The turmoil in the financial market was far from good news to President-Elect Donald Trump.

The 10-year Treasury yield was on pace for the largest 2-week rise since 2009. The crash in the bond market happened alongside a 10% devaluation of the Japanese yen.

The mainstream media presented the dumping of Treasury bonds as good news. Investors miraculously expected the US economy to boom and inflation to rise now that Donald Trump will be their president. The same media analysts that predicted two weeks ago that the financial world would collapse if Trump were elected are now convinced that Trump’s plan to increase spending and lower taxes will finance itself.

This can be the case for the 1 trillion infrastructure spending Trump promised, but the tax cut for the more wealthy Americans will do nothing more than explode the public debt1)What the Rich Are Doing Now to Reap Trump’s Tax Bonanza Source Bloomberg 2016-11-14 .

Now that interest rates are rising, consumers, companies and the governments have to pay more to service their debt. They will spend more money on interest without increasing productivity, hiring more employees or consuming more. The sell-off in Treasuries was bad signal for the US economy at large.

The increase in interest rates has a negative effect on:

Mortgages

With Treasury yield, mortgage prices have gone up and mortgage rates are now the highest since July 2015. The average mortgage rate increased 0.5% within a couple of days, implying a 14% growth in mortgage costs for consumers2)Mortgage rates move higher for Friday Source Bankrate 2016-11-18.

Consumer Credit

An increase in interest rates will also have its effect on credit card debt and car loans.

However, these loans are more dependent on short-term interest rates and will only be affected when the FED starts hiking rates. US car sales, fueled by low interest, began to decrease before the election, and, according to Reuters, dropped 6 percent despite discounts3)U.S. Consumers Are Increasingly Defaulting on Loans Made Online Source Bloomberg 2016-11-154)Average Credit Card Debt in America: 2016 Facts & Figures Source Value Penguin 2016-08-305)What Surging Interest Rates Mean for Your Credit Cards, Auto, Student and Home Equity Loans Source The Wall Street 2016-11-15.

Federal debt

The US Federal debt is now more than 100% GDP. Every percentage point of interest rate rise, increases the deficit without the government spending more on the US economy6)National debt of the United States Source Wikipedia.

Muni-bond market

The US public debt is not limited to Federal debt; local governments are also indebted and last week investors also started to unload their muni-bonds. In 2011 some analysts warned that the $3 trillion municipal bond market faced the immediate threat of hundreds of billions dollars in default7)The Worst Prediction of 2011 Source Wallstreet Daily 2011-12-238)Muni Bond Week in Review: Yields Jump Like Crazy Source ABC-news 2016-11-10.

