Last month we saw the iPath S&P GSCI Crude Oil ETN (USA) making an unusual dive, doing completely the opposite of what it was designed to do. Exchange Traded Funds (ETF) and Exchange Traded Notes (ETN) are mainly designed to follow an index. To explain the basic principles of an ETF real quick, we take the AEX index as an example. The AEX is formed out of 25 funds each with their own weighing. The ETF issuer buys the shares of the companies according to their weighing in the AEX index. One is able to track the index pretty accurately this way. The ETF issuer buys it on a big scale and sells shares of their basket of AEX shares. The share that they are selling are called ETFs. The difference between an ETF and an ETN is the fact that the ETN is a note. The problem is the third party risk, with an ETN you’re facing the risk of the issuing party going bankrupt. If they do, the chances are that you will lose your money.

Last month we saw the iPath S&P GSCI Crude Oil ETN (USA) making an unusual dive, doing completely the opposite of what it was designed to do. Exchange Traded Funds (ETF) and Exchange Traded Notes (ETN) are mainly designed to follow an index. To explain the basic principles of an ETF real quick, we take the AEX index as an example. The AEX is formed out of 25 funds each with their own weighing. The ETF issuer buys the shares of the companies according to their weighing in the AEX index. One is able to track the index pretty accurately this way. The ETF issuer buys it on a big scale and sells shares of their basket of AEX shares. The share that they are selling are called ETFs. The difference between an ETF and an ETN is the fact that the ETN is a note. The problem is the third party risk, with an ETN you’re facing the risk of the issuing party going bankrupt. If they do, the chances are that you will lose your money.

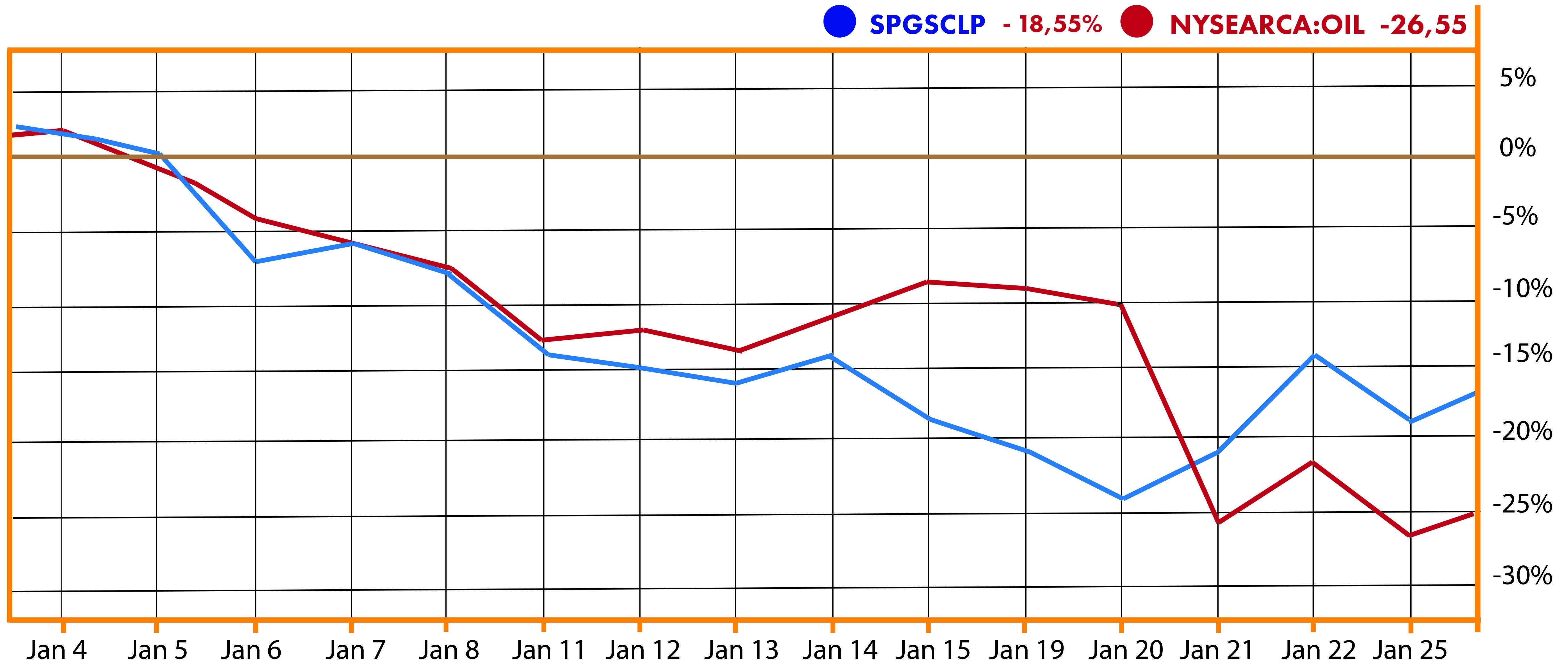

With that in mind let us have a look at the following graph. Since the beginning of January the ETN declined not as much as the underlying index, the S&P GSCI Crude Oil Index. In the period between the 31stof December and the 20th of January the index declined with 25%, whereas the price of the ETN only declined 12%, as can be seen the graph.

On the 20th January the Net Asset Value (NAV) of the ETN was 3.69USD; however, the ETN was trading for a whopping 5.51USD. The NAV is the sum of all its assets (the value of its holdings in cash, shares, bonds, financial derivatives and other securities) divided by the number of outstanding shares. The ETN had built a premium of nearly 50%. One was paying 1.81USD over the NAV. It is unlikely to see ETFs trading with a 10% premium, let alone a 50% premium. Barclays, the issuer of the ETN, made a press statement that the bank had limited but not closed the number of ETNs it is selling form its inventory each day. They had even released a guide on trading ETNs, as they warned investors of the high premium. The number of people betting on a rising oil grew, but with a limited inflow of new notes the prices of the ETNs rose.

What goes up most come down.  Premiums of 50% on ETNs are unsustainable and on the 21st the inevitable happened. The price of the shares came tumbling down, partly because of a massive short selling. As most professional investors are aware of the risk of premiums, retail investors are not. Before investing in a ETF, consider this this risk, as it’s not limited to this fund alone.

Premiums of 50% on ETNs are unsustainable and on the 21st the inevitable happened. The price of the shares came tumbling down, partly because of a massive short selling. As most professional investors are aware of the risk of premiums, retail investors are not. Before investing in a ETF, consider this this risk, as it’s not limited to this fund alone.