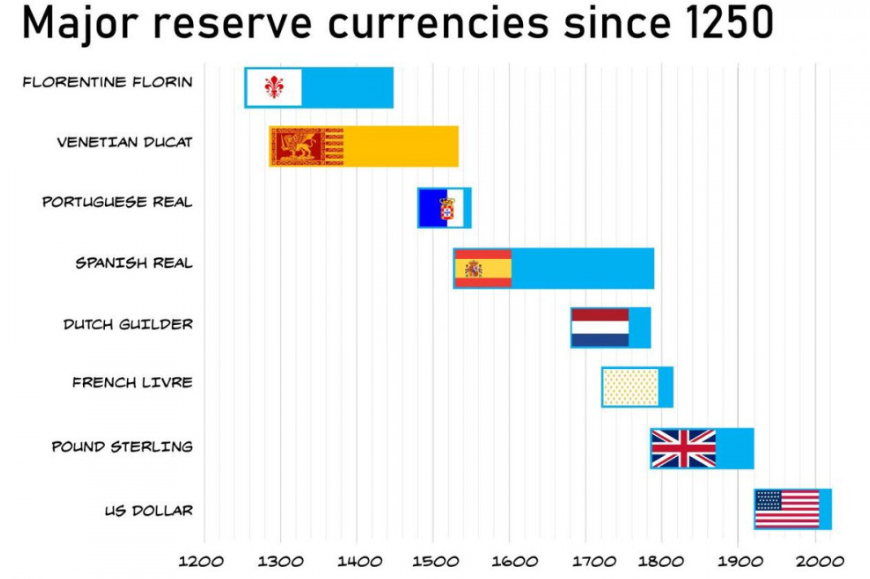

The Euro has been around for almost 20 years. The Russian transfer ruble survived 25 years. The two currencies have something in common: they were and are not a success story.

The introduction of the transfer ruble was intended to enable free trade between the countries of the Eastern bloc. The creation of the common clearing system led to the exchange rates for the East German mark, zloty, forint, lev, and even the Mongolian tugrik being arbitrarily fixed by the Soviet Union, regardless of the purchasing power of the national currencies. In the 1960s, the Bulgarian lev was 20% undervalued and the Polish zloty about 45% overvalued. Since the transfer ruble was not yet convertible into Western currencies, it remained an illusion and a means by which the Soviet Union could enrich itself and save its budget at the expense of its satellite states: the Russians bought raw materials, goods, food for convertible currencies in the West and sold them to their “socialist friends” for transfer rubels. The international bank for economic cooperation, which sat in Moscow and handled all transactions in the transfer ruble, swept the real trade surpluses and deficits under the carpet. With the political change the common settlement currency came to to an end, and it turned out that the Soviet Union owed huge sums to its “brothers”. Continue reading