Corporations

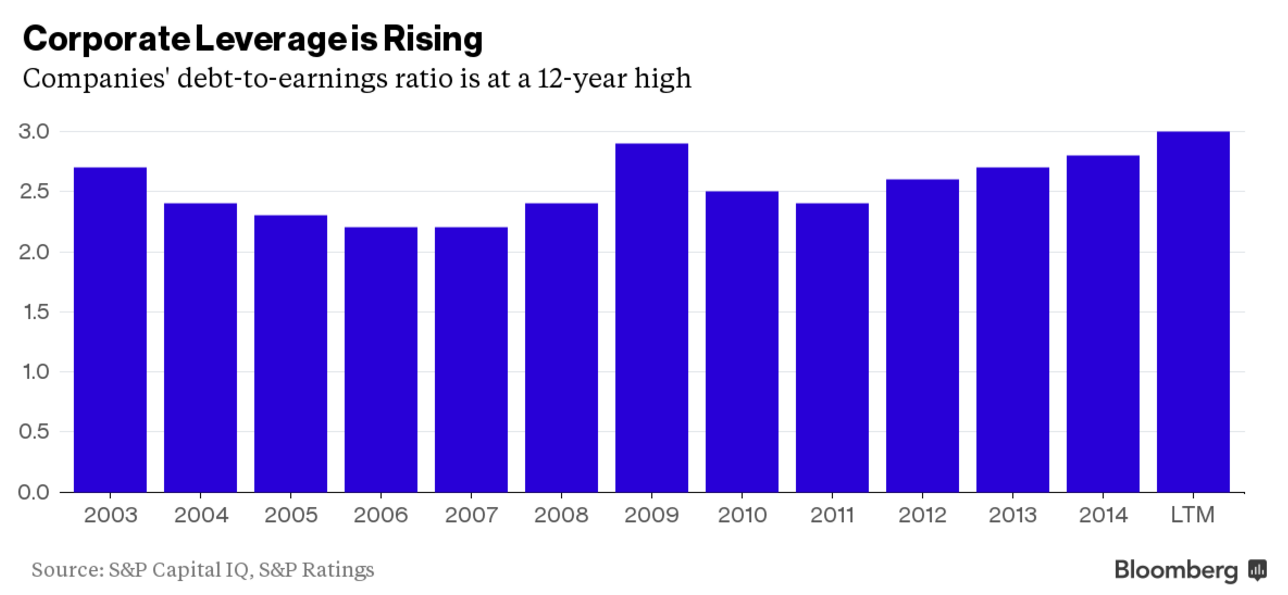

The Treasury bond sell-off is also bad for USA corporations. Since the 2008 financial crisis, US companies have started to increase their debt at a fast pace, and now corporate debt exceeds the 2009 levels. According to Bloomberg, “There’s been endless speculation in recent weeks about whether the US, and the whole world for that matter, are about to sink into recession. Underpinning much of the angst is an unprecedented $29 trillion corporate bond binge that has left many companies more indebted than ever.” An increase in yield raises the cost of these indebted companies without increasing production or hiring more staff.

The sell-off of Treasuries is a setback to President-Elect Donald Trump and can cripple his plan to make America great again. We would not be surprised if the Chinese started to dump treasuries as a warning signal to the Trump administration. During the election campaign Trump was very negative about China and its leadership and made it very clear: “On day one of the Trump administration, the US Treasury Department will designate China, a currency manipulator,….This designation will trigger a series of actions that will start the process of imposing countervailing duties on cheap Chinese imports, defending American manufacturing and protecting American jobs.”9)Trump: Currency manipulation ‘the worst of China’s sins’ Source The Hill 2015-11-10

Whoever is behind the dumping of Treasuries last week, it becomes clear that the US is at the mercy of its main creditors; China and Japan. The Treasury sell-off must have created panic in the Trump Tower last week. While China is a potential adversary of the US, Japan is seen as a US vassal. For that reason it is no surprise that we are convinced that the Japanese came to the rescue of the US bond markets.

Shinzō Abe, Japan’s prime minister, was the first foreign leader to visit President-Elect Trump. Both Trump’s daughter Ivanka and her husband Jared Kushner attended the meeting without being officially members of the new White House staff. A sign that this meeting had some urgency10)Ivanka isn’t the only reason these photos of Trump meeting Abe are problematic Source Quartz 2016-11-19. On the day that Abe visited Mr Trump, the Bank of Japan unexpectedly offered to buy an unlimited number of Japanese government bonds at fixed rates11)Bank of Japan unveils surprise bond-buying plan Source Market Watch 2016-11-17.

Japanese institutional investors are now able to exchange their Japanese bonds for US Treasuries and provide the much-needed demand for Treasuries, preventing a total bond-market meltdown. As a result, the Japanese yen lost nearly 10% of its value because Japanese investors exchanged their bonds at the BoJ for yens. These yens were exchanged for dollars to buy Treasuries. By buying unlimited amounts of Japanese Government Bonds the BoJ prevented the US Treasury market from imploding.

Thanks to the action of the BoJ the US bond market was rescued without the help of the FED. At the same moment Janet Yellen, the chair of the FED , was able to announce a possible rate hike, pretending everything is fine. The mainstream media did the rest of the job by explaining that an increase in interest rate is an incredibly good signal for the US economy at large.

References

| 1. | ↑ | What the Rich Are Doing Now to Reap Trump’s Tax Bonanza Source Bloomberg 2016-11-14 |

| 2. | ↑ | Mortgage rates move higher for Friday Source Bankrate 2016-11-18 |

| 3. | ↑ | U.S. Consumers Are Increasingly Defaulting on Loans Made Online Source Bloomberg 2016-11-15 |

| 4. | ↑ | Average Credit Card Debt in America: 2016 Facts & Figures Source Value Penguin 2016-08-30 |

| 5. | ↑ | What Surging Interest Rates Mean for Your Credit Cards, Auto, Student and Home Equity Loans Source The Wall Street 2016-11-15 |

| 6. | ↑ | National debt of the United States Source Wikipedia |

| 7. | ↑ | The Worst Prediction of 2011 Source Wallstreet Daily 2011-12-23 |

| 8. | ↑ | Muni Bond Week in Review: Yields Jump Like Crazy Source ABC-news 2016-11-10 |

| 9. | ↑ | Trump: Currency manipulation ‘the worst of China’s sins’ Source The Hill 2015-11-10 |

| 10. | ↑ | Ivanka isn’t the only reason these photos of Trump meeting Abe are problematic Source Quartz 2016-11-19 |

| 11. | ↑ | Bank of Japan unveils surprise bond-buying plan Source Market Watch 2016-11-17 |