Saudi Arabia and Russia decided on Tuesday 16th February to maintain their oil output at the January levels if others follow suit. Paradoxically it was not good news for the market. Investors wrongly expected from Doha talks some oil production cuts because there will not be any cutting without losers. With the output frozen at the oversupply levels or, to put it otherwise, with the continued oil war, the next potential victim is not the US shale oil industry but emerging markets affected by low oil prices and high cost wells.

Since the announcement from Saudi Oil Minister Ali Al-Naimi and Russian Energy Minster Alexander Novak is not going to help the industry, it could only maintain the status quo, the oil price will not rebound. The reason is that the oil production of Saudi Arabia and Russia has not grown much in recent years and so these countries are not responsible for the oil price collapse. It is not Saudi Aramco that has flooded the world with oil, as you can hear from or read in the mainstream news, but the USA and its shale oil industry. Smaller, weaker and poorer producers will feel the effects of the war most severely.

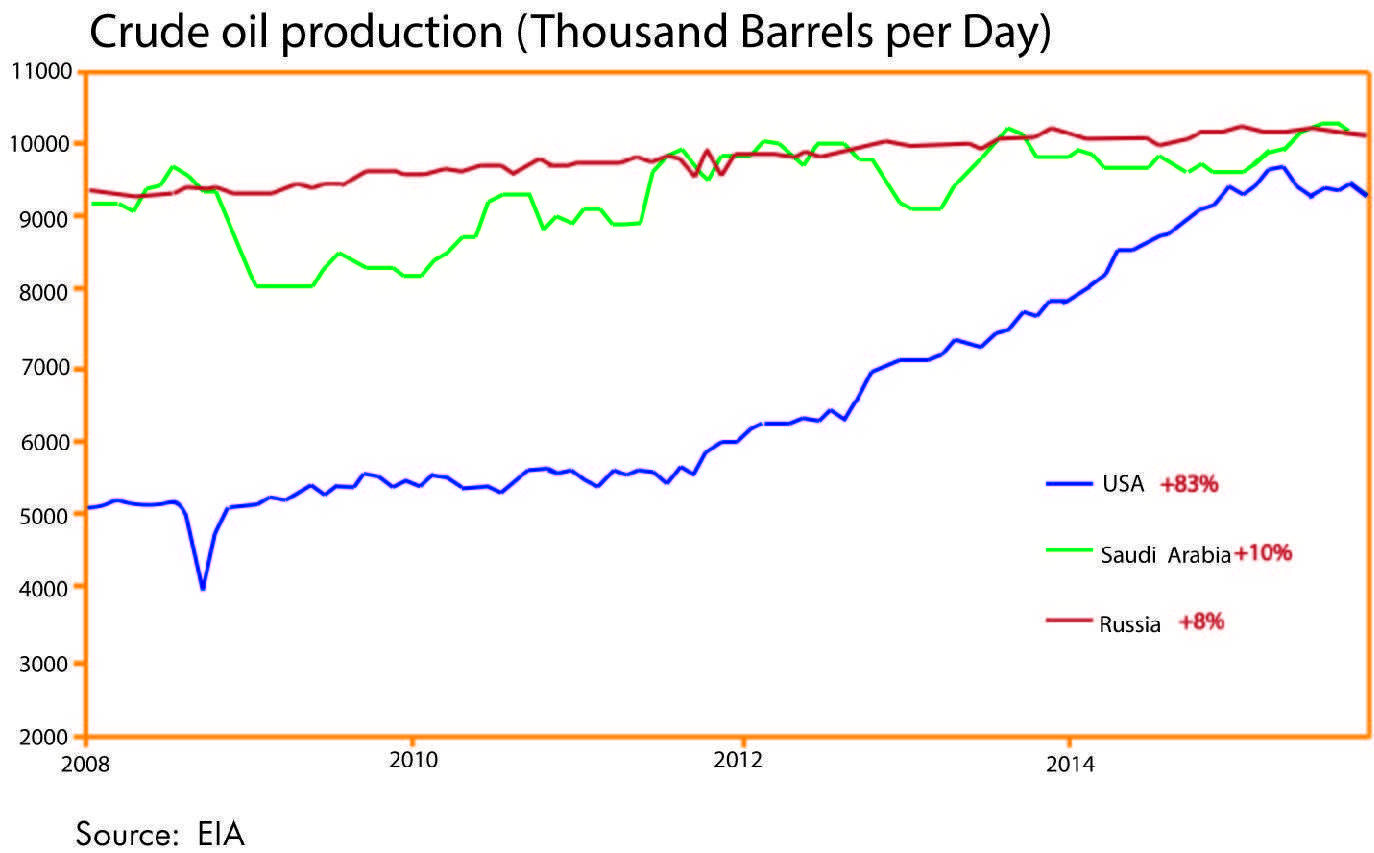

