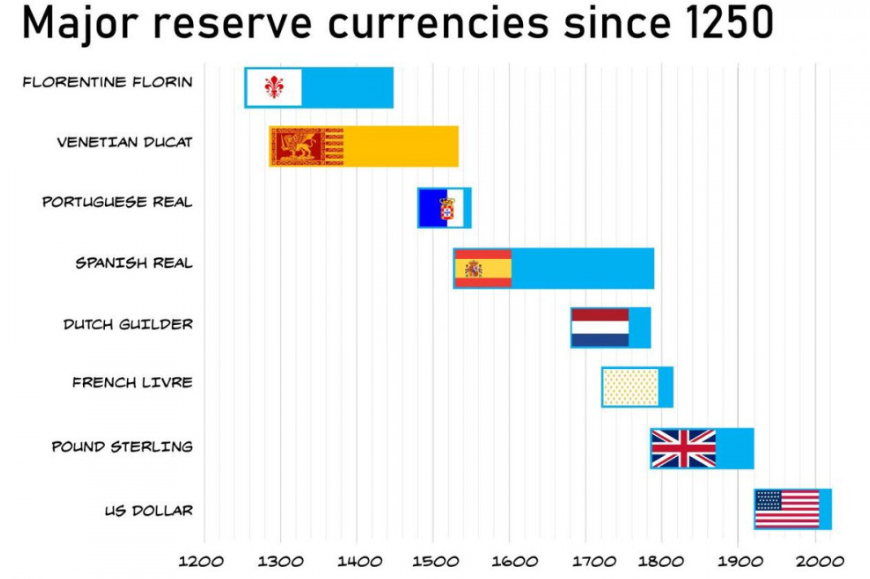

Clouds are gathering: Weidmann will end QE while Macron’s reform will not solve any problem whatsoever. It’ll be the final push for a Eurosceptic Italy, where plans for parallel currencies are popping up. Add Trump’s trade war to the soup and 2020 promises to turn nasty.

It is becoming increasingly clear that at the end of 2019 Jens Weidmann, current President of the Bundesbank, will replace Mario Draghi at the helm of the European Central Bank. The change in terms of economic beliefs will be radical and, combined with the other developing issues in Italy and the US, which will be discussed later in the text, might as well put an end to the misery of the Eurozone.

What does Jens Weidmann believe in?

As a typical post-Weimar German, he believes in strong currency and low inflation. The Financial Times carried an interesting interview with him a few weeks ago,in which the German financier expressed his opposition to everything that Mario Draghi has stood for in the last few years and made known his wish to stop the quantitative easing program and replace it with raised interest rates. What happens when interest rates increase? If they go up too fast, markets crumble. Low interest rates offered for too long have contributed to the subprime mortgages debacle of 2007-8. Continue reading