1% owns 50% of the world’s wealth and there are countries that want to change it. About geopolitical redistribution.

In 1974, the middle class had the highest share of world wealth. Today, it is at its lowest level in 100 years. Within the last 50 years, there has been a gigantic transfer of wealth from the working class to the class of society that owns assets. The latter, elitist stratum owns a disproportionate share of the wealth generated throughout the world and constantly increases it thanks to the central bankers who skillfully cause sometimes recession, sometimes revival of the economy through their interest rate policies and increase or decrease the money supply. These are the waves on which the great ones of the financial world surf and later eat caviar and drink champagne. You know it well that this elitist class is not sitting in Beijing, Jakarta, Rio or Moscow. It’s enough to name two cities and you already know who it’s really about: London and New York.

Erdoğan and the president of Brazil, leaders of ASEAN countries and comrade Xi – they all want to make their middle class bigger and stronger because they know it that the first industrial revolution, which lasted 150 (!) years, was possible only thanks to the creative and hard-working middle class. Therefore, they want to introduce their own monetary system, independent of Anglo-Saxon influences, which

(i) operates fairly,

(ii) is not dependent on a fiat currency like the dollar,

(iii) enables the middle class to accumulate wealth, and

(iv) does not serve to remove politically undesirables from the face of the earth through currency wars or military intervention. Suffice it to mention here how weak the Turkish lira is during Erdoğan’s tenure, or how Saddam Hussein fared because of the oil trade in euros, or Gaddafi because of the attempt to introduce the Pan-African currency, which was supposed to be based on gold.

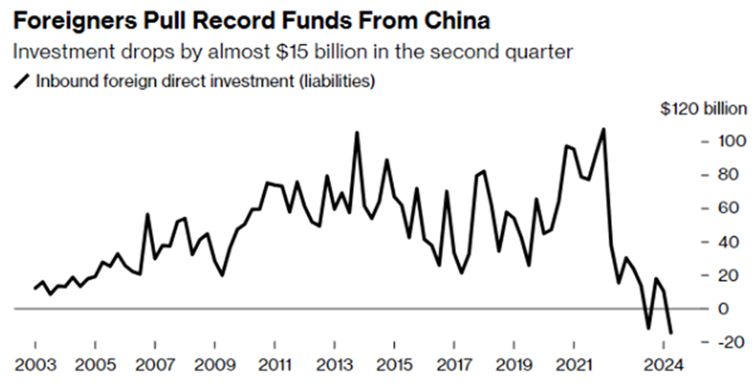

The latter initiatives of countries seeking to free themselves from dollar domination – be it agreements between Russia and China, the BRICS initiative, agreements among ASEAN countries, and many others – all aim at creating some kind of common currency for these, as they are called in the West, “rapidly developing emerging economies.” This currency, however, should not be a fiat currency, such as the euro, but a currency based on tangible assets, thereby ensuring its purchasing power. It may be digital or classic – one thing is certain: its introduction will mean a huge war against the U.S. dollar. It will mean a war against the COMEX (USA) and LME (London) exchanges, where precious metal prices are now decided. And as we emphasized several times before in analyses in our bulletins: these prices have been suppressed and manipulated for decades by the so-called US bullion banks. So, the elitist class that owns the highest share of the world’s wealth may be in for a treat this September, when the BRICS group’s decisions are to be made. One possible scenario: the BRICS countries may, for example, buy countless futures contracts on precious metals and demand delivery of the physical commodity on the expiration date. Since it is common knowledge that COMEX and LME can physically back up perhaps only 20% of their transactions with physical reserves (the paper gold problem), there would be a collapse similar to the Nixon days.

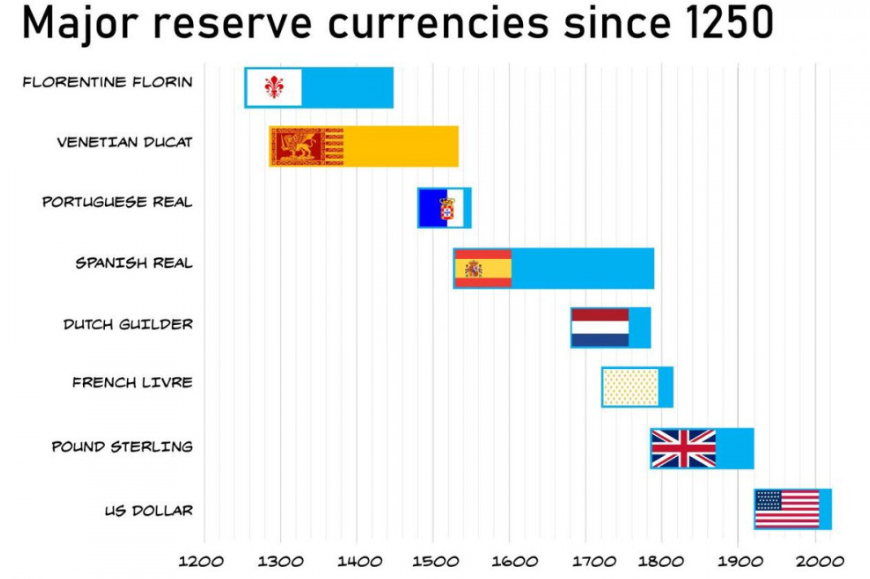

So will the yuan or a whole new emerging market currency soon become a new world reserve currency? If you look at the chart below, you can see that nothing lasts forever and that the dollar’s days may be numbered.

Major reserve currencies since 1250