Interest rates are not a simple thing, let alone negative interest rates! We are accustomed to positive rates – it is obvious that we have to pay interest on credit and that we are paid for a deposit. But times are changing. Now money supply is larger than demand, people save more than borrow, inflation is close to zero or below, so we are going to be forced to change our thinking. Or maybe not?

You take a €1000 loan. The interest rate is 5%, so you give back to the bank €1000 plus €50 of interest, altogether €1050. Easy? Only at face value, though.

Now imagine: you take a €1000 loan, but the interest rate is minus 5%. So you give back €950 to the bank. Great, isn’t it?

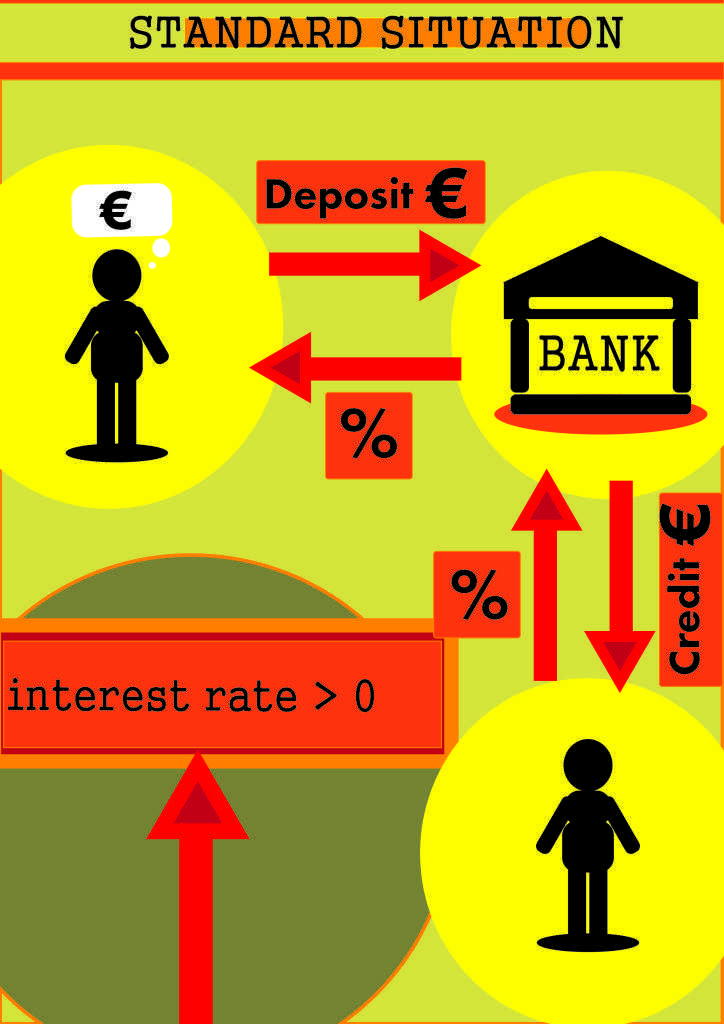

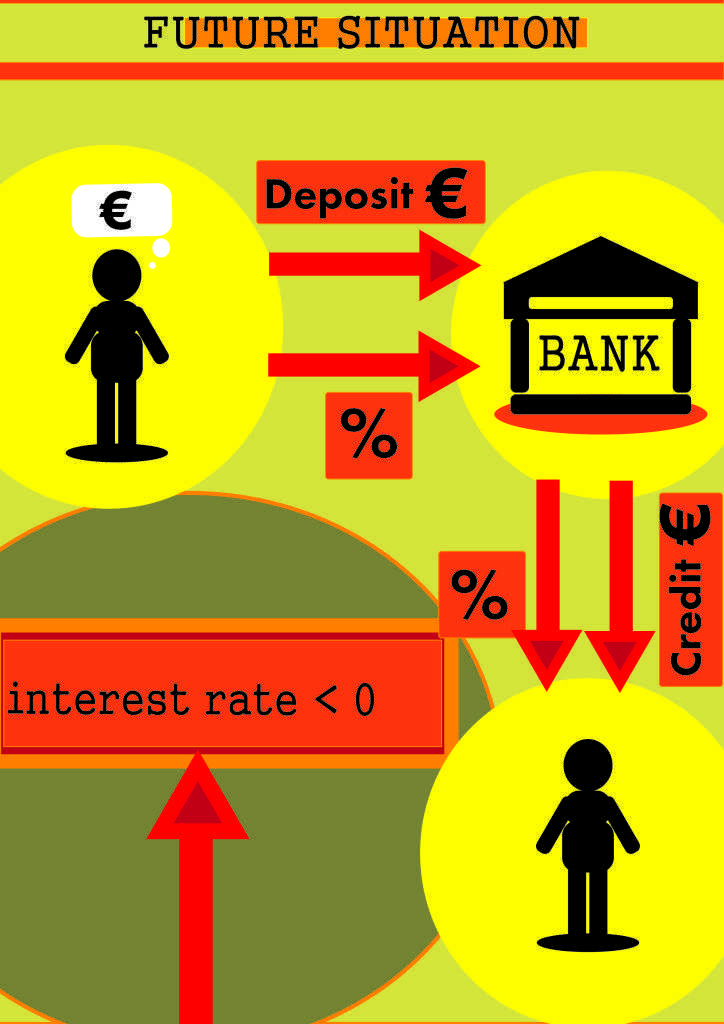

In theory, the known flowchart of banks as intermediaries between depositors (those who have savings) and borrowers (those who need capital) would be completely reversed in the case of negative interest rates. Depositors would pay borrowers the interest, because of oversupply of deposits and shortage of demand for credits. In reality it would not be so easy, though. And not so revolutionary as it seems.

Low or negative interest rates are bad not only for savers, but also (in theory) for banks which need to get rid of the money, yet they do not want to invest in risky assets. So they need to find good borrowers, like great and stable companies or states, to be assured that the money will come back, even if the amount received back is smaller than the amount that was loaned.

Keeping money on deposits in the central bank means a loss for a bank that would have to be compensated for it by raising fees and charges, which are also a kind of negative interest rate; customers may not have recognized it so far. The banks can raise the fixed account maintenance fee or the ATM fee, shifting costs of negative interest rates onto their clients.

