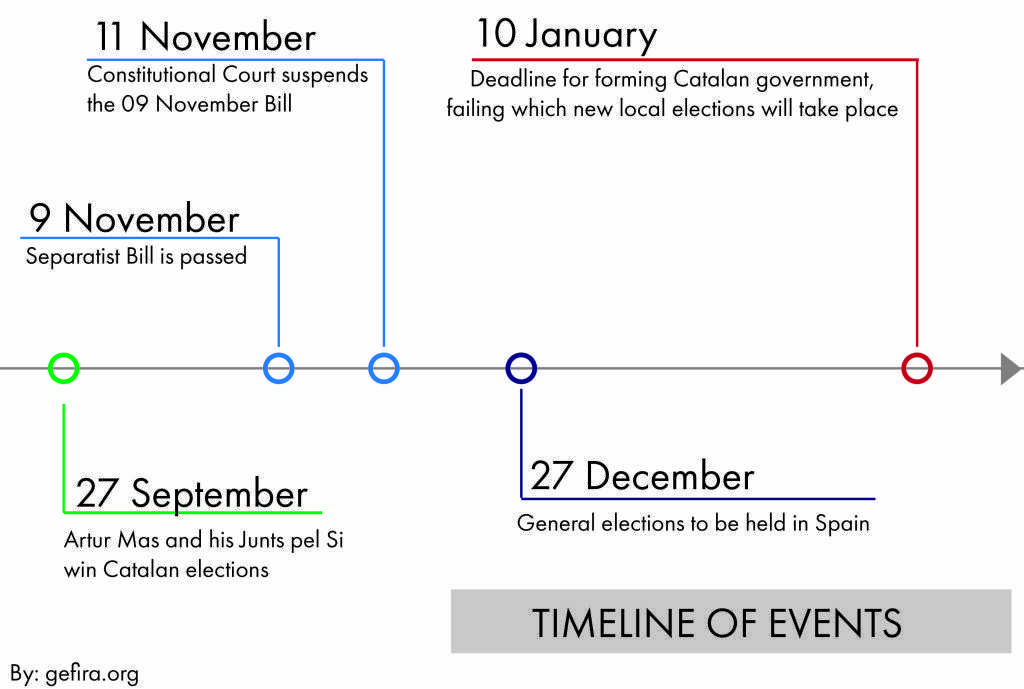

On September 27 the coalition Junts pel Si (Together for Yes) led by Artur Mas won the local election in Catalonia. Its political platform promised to work towards Catalonia’s independence of Spain. On November 9 the Catalan parliament passed a separatist motion: the legislators were tasked with

(i) drafting the Catalan constitution,

(ii) designing the Catalan social security system and

(iii) creating the Catalan treasury1.

Within the meaning of the same motion the Spanish Constitutional Court no longer had jurisdiction over Catalonia. In the wake of these events the Spanish government headed by Mariano Rajoy appealed with the Constitutional Court to suspend the Catalan motion and to issue a warning to 29 top Catalan politicians. On November 11 the Constitutional Court ruled as was expected: the bill of November 9 was suspended and the top Catalan politicians were duly given a warning. The court has a further 5 months to rule over the case. Before that, on December 20 Spain will have a general election whose results may greatly affect the political process in Catalonia; so much so that the go-away region may have its own elections in case acting prime minister Artur Mas fails to form a government by January 10.

On November 11 the Constitutional Court ruled as was expected: the bill of November 9 was suspended and the top Catalan politicians were duly given a warning. The court has a further 5 months to rule over the case. Before that, on December 20 Spain will have a general election whose results may greatly affect the political process in Catalonia; so much so that the go-away region may have its own elections in case acting prime minister Artur Mas fails to form a government by January 10.