All nations can be made to suffer from disturbed or split personality and then they are unhappy after their own fashion, toys in the hands of the powers that be.

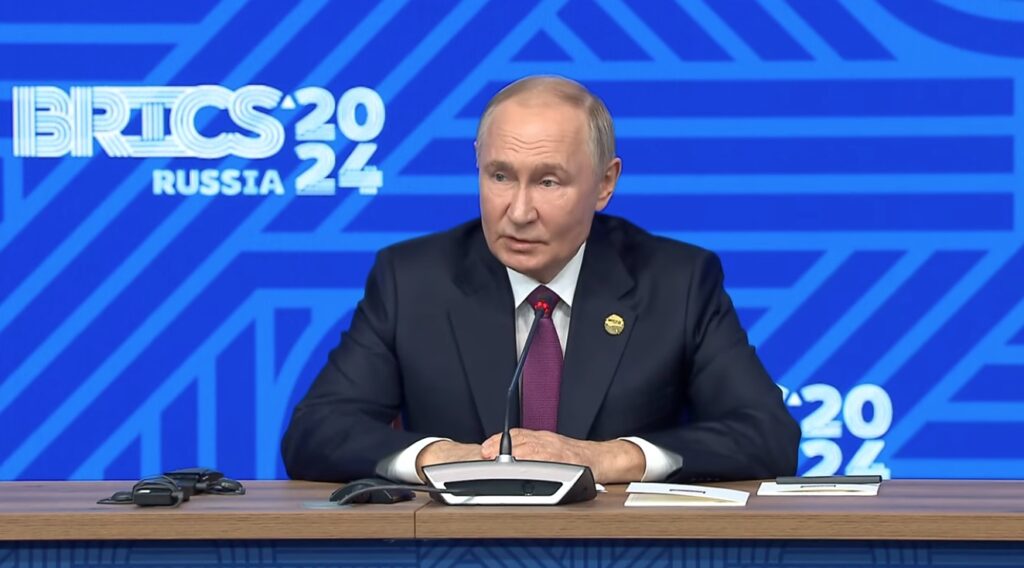

All healthy nations are alike, but an unhealthy nation is unhealthy after its own fashion. This paraphrase of the opening sentence from Leo Tolstoy’s Anna Karenina neatly serves the purpose of analyzing the Ukrainian soul, a soul that has dissociative identity disorder. A transgender man has an identity disturbance in that he thinks or feels he was born a woman and other females are not his sexual partners. The same is true of peoples. A Ukrainian thinks or feels he is not Russian and, consequently, that Russians are not his brothers. A transgender man physically looks like a man and still thinks he is not a male; a Ukrainian speaks Russian, professes Orthodox Christianity, writes Cyrillic and still says he is anything but.

We from such European countries as Poland, France or Germany may ask ourselves, what is the origin of the Ukrainian state? What is the origin of the Russian state? Ukrainian and Russian children learn about the same beginnings of their respective countries, read stories about Rurik, Oleg and Olga, Vladimir the Great and Yaroslav the Wise. Polish and Czech, French and Spanish, British and Norwegian children do not learn that their respective nations share the same origin whereas Ukrainian and Russian children do. Kiev is regarded as the mother of Russian cities. True, there was a time when the Russian vast lands were split into a number of principalities, but then Italian, Polish, and German were too. Continue reading