First in Sweden and Switzerland, and now in the whole of the Euro Area borrowing has become a good business. The European Central Bank with Mario Draghi in charge announced on March 10th that the benchmark interest rate is cut to 0,00 which is a maximum interest rate of loans within the frame of TLTRO II programme. However, the banks that will be really active on the credit market, will be able to borrow money from the ECB on the negative rate (up to minus 0,4 per cent), so literally they will be given cash by the ECB for taking its money!

First in Sweden and Switzerland, and now in the whole of the Euro Area borrowing has become a good business. The European Central Bank with Mario Draghi in charge announced on March 10th that the benchmark interest rate is cut to 0,00 which is a maximum interest rate of loans within the frame of TLTRO II programme. However, the banks that will be really active on the credit market, will be able to borrow money from the ECB on the negative rate (up to minus 0,4 per cent), so literally they will be given cash by the ECB for taking its money!

Sounds sensationally, BUT. The TLTRO II (Targeted Longer-Term Refinancing Operations) perhaps may stimulate the European economy, as it is more orientated to the real economy than Quantitative Easing is: it should provide money for households and companies. However, as Silvia Merler grom Bruegel reports, the link “to the real economy might have been weakened” because of lack of “requirements for banks to return the funds when they do not achieve their lending benchmark”. So if the new TLTRO is not designed to boost inflation, what is it then for?

First, some quick facts:

-

The first TLTRO failed;

-

The ECB does not control inflation as it depends on the oil price;

-

The European bank system is jeopardized.

The first TLTRO began in September 2014 before QE was introduced. Its aim is to encourage banks to lend to private sector but the only effect was reversing the loan contraction, as Fitch Ratings said in a report last autumn. “The stock of lending to euro zone non-financial corporations has remained flat over the past year”.

What is important, the TLTRO I had a mechanism forcing banks to return the funds they had borrowed if they lent less than they were supposed to lend. Now this obligation has gone.

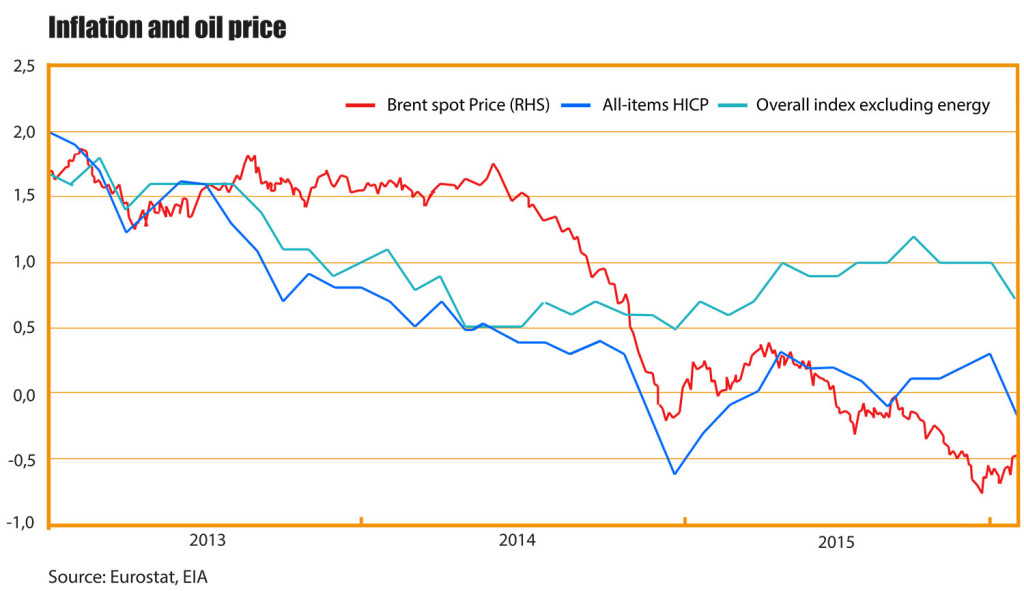

Saying that TLTRO I influenced the inflation would be thus a misjudgment. Before the collapse of the oil price in the mid-2014, inflation was dropping but still a yearly change was not lower than 0,5 per cent. After the oil price crashed, the ECB has lost control over price index. The spread between the HICP (Harmonised Index of Consumer Prices) and the HICP, excluding energy, started to grow quickly. Since then, prices apart from energy, have been increasing monthly even by 1 per cent year on year, with the overall index circulating around zero.

