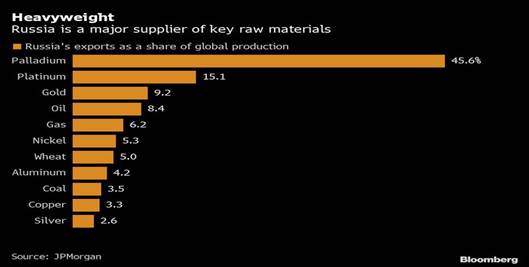

Even a diagram is enough to give you an idea:

Quellen: JPMorgan, Bloomberg

When the tensions between the West and Russia arose recently, not only oil but also precious metals became much more expensive. The price of palladium already climbed to its all-time high of almost 3000 dollars per ounce (28.35 grams) last year. At present, it seems to have ended its correction in the face of looming shortages in the event of a conflict with Russia. The precious metal is more of an industrial metal and almost half of the world’s production is in Russian hands (mainly in Siberia, where Norilsk Nickel accounts for 25 to 30% of world production). The Western decision-makers hardly thought twice when they began to steer a collision course with Putin – their green transition, their green revolution depends to a large extent on this very raw material. Palladium is used in catalytic converters to curb harmful emissions, especially in petrol cars. As most motorists in many countries switch from diesel to petrol because of new regulations and taxes, demand for the palladium is increasing. In recent years, precautionary Chinese companies have been buying up the global palladium market and Western traders are now having to put up with its ever-higher price.

One could also look at South Africa – the world’s second-largest producer – in this regard, but when one considers the cost and infrastructure problems there, one quickly forgets the desire to invest in the country. Last year, for example, bush fires caused ongoing power supply problems for palladium producers there. Apart from the fires, Eskom, the main electricity supplier in the country, which is unable to keep the infrastructure intact and expand it, causes constant blackouts and bottlenecks. Cables, transformers are stolen by the local population and Eskom employees are so corrupt that they are the envy of all Africa.

Okay, you don’t have to believe in palladium. But look at the green agenda around the world – their real goal, as Dirk Müller said long ago in his book “Power Quake”, is hydrogen cars, the electric cars with lithium batteries are only a transitional phase, as they do not play into the hands of the oil and gas producers. The fuel cell in the hydrogen car, as its name suggests, is fed with hydrogen, and this can be produced cheaply from natural gas. So the green transition will not hurt BP, Total, Chevron, but also Rosneft and Gazprom. Now fuel cells need a lot of platinum to work and its price is low compared to other assets at the moment. Not to mention the importance of the metal and other precious metals for the electronics industry, where the chip market has been in deep crisis since the beginning of the pandemic.

We do not want to talk about the importance of Russian natural gas itself – as a raw material for heating and energy production – for the political security of Europe, as you are certainly familiar with this topic from the mainstream media.

More recommendations and considerations for apt investments can be found in our bulletins.