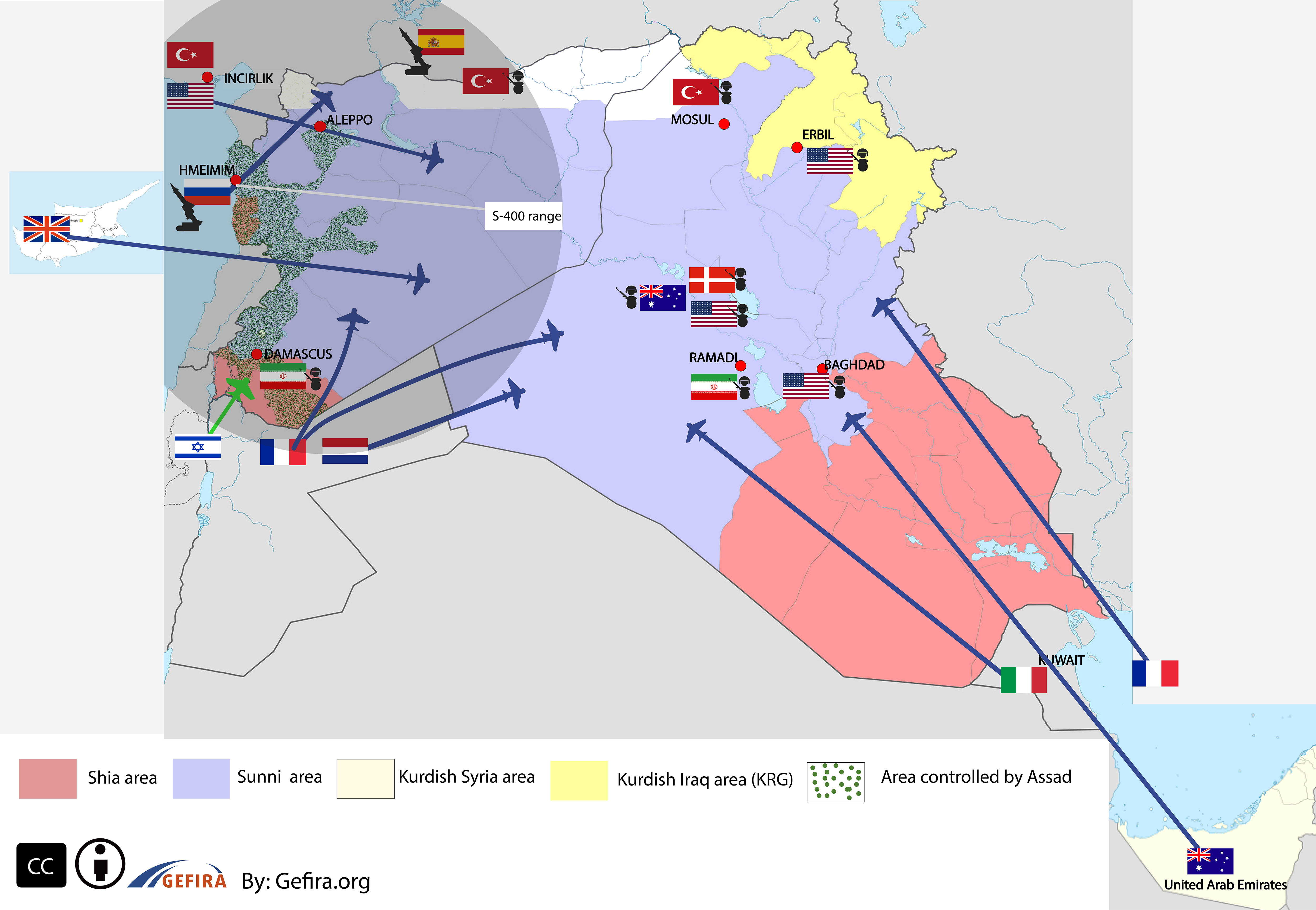

The Syrian war has spilled over into Turkey. The Kurdish fighters are now the preferred weapon recipients of the West. The US, Germany, the Netherlands and the UK are supplying Kurdish fighters with arms and training.

Turkish Tank Gets Hit While Shelling Cizre

Not only the Peshmerga troops in Northern Iraq, commanded by President Barzani, a key US ally in the region, but also the Syrian Kurdish factions that are run by the Democratic Union Party (PYD) are being armed by the US. The Syrian Kurdish militias solemnly promised not to hand over the US-supplied weapons to their PKK brothers in Turkey. There is no way to control this and the Turkish state media “Daily Sabah” is already complaining that Germany is delivering arms, and training PKK insurgents.

Erdogan is now transforming Turkey into an Islafascist state: a mixture of extreme nationalism combined with Islamism, a strong leader, backed by a strong army.