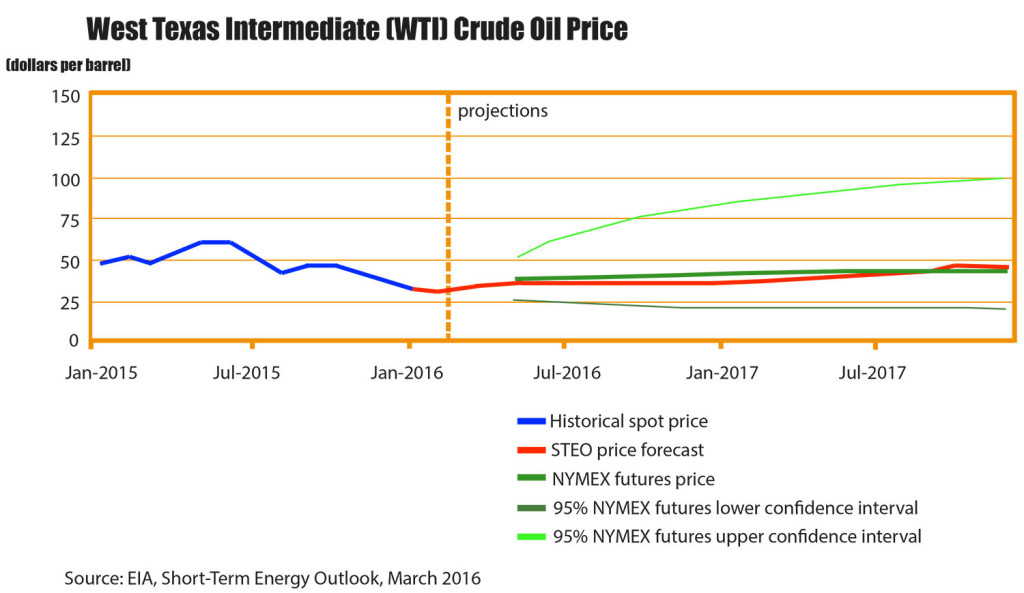

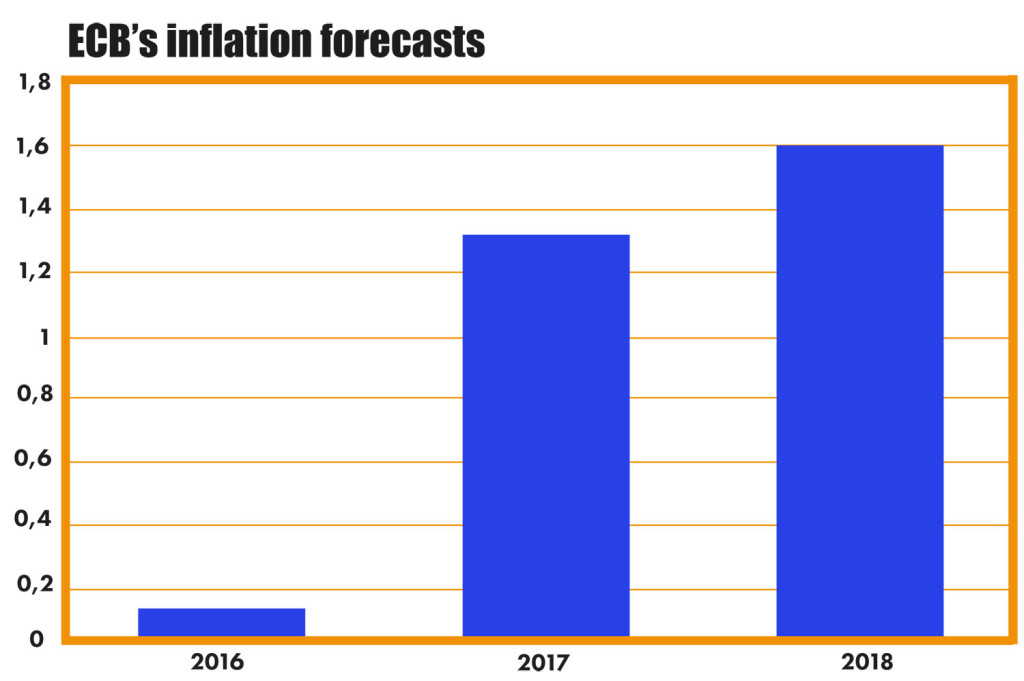

Since the price index shows changes year on year, the ECB’s goal (inflation close but below 2%) will be achieved as soon as the oil price starts to increase and the HICP’s reference period is the period with oil prices that are already low. The ECB knows it very well, forecasting a major inflation growth despite minor oil price rebound.

As for TLTRO, it is going to affect the European economy at least until 2021 when the last part of the programme expires. If these loans can really bring inflation (and such measures are designed to have a medium-term affect on the economy) together with interest rates already announced to be low or lower beyond 2017, there might be a risk that the ECB could lose control over rocketing prices.

But it is not going to happen, because we do not believe that TLTRO II has much to do with real economy. What is it, then? Most probably, this is a program designed straight for the banking system to improve the balance sheets. of banks. As they are strongly affected by negative interest rates (NIRP cost European banks €2 billion, according to Bank of America Merrill Lynch), the TLTRO is a great opportunity to boost profits by gaining non-binding loans at negative rates. This is why European bank share prices soared after Draghi’s conference: Deutsche Bank 6,8% up, Societe Generale 9,8% up, Uni Credit 8,1% up, BNP Paribas 4,7% up, Credit Agricole 3,7% up, Banco Santander 5,5% up.