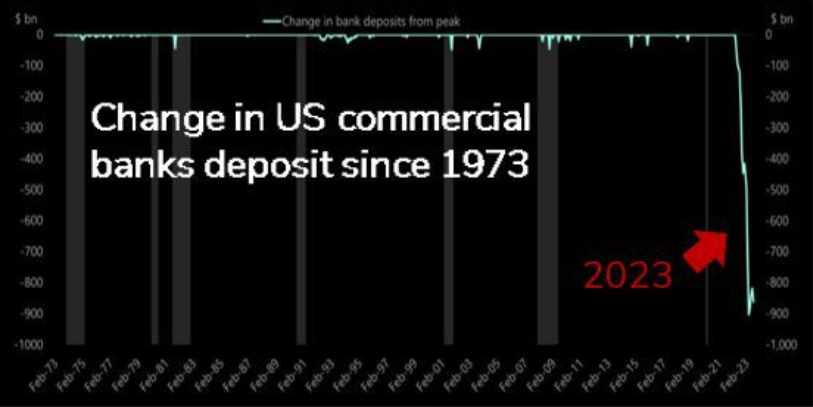

The leading media keep quiet about it, or only express it here and there in some comments by vigilant editors, that the economic situation in the U.S. is not at all as brilliant as the stock market indications (still) suggest. The yield on U.S. bonds is always climbing upward, and U.S. citizens are massively pulling their money out of the banks to invest in the government’s debt instruments. The scale of this process has reached unprecedented levels, threatening U.S. regional banks in particular with insolvency.

Change in deposits at U.S. commercial banks since 1973. source: Apollo

At the same time, discontent is rising in American society, and not just because of what is arguably the most unpopular president in many decades, Joe Biden. How to explain the paradox that during Biden’s administration, 12 million new jobs have been created, unemployment is at 3.5%, and yet in 2023 a wave of strikes not seen in 20 years is sweeping the country? Something must be ticking not quite right in the economy and in society.

The number of lost workdays this year is already in the millions.

We think that the global recession has already started; it is not yet becoming the central topic in the media. They are always talking about a possible “soft landing” of the economy after the current energy and inflation crisis since the recovery after the pandemic and the first wave of inflation. If you take a close look at such accumulating statements from the bright minds of television and compare them with other periods in history when economists have reassured us en masse, you can safely conclude against the tide: Recession is inevitable.

The graph above shows that every time Wall Street Journal articles piled up about a “soft landing,” a crisis or recession came right after.

In our latest bulletin (October issue), we analyze, among other things, the state of the two of the world’s largest economies – that of the U.S. and that of China – and show other signals that may point to a world recession.