Do you believe that every central bank acts independently of other countries? That the currency you pay with every day means anything in the world? Well, francs or crowns do, but others… Anyway, central bankers from all over the world gather from time to time at their headquarters in Basel to set the course for all currencies, their appreciation or depreciation, at secret meetings. Yes, at secret meetings, which is not in keeping with the transparent, democratic world and Switzerland in particular. There in the tower of their bank (the headquarters of the BIS – the Bank for International Settlements) they pay their bills, plan the next crises, the next helicopter monies, the next bailouts. Yes, there are such circles and their history goes back to the times before the Second World War.

The headquarters of BIS, the infamous bank about which numerous authors such as Le Bro and Ronald Bernard wrote volumes. Source: Wikipedia.

Now some are stepping out of line: the BRICS countries are throwing down the gauntlet to the dollar, the king of all currencies, to which they have all had to submit up to now.

The absolute dominance of the dollar is beyond doubt because:

First

When the Second World War ended, the US economy undoubtedly became the most powerful in the world. In 1970, the United States accounted for about 40% of the world’s GDP. It was the only one left untouched after a major armed conflict and was able to use its position to introduce convenient rules for itself. For example, funds under the Marshall Plan (post-war reconstruction of Europe) were nominated in dollars.

Second

The US has created a financial system based on its currency. Until its link to gold was severed, every other currency was firmly tied to the dollar. This meant the need to hold dollar reserves. For example, the UK had up to 70% of its reserves in US currency at the time.

Third

The International Monetary Fund and the World Bank are institutions dependent on the USA (30% of the dollar reserves gave the USA a decisive vote). Therefore, loans in dollars were granted to countries in a difficult financial situation. In addition, they often had to open their markets to American exports, which only strengthened their dependence on the dollar.

Fourth

Until recently, all commodities were traded on the stock exchanges and always denominated in dollars, be it gold or oil, it doesn’t matter. All of them.

However, the era of globalization set in motion in the USA has begun to have negative effects. One of these was the unprecedented economic growth of many countries, especially China. They all increased their production and trade, and so their currencies became more and more relevant. In the 1980s, the dollar was the currency of 80% of trade accounts. Later, this share declined: from the 1990s to today, it has fallen from 70% to 54%. JP Morgan predicts that it will be around 50% by 2030.

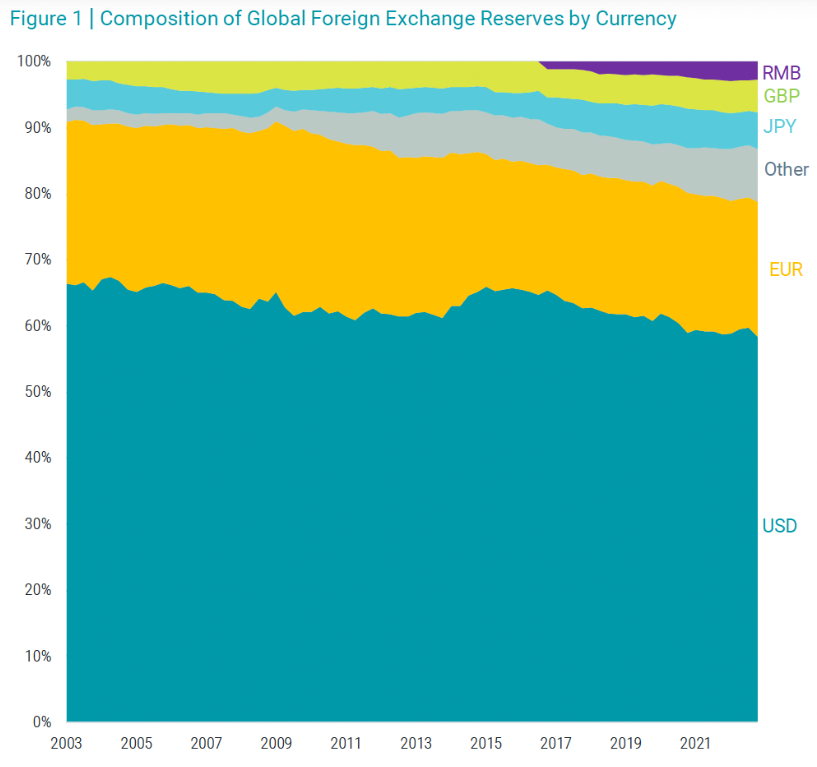

A similar trend can be observed by analyzing the share of individual currencies in global reserves. The dollar’s dominance peaked at the beginning of the 21st century, when it accounted for around 72% of all reserves. As you can see in the chart below, this share has gradually declined over the last two decades.

Source: Arcadiawm.com

As you can see, the majority of the new shares of currencies other than the dollar are due to the development of the economy in almost the entire world (“Other” in the chart). This is the effect of globalization and the growth of wealth in many countries. Interestingly, the Chinese yuan only started to play any significance in 2017.

The growing popularity of the yuan can also be seen even more clearly by analyzing SWIFT data, i.e. the American payment system used worldwide: In 2023, the value of transactions made in this currency increased dramatically. This made the yuan the 4th most popular currency in this system. This is indirectly due to the sanctions imposed on Russia for its invasion of Ukraine. This forced the Russians to bypass the dollar, which is why the yuan and ruble currently account for around 90% of the country’s trade with China. To this should also be added bilateral agreements with Brazil and Argentina, which were signed at the time and have included the yuan in trade between these countries.

