High inflation and the energy crisis have become a fact. We have warned our readers about this ahead of time and explicitly, especially in our bulletins. The mainstream media only shed light on the three topics: Russia, the aforementioned energy crisis, and inflation. However, many factors indicate that the current crisis has only just begun and that dangers lurk in the areas of previous crises. Consider some less discussed facts:

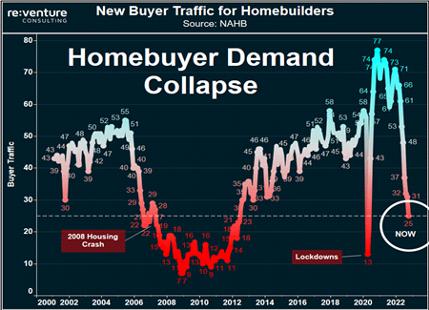

[i] The U.S. housing market, which sparked the 2008 crisis, is in steep decline. The U.S. NAHB index shows how much interest there is in buying a property and this is now dropping to lockdown and 2008 levels. What will boost the U.S. economy in the coming years? If the FED decides to pivot and start easing monetary policy again, it may save the real estate market, but it will finally bury the dollar, the current king of currencies (whose importance rose due to the Ukraine war).

[ii] The 1848 revolution in Europe resulted from economic conditions. By early 1847, staple food prices had doubled across Europe, leading to unrest and fears of famine. European governments responded with restrictive monetary policies that led to a recession. In 1848, Europe realized the political consequences of the two years of economic chaos. History does not repeat itself but it often rhymes. Today’s circumstances are reminiscent of those then, but there are two key differences: capital is abundant (albeit less so than two years ago) and labor is scarce (Europe’s fertility rate was over 3 in 1848, it is 1.5 today). So should we expect similar political instability? We cannot rule out the possibility that the Yellow Vest movement will return in one form or another in France in 2018, and that it will spread all over Europe, especially in Germany and Sweden, squeezed by green ideologues through electricity price increases and additional eco-tax burdens. The most immediate political consequence of citizen discontent is the rightward turn of European voters (see September election results in Italy and Sweden). Voters have come to understand that today’s energy crisis results from the foolish abandonment of nuclear power, the impossibility of a complete switch to green power, and the stubborn green ideology that puts “saving nature” above saving people people.

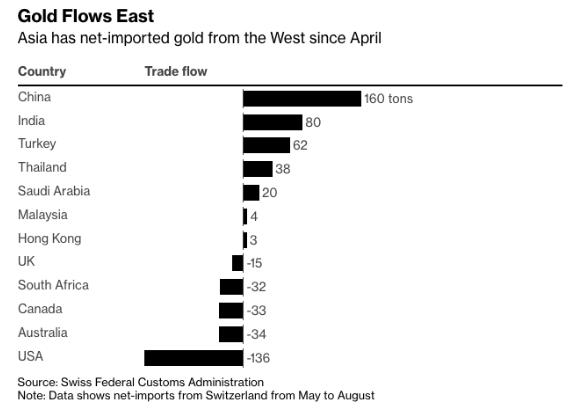

[iii] The de-dollarization is getting wind at its back. The West is selling precious metals, the East is buying up everything to quickly free itself from settlements in dollars and strengthen its own currencies with the gold and silver parity it seeks.

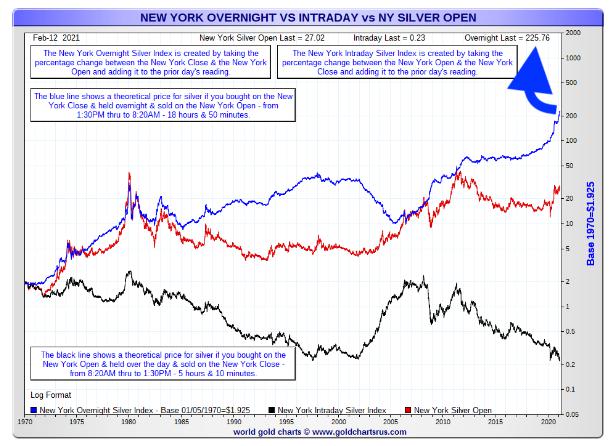

The flow of metals from west to east also agrees well with the well-known chart simulating the development of silver trading during and outside New York trading hours. During trading in New York, the price tends downward in the long run, and vice versa outside of New York trading hours. Simply put, NY sells, Asia buys.

This may be a sign of currency wars to come.

[iv] The corruption of the precious metals market: while at the moment it doesn’t matter whether you own pounds, dollars or euros because these reserve currencies are trading at parity 1:1, the price of gold, platinum and silver has been detached from the reality of the economy, from the supply-demand relationship. Or to put it correctly: it has been detached from the reality because this price is totally manipulated by the big western bullion banks.

The leverage of a paper instrument is usually measured as the amount of margin required to open a position relative to the value of the entire position for which the contract stands. In commodity markets where there is a right to physical fulfillment of a contract (rather than cash redistribution of gains/losses), the stability of an instrument can also be measured by how many contracts are open for that instrument relative to how much physical commodity is secured to meet the demand for physical fulfillment. We have pointed out several times the very significant drop in silver inventories in the Comex and LBMA vaults. In addition, silver mining costs have fallen below profitable levels long ago, and margins in the physical market (for silver coins, for example) are breaking records, already exceeding 2009 levels.

Another issue is a very small market of platinum (whose physical holdings are also shrinking very significantly) in terms of capitalization. Below is a tweet from a well-known member of the precious metals community who looked at the number of open positions relative to the total amount of metal stored in vaults, but, most interestingly for us, also relative to registered positions, i.e., metals available for release in physical settlement. As it turned out, more than 15 times as many contracts were issued for silver. However, platinum has been the real hit, with a 40-fold ratio of open contracts to metal available for settlement. Such conditions are very susceptible to short squeeze.

The decoupling of the physical metal from the paper price may lead to the insolvency of large banks such as JP Morgan, which act as bullion banks.

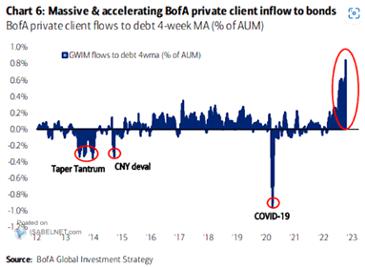

[v] The avalanche rise in U.S. bond yields in recent weeks is causing some market participants to take advantage of the discount in debt securities and increase their exposure to them. Those using Bank of America Private Banking are definitely gaining exposure to bonds. For their part, capital inflows into debt securities (as a percentage of assets under management) are now the largest in a decade.

At the same time, as can be seen below, Bank of America, one of the largest banks on Wall Street, warned on October 20 of the risk of a massive sell-off or collapse in the market for U.S. Treasury securities. So something is wrong with the story, warnings on the one hand, massive buying on the other.

How will the global financial system cope if monetary policy is tightened in the face of the gigantic mountain of debt? Perhaps not at all.

The difference between today’s crisis and its predecessors is that it is obvious that the Western elites want to use it to push through a major upheaval in which all debt is invalidated overnight, in which all currencies become worth the same and, at the same time, nothing, given the new, common, digital world currency. An upheaval from which everyone will have to tighten their belts, otherwise they will be chased from one crisis to another. Modest living with regulated access to energy, home and car sharing, the new communism will become fact. First, the old, bad capitalism with its “free” markets must perish.