We have not yet forgotten the last financial crisis, we are still licking the wounds of the European debt crisis, and the next one is already in progress. Deutsche Bank troubles have dominated news this week, however, it is not the end of bad tidings. Such a lot terrible economic news, in barely a few days is not a coincidence. Something really bad has just started!

It was not only Deutsche Bank that has brought some grim news recently. It is also the industrial data from Germany, a looming wave of bankruptcies of energy companies and a rising probability of recession. Financial markets, including Goldman Sachs, are acting nervously. And we cannot forget about China’s slowdown, the crash of commodity prices and a falling trade. If you think you still have good prospects, you had better look around.

Firstly, let’s sum up some latest news from financial markets. The Wall Street Journal, 2016-02-08:

‘Deutsche Bank AG ’s shares dropped almost 10% on Monday as the battered European banking sector was hit by a fresh selloff amid investor concerns about lenders’ capital buffers and ability to navigate topsy-turvy markets.

The German lender’s shares now have declined almost 50% since co-Chief Executive John Cryan made his first public appearances in his new role, in late October in Frankfurt and London.’

Deutsche Bank shares hit a 30-year low and are back at the 2008 level now. Co-CEO John Cryan tried to reassure investors but he failed, as Reuters reports:

“Investors have completely lost their faith in the bank,” a top 10 shareholder told Reuters, adding that a fast recovery in the share price was unlikely given the magnitude of the problems weighing on the company.

“We believe that Deutsche Bank has a capital shortfall of up to 7 billion euros, depending on the outcome of a range of litigation issues, which could necessitate a highly dilutive capital increase,” Citi analysts wrote in a note last week.

Deutsche Bank reported a full-year net loss of 6,8 billion euros. However, the investors are losing faith in the hole sector and its risky debt, which Financial Times reported on Tuesday:

‘The surge in the cost of credit default swaps reflects growing investor anxiety about the health of Europe’s banks and highly indebted companies, feeding into concerns over the fall in oil prices and turmoil in global equity markets.’

The reasons behind the turmoil are CoCo’s – contingent convertible bonds. This name is worth remembering, because if the crisis explodes the blame will be put on CoCo’s as it was on MBS’s or CDO’s last time.

Deutsche Bank, with its $60 trillion in derivatives exposure (16 times more than the German GDP!!!), is not the only problem now. The second bad news related to Germany is its slowing industry, as Bloomberg reported also on Tuesday:

German industrial production unexpectedly fell for a second month in December [1,2%], a sign that a slowdown in major export markets is holding back factory activity despite strong domestic demand.

Real economics must be influenced by the latest really poor moves on stocks and commodities. We are entering a period of numerous bankruptcies of energy companies, especially in the USA. As Bob Fryklund from energy consultant IHS Inc. said to Bloomberg:

About 150 oil and gas companies tracked by IHS may go bust as a supply glut pressures prices and punishes revenues (…) More bankruptcies would be one signal that energy prices have reached a bottom and would help kick off deals for the $230 billion worth of oil and gas assets currently up for sale.

If somebody believes that it cannot be worse, then the International Energy Agency is providing us with some sobering news (yes, we are still by Tuesday’s news!):

The global oil surplus will be bigger than previously estimated in the first half, increasing the risk of further price losses, as OPEC members Iran and Iraq bolster production while demand growth slows. Supply may exceed consumption by an average of 1.75 million barrels a day in the period, compared with an estimate of 1.5 million last month (Bloomberg 2016-02-09).

Let’s go back to the financial markets where the panic has started. Goldman Sachs is surprisingly convincing that “the Fed will raise rates by 25 basis points three times this calendar year, to 1.3 percent,” (Bloomberg 2015-02-09), while nobody believes that any more. It seems that Goldman Sachs faces great losses on derivatives as well.

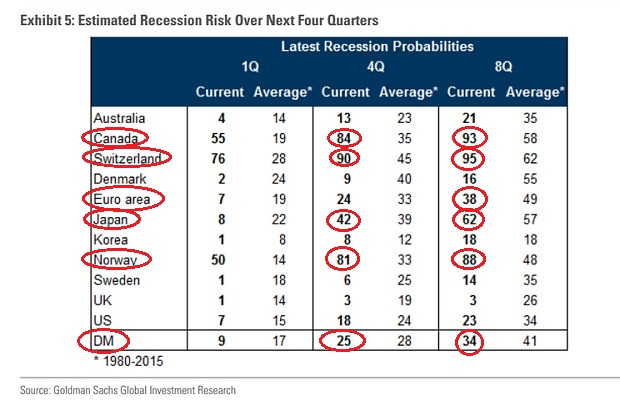

However, just one day before, Goldman warned that there was a 25% risk for the developed world to turn into recession in the next year and a 34% risk over the next two years. In comparison to other estimates, this one is conservative, even though Canada, Switzerland or Norway can just start to get ready for declines.