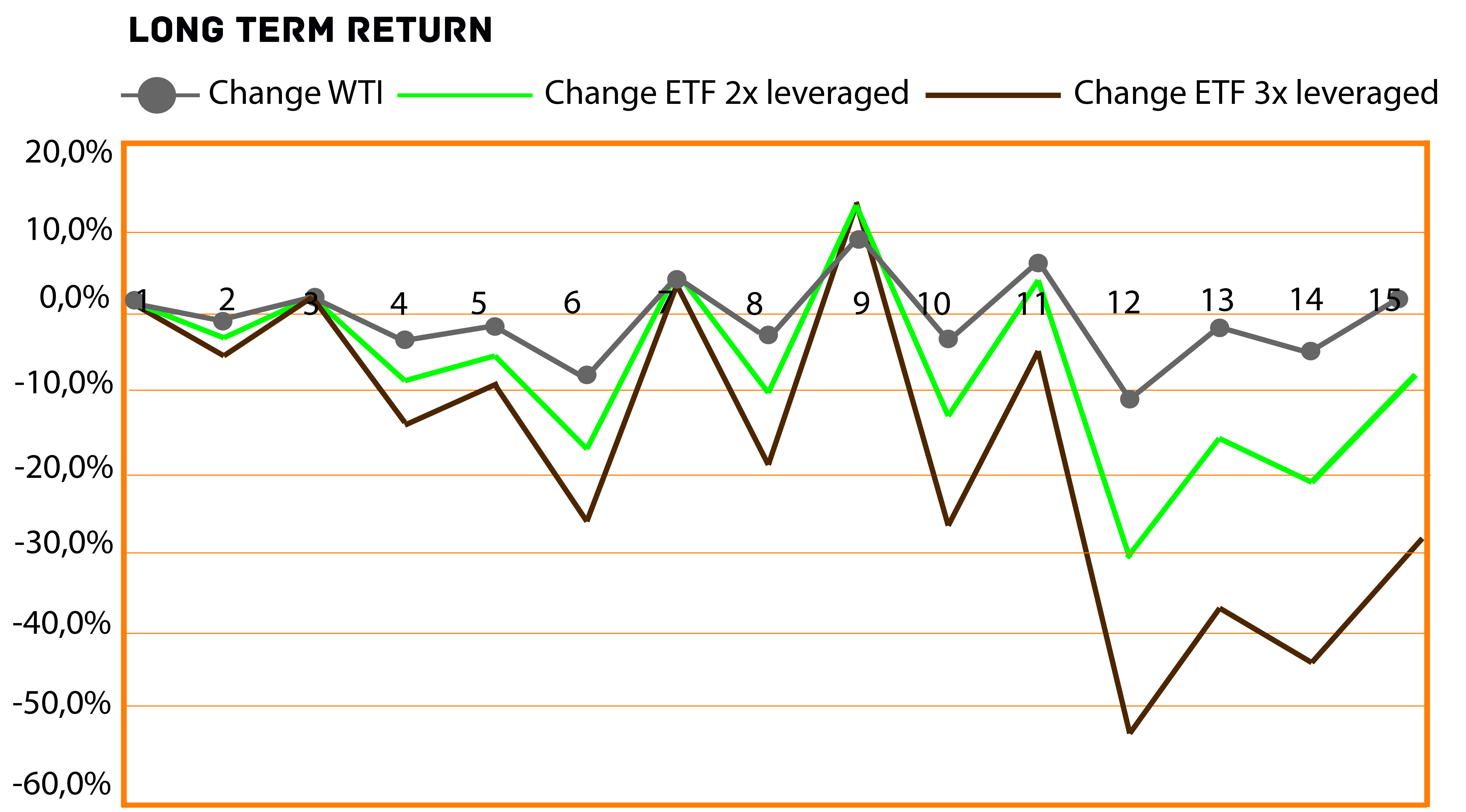

In the graph we have taken the WTI (oil) closing price from the 11th of January to the 17th of February. WTI closed on 17th February with $31.36 per barrel, standing at 0.67% higher than 5 week ago. Investors who bought those ETFs back then, have lost between 10 and 30% of their money by playing the waiting game. If these investors ever want to see their money back, oil needs to rise in a uniform upwards motion with 7% for the 2 times leveraged and 16% for the 3 times leveraged See the math example.

The math

We imagine a leveraged ETF portfolio to make money on the “in the long term rising oil” bet. If the underlying asset rises by 1% the ETF would increase by 2% (two times leveraged) or 3% (tree times leveraged). We assume at first glance that with WTI doing $30 per barrel our ETF would five-fold or even seven-fold when we reach the $90 per barrel. (90-30 = 60 => 200% profit times two is a 400% increase, the ETF has 500% its original value.) Our two times leveraged ETF would skyrocket to five times the current worth, a whopping 400% profit. My VelocityShares Daily 3x Long Crude ETN (UWTI), currently trading for $1.453would be $10.171 a share. We couldn’t be fooled less.

To keep it simple we take a two times leveraged ETF trading for $100 as an example. Imagine the underlying asset rising by 10% on a day. The ETF would increase by 20% as it is twice leveraged, meaning it would be worth $120. Now the underlying asset, oil, drops by 10% again. The price of the ETF will drop by 20%; saying it will fall back to $96. At the end of the day you have lost 4 dollars. Where the underlying asset was $100, after a 10% rise, the asset is now trading for an $110. It drops to 10% again, meaning the asset closes at a $99. The asset only dropped a dollar. A decrease of one dollar resulted in a 4 dollar loss on the two times leveraged ETF. Three times leveraged ETF would close on $91. With four times leveraged it would have ended at an astonishing $84, a 16 times loss.

With a 1% oil price drop in two days we record a loss of 4% for the twice leveraged ETF, the three times leveraged recorded a loss of 9% and the four times leveraged noted a loss of nearly 16%. If we are holding those leveraged positions for a longer period, just start burning the rest of our money while we’re at it.