An increase in costs and a reduction in interest rates can cause the so-called ‘run on the bank’, which means a large withdrawal of cash from deposits made by customers. It is an enormous threat for banks, because they could become insolvent i.e. they do not have enough cash to pay back all deposits. To prevent leakage of funds, necessary charges and fees cannot be tied with the amount of deposit.

Otherwise, governments would have to ban the ready cash, as Citi’s economist Willem Buiter indicated1. If people are not eager to hold cash in banks but, on the contrary, prefer to hide savings in their piggy banks, which is a threat to monetary authorities because they lose control over money supply, the easiest solution is to abolish the ready cash; or at least tax it. Under such circumstances it will be an average bank customer rather than the richest one who will bear the relatively biggest part of the costs.

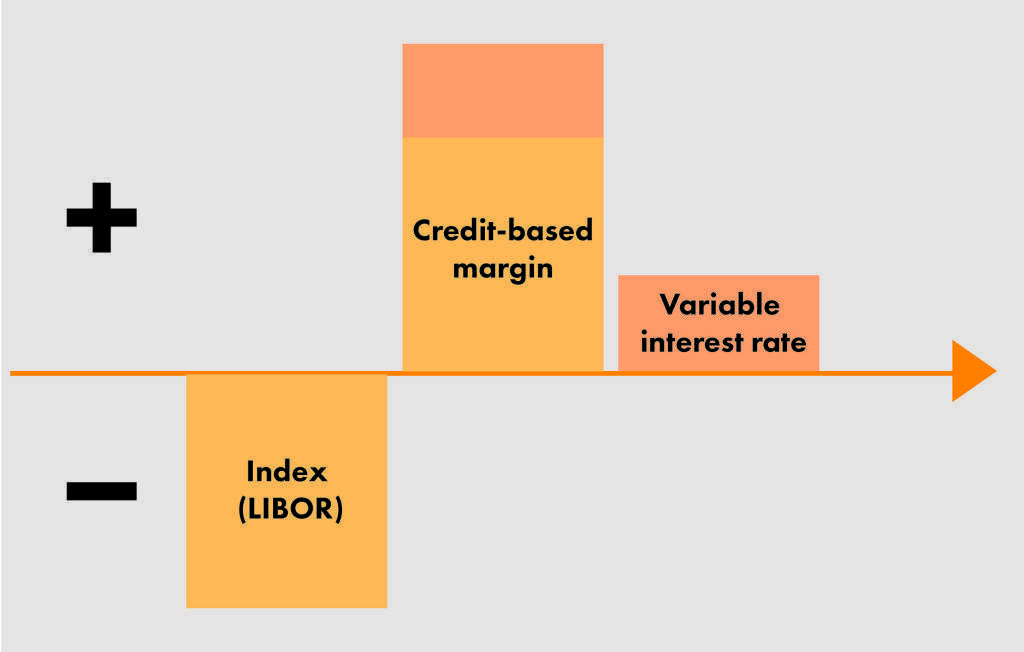

One thing is deposits, and quite another credits. However, the negative interest rate charged by the central bank does not necessarily mean a negative loan interest rate: it is only the interest rate on the interbank market that can be below zero (as it is: see LIBOR). But there is still a bank margin to be paid by a borrower. This credit-based margin must be at least as high as the index (LIBOR) is low. Then the cost of credit is zero. And if the bank margin is high enough, the loan interest rate is still over zero. Thus, it is a long way, before we are paid for taking a loan.

Conclusion? Be on your guard what your bank wants you to pay because nothing is for free.

Reference:

1. Citi Economist Says It Might Be Time to Abolish Cash Source: Bloomberg 10-04-2015

The world’s central banks have a problem.