If the American economy is doing so well, why did FED suddenly become so mild in its rhetoric during the last session? At the previous meeting in March, none of the FOMC Committee members was willing to lower interest rates, now there are 7 members who want to pump cheap money into the market. Perhaps it was the reaction to Draghi’s speech in Vilnius, in which the ECB chief announced further bond purchases and stated that he “will use all possible means” to boost the European economy before his term ends in autumn.1)Mario Draghi prepares fresh stimulus as economic fears grow, Financial Times 2019-06-06.

It looks like currency wars will continue and the central banks will continue to compete with each other in easing their policies. The markets are happy about this, and stock prices in the USA are setting new records. For European citizens, Draghis’ announcement is rather a threat to their savings. If the ECB introduces the negative interest rate, the sums on their accounts will slowly but surely melt. We have warned about this several times.2)Gläserne Bürger, Minuszinsen und andere verrückte Ideen der Wirtschaftsexperten, Gefira 2017-12-15.Data from the retail trade and from orders in industry show that American citizens are not doing so well either. Even in April, i.e. before the new steps Trumps in the trade war, they performed very weakly. Why is that? Unemployment is at its lowest level for 50 years, inflation is low and American companies paid record dividends in the first quarter. Nevertheless, consumers are not willing to spend much. It is because, despite full employment, wages are not raised. Another factor is the huge indebtedness of Americans. An example: only the debts made with credit cards amount to 1 trillion dollars! The point is: the interest rate on loans in the USA remains low, but the interest rate on credit cards is growing and currently averages 17% annually. This means that Americans have to pay 170 billion dollars in interest every year!

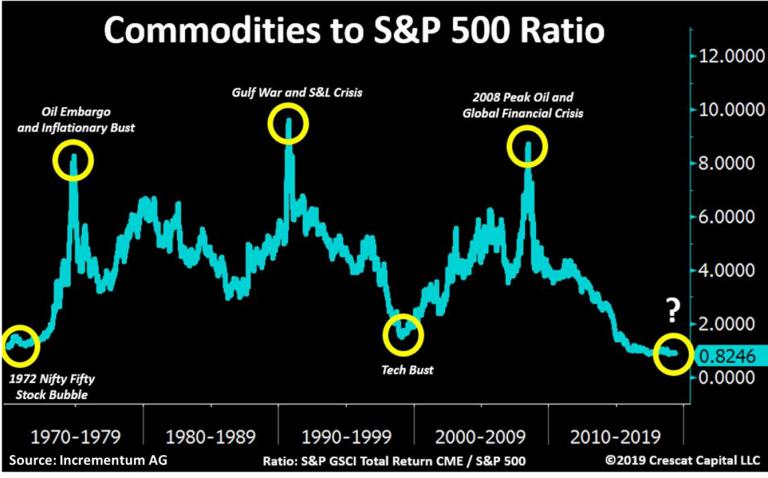

The markets ignore these facts, as well as the PMIs (Purchasing Managers’ Index – early indicators of economic activity) in the EU, which have been falling for many months, proving that the economy on the Old Continent is weakening. Moreover, the discrepancy between stock prices and commodity prices is growing. If the American economy is flourishing and the European economy is recovering thanks to Draghi’s “beneficial” policies, commodities should also become more expensive, shouldn’t they?

But what’s getting more and more expensive are cryptocurrencies. Perhaps they have become a new safe haven in the world of “weakened” traditional currencies? There is something wrong with this bull market: either the stock markets or the central banks are wrong.

Many recommendations and in-depth analyses on finance and geopolitics can be found in our bulletins.

References

| 1. | ↑ | Mario Draghi prepares fresh stimulus as economic fears grow, Financial Times 2019-06-06. |

| 2. | ↑ | Gläserne Bürger, Minuszinsen und andere verrückte Ideen der Wirtschaftsexperten, Gefira 2017-12-15. |