However, one of the main reasons for the popularization of the Chinese currency is the activity of the BRICS. This bloc accounts for 31.5% of global GDP, 40% of the population, 40% of the oil market and 72% of the rare earths market. The participating countries cooperate with each other through investment in infrastructure and trade. One of the group’s most important assumptions is the pursuit of a multipolar world order and thus a world in which the dollar is no longer the most important currency. Within the framework of the BRICS, institutions were created that represent alternatives to the World Bank and the International Monetary Fund. These are the New Development Bank and the Contingent Reserve Arrangement. Their business is very similar to their Western counterparts, but there is one fundamental difference. Loans are granted in local currency, which reduces dependence on the dollar. As a result, 69% of trade between the BRICS countries will bypass the US currency in 2025.

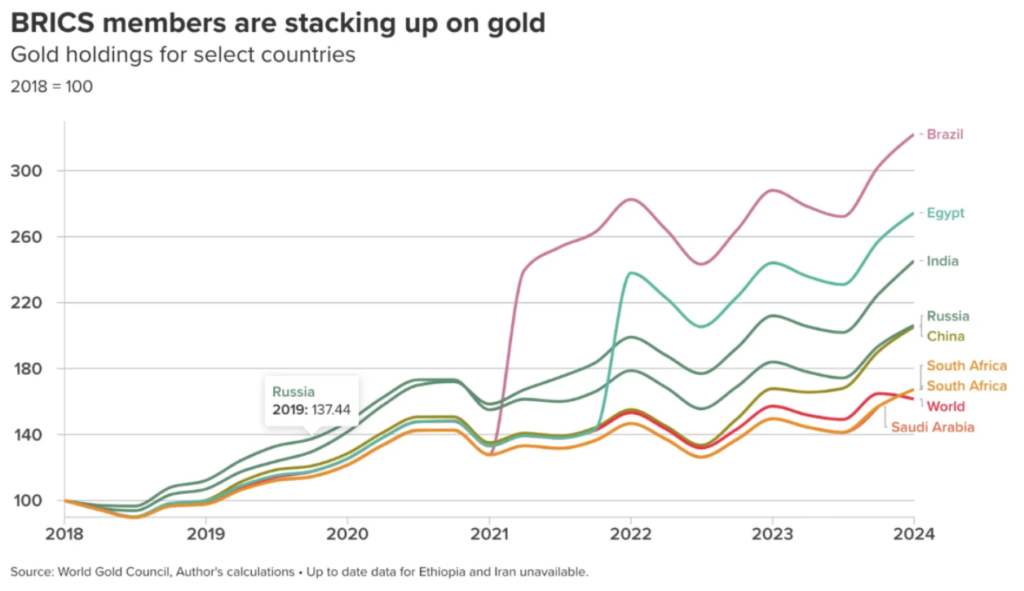

In addition, BRICS countries are buying gold instead of dollars. Recently, it has been the very countries (with China in the lead) that have been most responsible for global gold purchases, mostly directly from local miners, further reducing dependence on the dollar. It is worth noting that the BRICS countries account for 20% of global gold bullion supplies. Therefore, it is obvious that many countries (including the BRICS) are trying to have as many gold reserves as possible, which should further boost demand for this metal.

What’s more: In October 2025, the Moscow Precious Metals Exchange was launched on the initiative of the BRICS. It enables calculations in gold, platinum, diamonds and rare earth metals. It bypasses the SWIFT system and the London Metal Exchange system. This decision makes countries such as Russia and China independent of possible sanctions and supports trade in commodities and currencies of the BRICS countries.

In addition to the newly opened Moscow Exchange, there is also a Shanghai Exchange specializing in gold and silver, which supports 30% of gold trading in the yuan. A merger with a newly opened organization could create a common market for metals within the BRICS, making the bloc further independent of Western influence. These events only emphasize that the role of gold will only increase in the coming future.

A thorn in the side of the Americans and Western bankers is the fact that the BRICS are using their control over 72% of rare earth element (REE) reserves as leverage against the West. The recent information about Chinese restrictions on the export of these commodities and Trump’s threats that followed only confirm this.

China, a tycoon in this market and the most important member of the BRICS, is also trying to establish alternative supply chains in order to circumvent Western influence as broadly as possible. One example is the Middle Kingdom’s investments in Africa. The Dark Continent is a kind of gateway to the implementation of the de-dollarization strategy, as there are huge, unknown REE deposits (up to 10% of global supply in the next 5 years). In Angola, for example, a new mine is being built. From 2026, it is planned to produce 20,000 tons of mixed rare earth carbonate (MREC) per year, which will cover 5% of the global demand for magnetic metals. Lobito Corridor (the Banguela railroad) will be used for export. It is an infrastructure financed by China as part of the New Silk Road (BRI). The key here is the fact that it completely bypasses the routes controlled by the West, facilitating trade with China and Russia. Therefore, China is building a new network of dependencies and cutting off its competitors from access to attractive markets in order to obtain economically critical minerals. We would not be surprised to see Angola join the BRICS in a few years, as well as Nigeria, where Africa’s largest REE processing plant is located.

To summarize: The emergence of a multipolar world order is very likely, even if the dominance of SWIFT, the BIS, the IMF and similar US-dependent institutions will continue for some time to come.