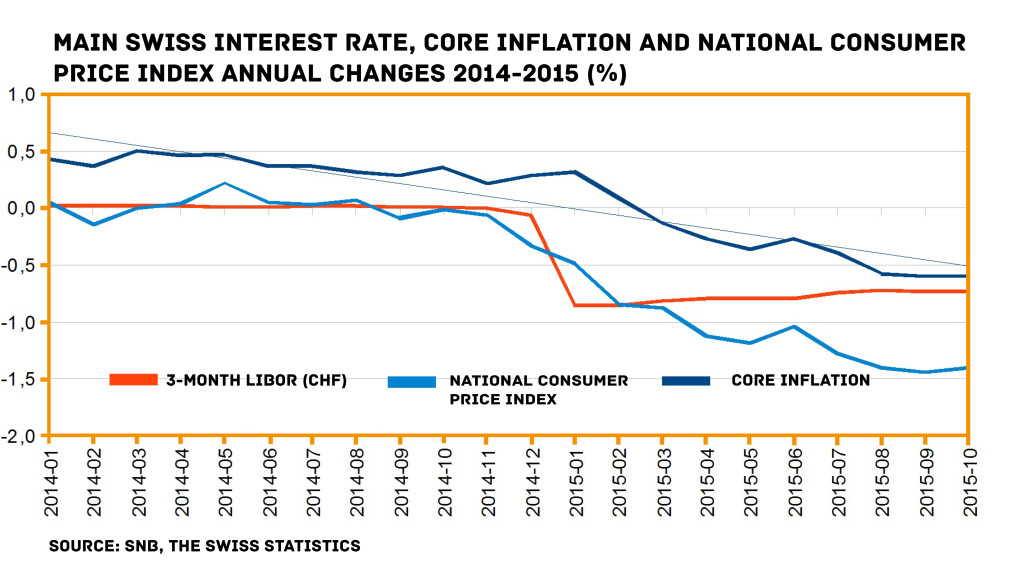

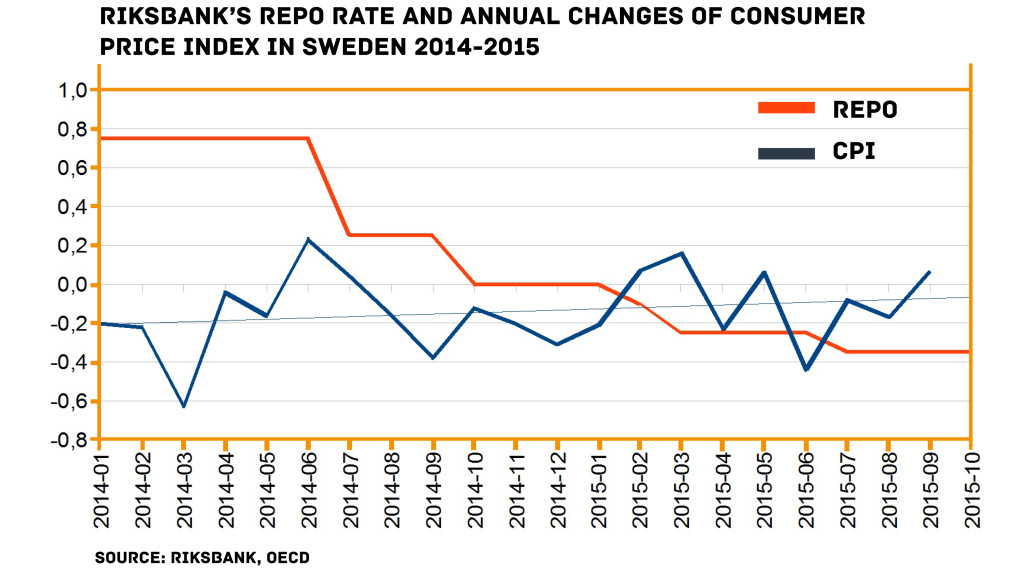

Low inflation or deflation is a feature of our times. The central banks in Sweden and in Switzerland have already reacted by decreasing the interest rates below zero. How have prices responded?

In Switzerland setting the basic interest rate range target below zero was actually not aimed at deflation but at a too high demand for the Swiss Franc. The bankers wanted to discourage investors from purchasing the Swiss currency in order to weaken the exchange rate, which makes the export more attractive and stimulates the economy. However, it was not the increased deflation that was intended.

In Sweden the lowering of interest rates has helped to stop the drop in prices, but it cannot be said that negative interest rates have boosted the inflation so far. Obviously, we should not forget that monetary policy impulses affect economies with a delay.

Comments are closed.