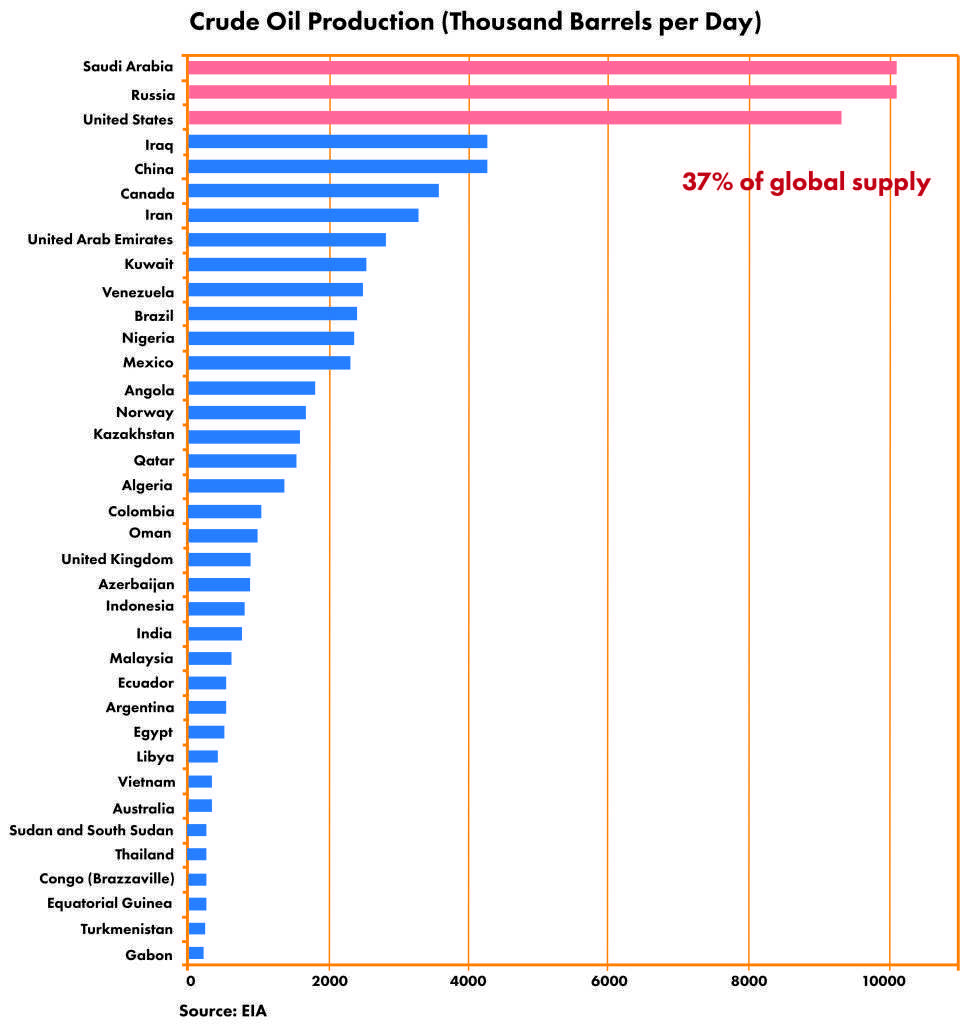

Since 2008 Saudi oil output has grown only by 10%, while American by 83%. The Russian output has, too, grown only by 8%, but Russia had its own ‘oil boom’ in early 2000’s. Nowadays, these three nations produce almost 40% of the global oil supply. Any Venezuela’s and Qatar’s production freeze means means next to nothing for the oil market.

While the low prices are threatening Russian and especially Saudi national budgets, for the USA, still the greatest importer of oil in the world, they are mainly favourable, apart from some ‘shale states’ like Texas or North Dakota. No changes in production on top of the list means no changes, at least in the long term, in the oil price.

Let us assume now that:

1. Saudi Arabia will not manage to eliminate cost-consuming US shale oil production from the market or it will be requested by the US government not to;

2. US fracking boom will not destroy either Russian or Saudi financial stability, as the two countries can use debt or fiscal cuts or depreciation to achieve the balance;

3. and the ‘Big Three’, though competing, will still be producing the same amount of oil.

It is a possible scenario, or is it? What can consequently happen next?

Some countries like Iraq, Iran or Nigeria would like to increase their output even more and are trying to take a market share over from their competitors. That could lower the price slightly. But some countries might not be able to cope and could run into trouble or even fall apart in a political turmoil. Let’s see which countries it will be.

As we can see, the most influential producers are only waiting until manufacturers from China, Canada, Venezuela, Brazil, Nigeria, Mexico, Angola, Norway, Kazakhstan, Algeria, Azerbaijan or Libya start going bust. Then, the massive sell-off will begin and global oil companies will gather in the harvest.

The very first in line to go bankrupt are companies overburdened by their own debt, especially from the cost-consuming deepwater sector1. OPEC hopes that oil supply will decline in 2016 in non-OPEC countries, like Norway and United Kingdom, whose total cost to produce one barrel ranks among to the highest (accordingly $36,10 and $52,502). OPEC expects also the supply in the USA (slightly), Mexico and Colombia, as well as in Kazakhstan and Russia to decline3.

