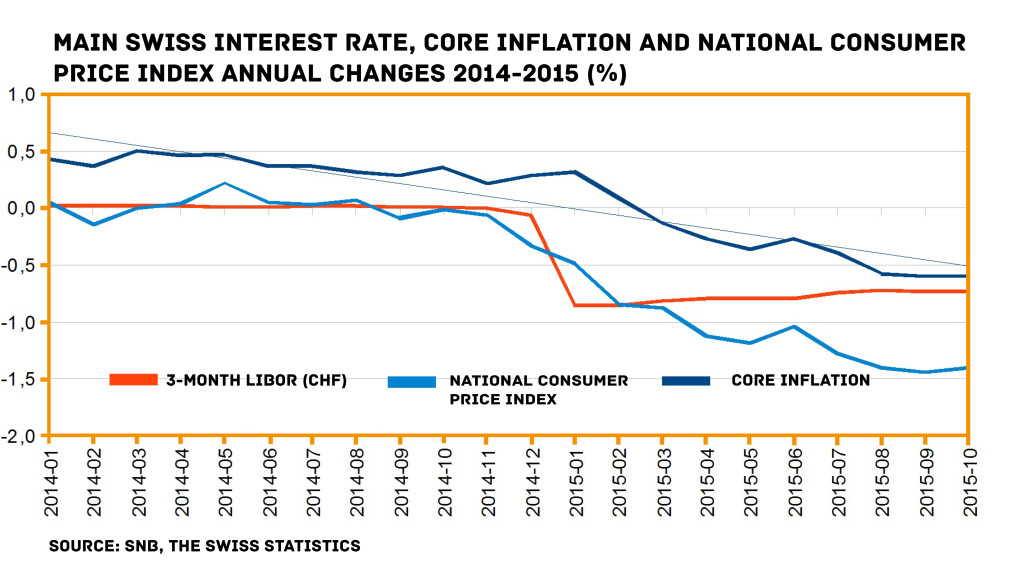

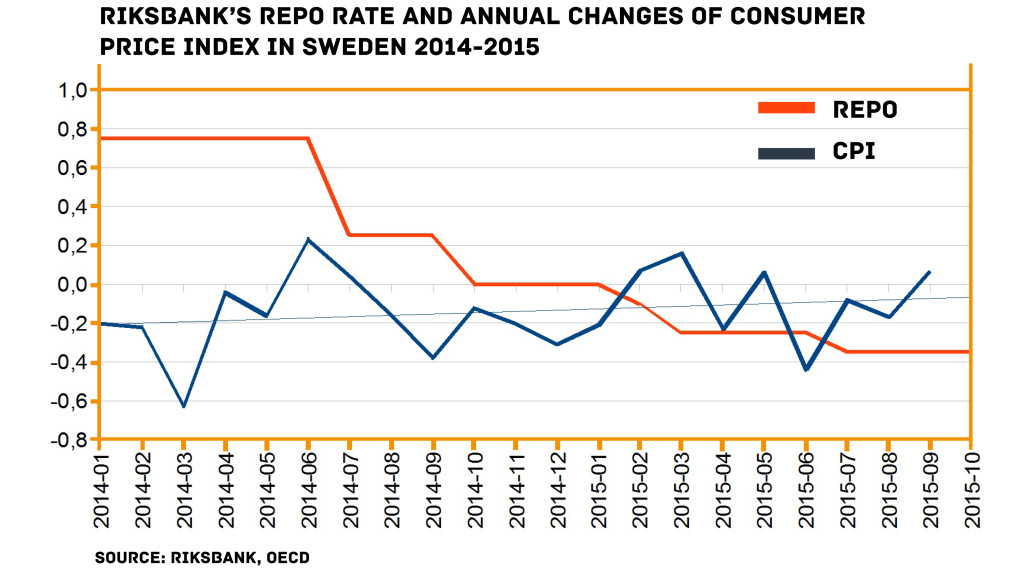

As the economic data for Europe look less and less optimistic, the negative interest rate, a concept that has been in circulation for a time now, is looming large. It is still uncertain whether the introduction of the negative interest rate is slated for December; it is assumed, however, that the European Central Bank is likely to make use of the example set by Sweden and Switzerland.

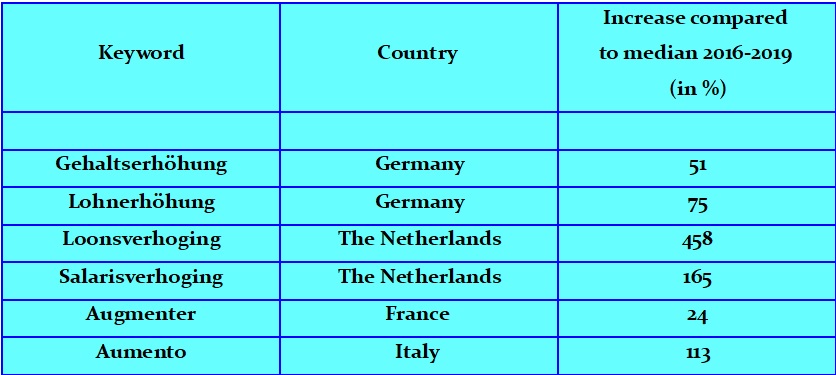

The low economic growth is of prime concern on the continent, since it entails a smaller number of jobs, especially for the young. This low growth co-occurs with deflation, which as bad as it can be, may at first glance appear beneficial for the customer due to the lowering of prices. The current deflation has resulted from the low prices of oil and other raw materials. Inflation is important to lower the debt burden. As prices and incomes increase, debt becomes relatively less valuable. Inflation is also used to adjust wages: since it is impossible to lower nominal wages without sparking off labor unrest, inflation does the dirty job. Freezing wages while prices increase results in their lower purchasing power and a relative lower real income. The Eurozone needs inflation to lower real wages in countries like Spain, Portugal and Ireland while wages in Germany and the Netherlands can be increased. The central banks are making attempts to reach the target of bringing the inflation back to the level that was assumed to be the optimal one, and they are resorting to ever more unusual steps. Continue reading