Every market analyst and observer believes that the markets always strive for a balance: the bull market is followed by the bear market and conversely. The art is to follow these waves.

Gefira Financial Bullletin #19 is Available now

We have been observing for over a year now, since the election of Trump as President, a huge wave of confidence. The financial markets believed in his policies and the strength of the American economy. The main indicators of the American stock markets are reaching one high after the other, breaking record after record. Investors are speculating on Trump’s tax reform, which promises huge relief for companies: corporate tax will be reduced from 35 to 20 percent. Private households will also pay lower taxes, but all special deductions will be abolished, so that the reform will not mean any changes for most citizens in the long term and will even be unfavourable for the poorest. Trump signed the Senate’s reform at Christmas, and now a correction is more likely to occur than further record-breaking, as markets are lacking a driving force for further growth. It is paradoxical, but good news only revives the stock markets in the short term, till profits are usually made. At present investors are waiting because they want to book profits for this accounting year, and now that they can, they will most likely reap them.

The success of Trump’s reforms may also have a negative impact on the quotations of many European companies, especially those that generate a large part of their profits from exports to America (automotive industry, for example, companies such as Daimler or BMW). Trump’s reforms may affect transatlantic trade as payments to companies outside the US are to be taxed at 20%. And even worse, the question arises how the GDP of such countries as Ireland (whose GDP grew a whopping 32% in 2015) will be affected as it will lose its preferred tax-haven status.

The fact that the markets may be facing a turnaround is also evidenced by the discrepancy between the prices on the stock markets and the quotations of some currencies and metals. Gold is approaching the psychological limit of 1300 dollars per ounce, the yen has not been able to cross the 115 mark in USD/JPY since January. Gold and the yen are traditionally considered safe havens. So why are investors so sceptical when America is flourishing? The weakness of the dollar is also striking in this context. After all, the new reform basically means a higher government deficit. Unless the US economy grows 5 to 6%, which demographically, i.e. with the ageing American population replaced by an increasing number of low qualified and undereducated migrants is impossible, the US debt will grow indefinitively.

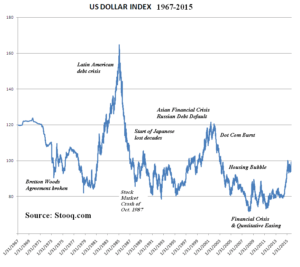

The U. S. Dollar Index, which measures the value of the U. S. dollar by means of a currency basket, remains below 95. If the market trusts Trump like it did Reagan, then perhaps the index should reach values above 120, even 150, as it did during Ronald Reagan’s term of office.

What can give the dollar a tailwind in 2018 is a tighter than expected Fed monetary policy. Investors seem to be placing too much hope in low inflation, which will be an obstacle to raising key rates at the next meetings of the US Federal Reserve. However, we take the view that the extremely good mood in the US economy will put increased pressure on the Fed as other data from the economy is good.

At the moment, the yield of 10-year US Treasury bonds is on the way to reaching the 2.4% mark. However, the 2.6% mark is crucial: once interest on the securities returns to the level, investors will reduce their funds on the US equity market to build positions in the USD bond and money markets. This would then probably also have an adverse effect on stock markets in other countries, especially emerging markets, as they will suffer from the strong dollar.

We expect that oil price will climb steadily and we project it to be 100 dollars somewhere in 2019. A surge in the price of oil was the catalyst of the 2008 financial and the 2011 euro crises. A high oil price will be the catalyst of the demographic crisis in 2020 that will dwarf the previous two crises. The number of people that will leave the German workforce will accelerate after 2020, while the native European, Japanese and American populations are already in full decline. In 2018 we will inform our readers why a financial, social and economic breakdown of the developed world after 2020 is inevitable.

These are the reasons why we think that the Gefira Financial Bulletin is indispensable to investors and traders worldwide.

To read Gefira Financial Research full analyses and economic forecast: subscribe to the Gefira Financial Bulletin and receive the next ten numbers complete with free access to our archive for just 225 euros

OR

buy a single item

The Gefira Financial Bulletin is a private briefing paper on the current economic events for investors and generally the business community. It is accompanied by our website, where you will find articles on social issues.

The Gefira research team is the only one that is acutely aware of the importance of the current unprecedented demographic changes not seen before in all of history.

The Gefira research team elaborates its anticipation, drawing on:

1. an extensive knowledge of finance and banking;

2. a comprehensive understanding of geopolitics and history;

3. detailed data analyses of millions of records;

4. computer-aided simulations.