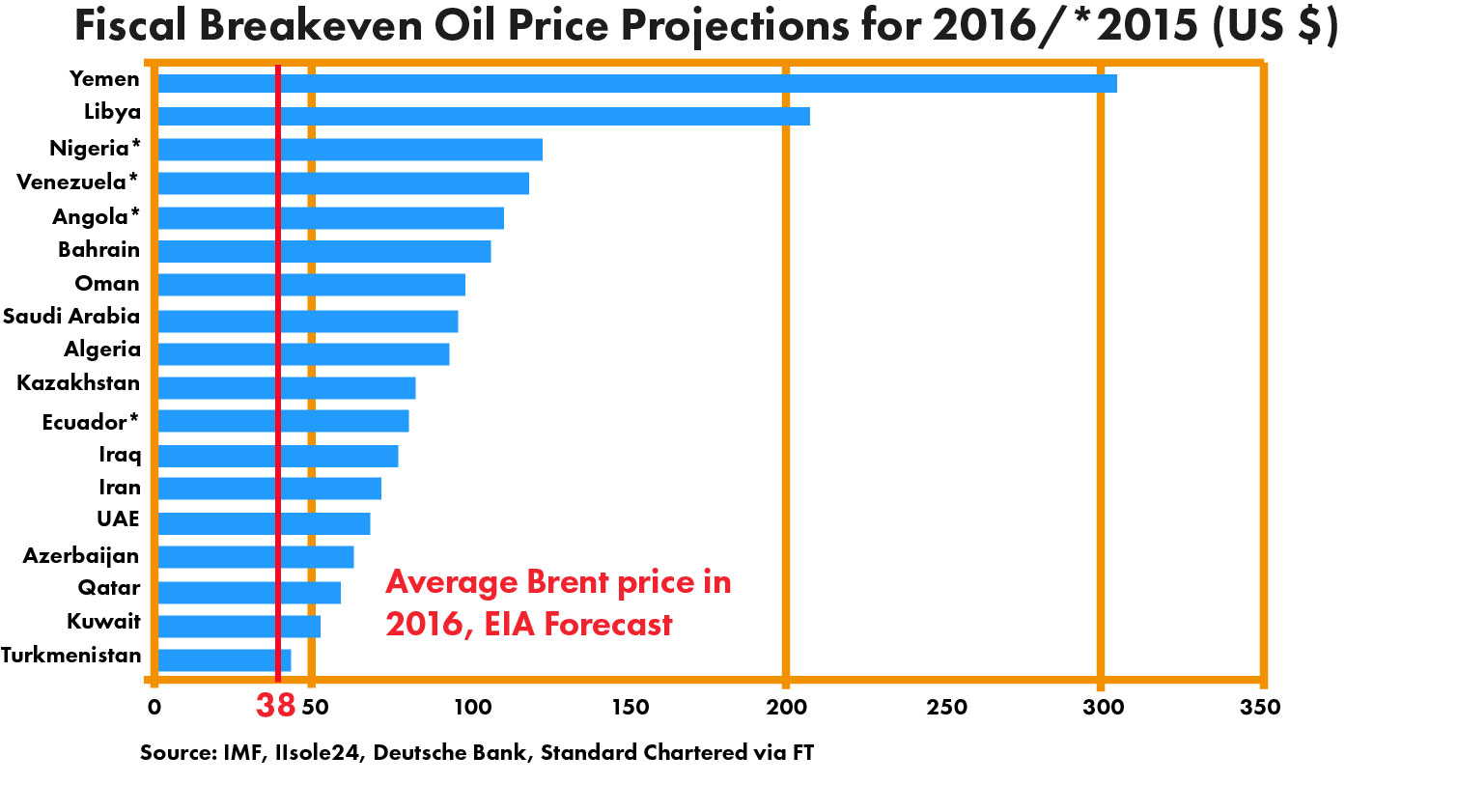

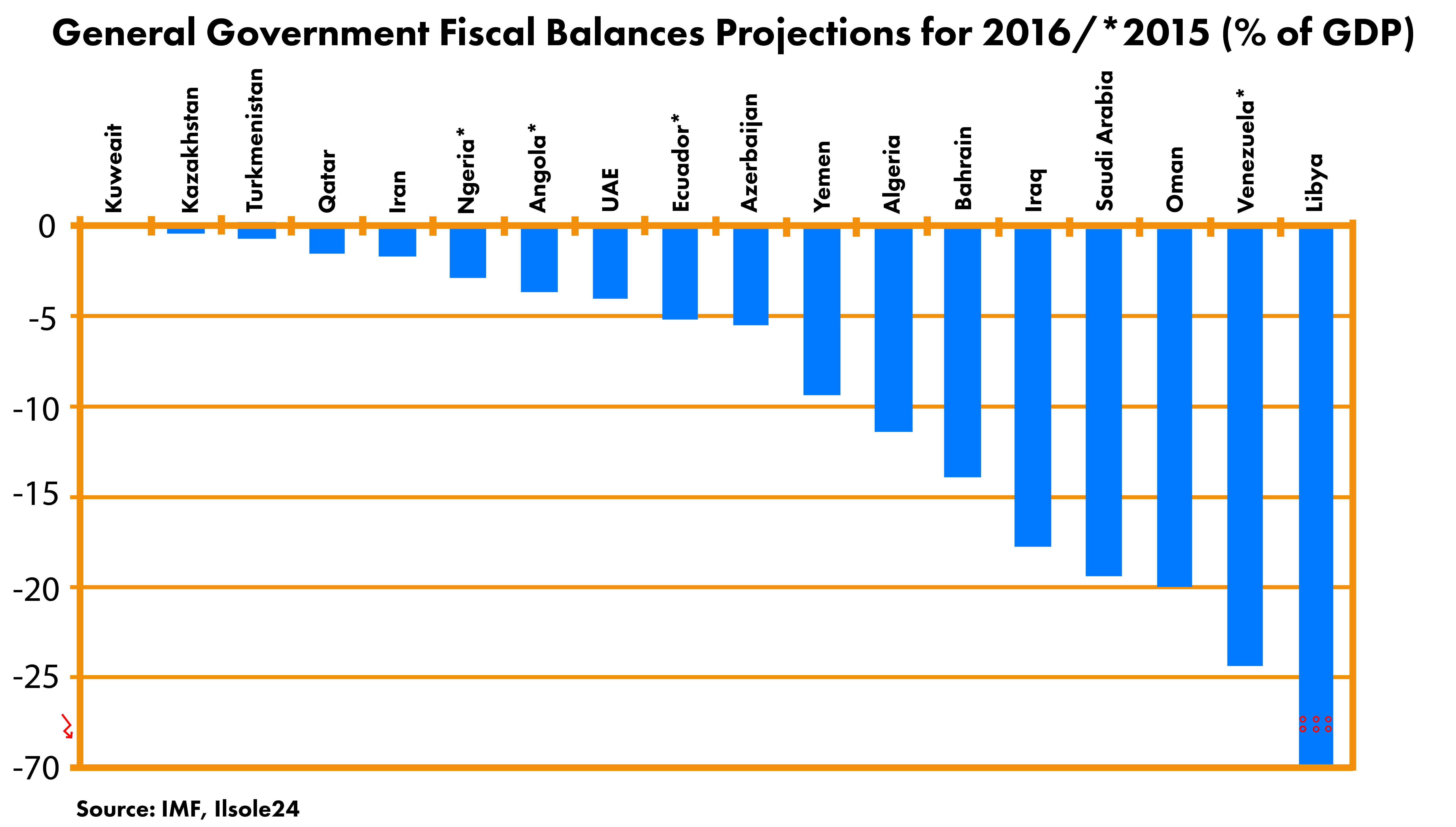

How can it affect other countries? Norway and Canada, as we wrote recently, are already facing a high probability of recession. The worst fiscal situation has, however, developed in Libya and Venezuela, the countries that are on the brink of falling apart. Countries like Yemen, Nigeria, Angola, Bahrain (the last mentioned had already a military intervention a few years ago) need the oil price for a barrel to be higher than $100 to have their budgets balanced.

Venezuela, Mexico, Ecuador or Colombia are highly exposed to fluctuations on the global oil market4. Venezuela’s Credit Defaul Swap is now valued at the same level as that of Greece just three months before its default5. Some other political turmoil cannot be excluded. There were already riots in Azerbaijan; Yemen and Iraq; Algeria, Bahrain and Oman are next in line.

We cannot also exclude some problems in Saudi Arabia, which we described in our first Gefira Anticipation Bulletin. Those who have most to lose, namely existential stability, are likely to fall easy prey to the ongoing oil war.

References:

1. Deepwater Sector In Deep Trouble, Source: Rigzone 2016-02-16

2. Crude Oil’s Total Cost of Production Impacts Major Oil Producers, Source: Market Realist 2016-01-13

3. OPEC Monthly Oil Market Report, Source: OPEC 2016-02-10

4. Sharply Lower Oil Prices Would Be Highly Damaging, Source: BMIResearch 2014-10-15

5. “Venezuela’s CDS is now at the same Level as Greece’s Three months before its Defaul”, Source: Zerohedge 2016-02-16