We have been anticipating the future for our readers for four years now. We have the key to understanding the mechanism behind today’s geopolitical and economic reality and it is demographics. While many do not dare to speak out, we do. To the establishment the social justice philosophy is more important than reality. Equality is a new religion which has superseded Christianity. The trouble is that the real world does not comply with the rules of social justice. If one had fully understood the demographic reality in the sixties and seventies, speculation in real-estate would be a no-brainer. Many still believe that populations keep increasing and urbanization will go on for the foreseeable future. So as is the case with the inertia of thinking, many people believe this process will continue. Since European populations began to shrink, investment in real estate can turn into a giant disaster.

Since 2015 we have been telling our readers that interest rates would never go up again. Yes, they may increase a little for a limited time, but even the FED board members knew they were joking when they made the economic community believe that the financial markets would normalize again.

Because the demographic reality in South Korea is even worse than that of Japan, the country’s industrial conglomerates are desperate for young workers from the northern neighbour. When President Trump called Kim Jong Un Rocketman, and the pundits were hysterical about a possible war, we repeatedly wrote that peace was just a matter of time. Now the animosity between the Koreas is a thing of the past and the two states are slowly working on reunification.

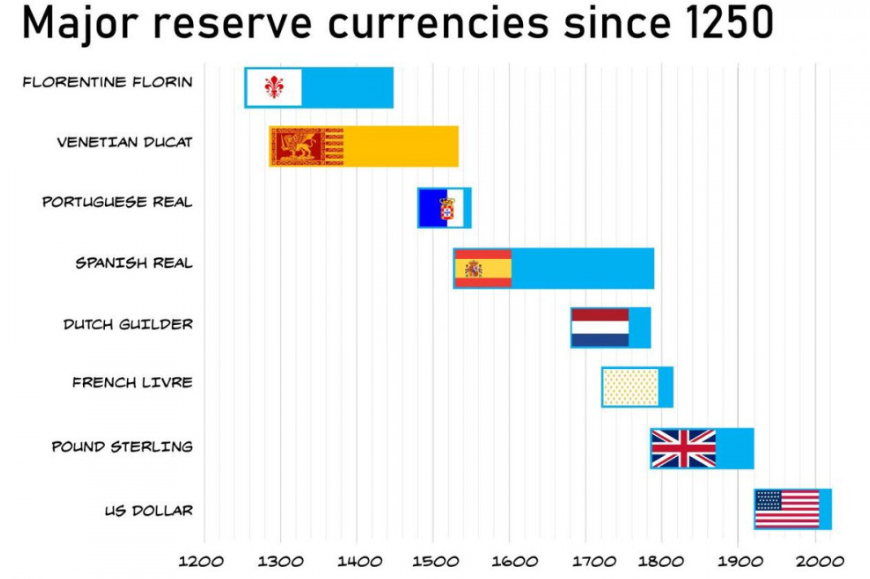

In 2017 the average financial journalist never heard of a mini-bot (mini-bills of Treasury) while our readers were fully informed. We once pointed to the possibility of Italy introducing the mini-bot as a parallel currency.

In 2016, when the bitcoin traded at 1000 dollars we suggested to our readers to have a close look at the crypto currency, and when the crypto crashed, we repeated that we still thought it would re-bounce to 100 000 dollars. At the time of this writing bitcoin is trading at 9 300. As for gold we were less enthusiastic, but we argued that we still saw it as a safe haven, protecting investors again currency swings. But now financial reality starts to sink in, and central banks do not see light at the end of the tunnel, we see a bright future for the yellow metal

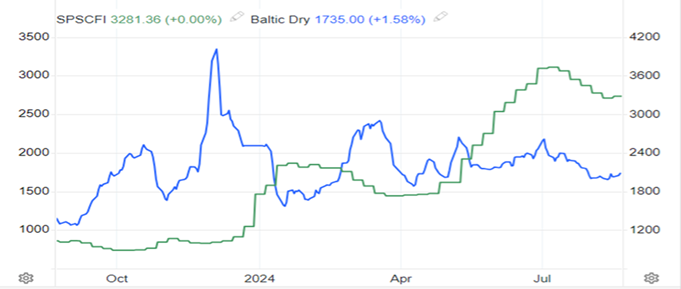

We have to admit, though, that up to now we have been wrong about the oil price: it still stands at around 50 to 60 dollars a barrel. Here we are witnessing two different trends: the global economy is not growing anymore, while China is slowly joining the club of industrialized societies with an ever-shrinking population. That explains why the demand for oil is growing at a slower pace.

With the price below one hundred dollars, more than 50% of the US oil production is economically unsustainable, so once it begins to falter, the oil price will go up, entailing a significant economic crisis. In the September 2018 Gefira bulletin, we wrote that “Tensions between Saudi Arabia and Iran will increase after the midterm elections in November. We can expect a limited tanker war, as we saw during the Iraq-Iran war, with instances of oil tankers being attacked. Such a “tanker war” started when Iraq attacked the oil terminal and oil tankers at Kharg Island in early 1984. Afraid of American intervention, the Iranians limited their retaliatory attacks to Iraqi shipping, leaving the strait open to international traffic.” We do not know who is behind the attacks. There are enough parties who want to draw the US into a war with Iran.

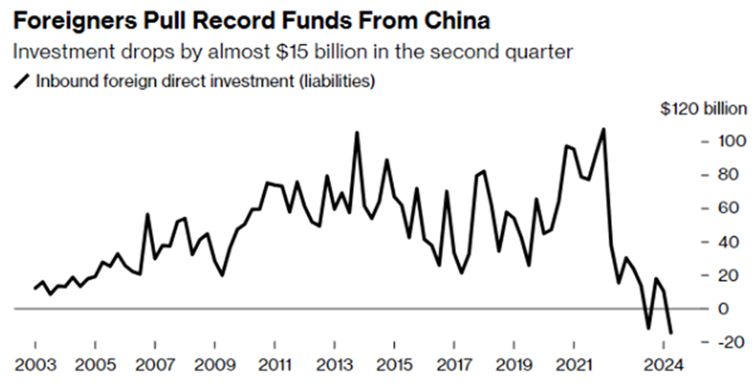

Many analysts believe that the emergence of China results in the decline of the US hegemony; they argue that a multi-polar world will distribute power more equally and keep the US in check. We see that the rot in the West is much deeper even though most residents will regard their countries as healthy and wealthy. As famous historian Oswald Spengler wrote, we are witnessing the end of modern Western Societies. With the decline of the West, regional powers will fight for their chair at the table, and the reemergence of the Ottoman Empire has just begun. While the Turkish lira is plunging, there is no sign President Erdoğan will yield.

We also framed the question, will Europe become an Islamic or an African continent? If immigration from sub-Saharan Africa supersedes that from North Africa, European destiny will change course. In such a case, our future will look more like that of South Africa. While geographically South Africa is not a part of Europe, the modern South African society has been built by Western nations. The country’s development has always stood out. In this Gefira we have a closer look at the Rainbow Nation. Last month CNN proudly announced that “South Africa makes history as women make up half of the cabinet for the first time”. It forgot to say that the country is socially and economically collapsing. Read more in Gefira 34