Redactional

In the past week Erdoğan has secured personal support from Brussels as Erdoğan is holding the key to the solution of the refugee crisis in Europe, he is forcing Brussels’ elite to accept his policy. His visit to Brussels cleared the way to grab more power, crack down on press freedom, increase the war against the Kurds and in the process abolish the democracy in Turkey. All of that without losing the support of Brussels’ elite. The bomb attack in Ankara this Saturday, will be the next pretext for Erdoğan to consolidate his power as the ruler of Turkey.

Erdoğan’s visit to Brussels was primarily to discuss the refugee crisis. When Erdoğan left Brussels many were surprised by the fact that both parties agreed to revive Turkish accession process to the European Union, without mentioning the dramatically deteriorating human right situation in Turkey. A clear sign Erdoğan is in the position to blackmail Brussels’ elite as he is holding the key to the current refugee problem. The European leaders are scared to death for the growth of the current refugee crisis in Europe.

Israel biggest enemy in the Middle East is Hezbollah. The Shia organization Hezbollah is much stronger, well armed and much better trained than the Sunni organization Hamas, in Gaza. Hezbollah is part of the Assad-Iran alliance and are armed by Iran. According to our analyst the Iran-Israel controversy is all about Hezbollah. A Nuclear Iran could arm Hezbollah with impunity. Israel will regard Iran’s armed forces in Syria as covert support for Hezbollah. Iranian troops at Israels Northern border will be unacceptable for the rulers in Tel Aviv, it will provoke a military reaction from Israel.

The situation in Syria is changing rapidly. Starting a full-blown war with the Kurds, Turkey signaled the US and its allies that it is not on the same footing. This summer it seems that the US succeeded in convincing the Turks to join the fight against the so called “terrorists”. Also round this time the US was given permission to use the Incirlik air base in Turkey and Turkey joined in preparing for the fight against the so called “terrorists”. The US was completely surprised when it turned out the Turkish definition of “terrorist” did not square with the US definition. After the announcement of the joined anti-terrorist operations, US diplomats were humiliated and embarrassed as Turkey directly went after the US-European main ally; the Kurd’s. Being completely in line with our expectation, Ankara’s definition of “terrorists” includes the Kurdistan Workers’ Party (PKK) and the Democratic Union Party (PYD). Since summer 2014 the Kurd’s could be considered Europe’s and the US’s most valuable ally. It looks like the US planners lack complete understanding of the situation. Continue reading

Is the tide finally turning from fighting the symptoms to treating the cause?

The migrants that are fleeing in from the Balkan, the Middle East and Africa did not come as a huge surprise for the European politicians. For many years now are millions of people fleeing their homes. But so far, practical enough for Europe, the refugees were seeking rescue in their neighboring countries. Relatively few people succeeded in reaching the northern African countries to cross to Europe from there or to try to make a rush for the fences of Melilla or Ceuta. The EU in its effort to build “Fortress Europe” even went so far as to associate with dictator Muammar Gaddafi, with whom they agreed on building and funding refugee camps in the Libyan Sahara.

In particular Germany’s asylum law reform in 1993 did not intend to fight the cause for flight, but was solely directed towards keeping refugees far from its soil. The concept for the now infamous Dublin Convention, according to which refugees have to seek asylum in the country where they have entered the EU, has been developed in the German Ministry of Interior. Continue reading

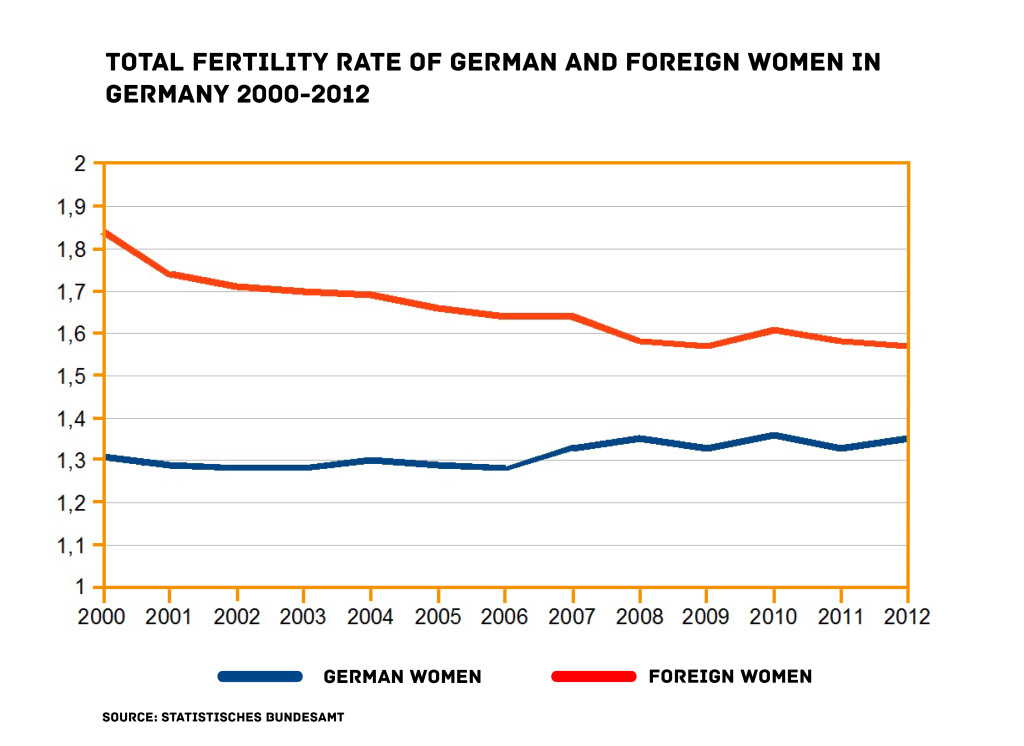

To sustain the population level of developed countries, The Total Fertility Rate should be 2,1. Continue reading

After many years of prosperity, the tough time has come for the US shale industry. Dramatic US oil production decline is inevitable and many shale companies face bankruptcy. Their assets can end up to larger producers, reinforcing market concentration. US energy independence can only be saved by government intervention. US government will remove exports limitation and FED September rate hike suspension is related to the unsustainable debt levels US oil industry is keeping afloat. But that is simply not enough to prevent a collapse of the US oil industry. From our research we learn that cost per barrel declined slightly but decreasing production cost is not enough to compensate for lower oil price. US oil production already declined 400K barrels per day from its April peak. We estimate an other 2 to 3 Million barrels can be wiped out the coming year.

A few months ago, when the oil price rise again before the June crush, the US oil industry seemed to be able to go through the difficult times. „It is too late for OPEC to stop the shale revolution”1, „OPEC can’t stop the shale industry”2 – roared the headlines. However, after last publications of Energy Information Administration (EIA) the OPEC and Saudi Arabia are the only one to triumph. Continue reading

Reports on increasing Russian activity in Syria are covered by rumors about reducing support for separatists from Donetsk and Luhansk People’s Republics. Vladimir Putin most likely will not risk the game on two fronts and will shift his military attention to the Middle-East. He does so not only due to threats related directly to Islamic State (IS) and to eventual downfall of Bashar al-Assad, but also because of the fact, that the road to a victory in Ukraine leads through Damascus and Latakia.

Since September 1st the ceasefire in the eastern Ukraine has been broadly respected by both sides of the conflict. However, reported single incidents of violation have been pointed out each other by rebels1 and Ukrainian army2. Also Contact Group failed so far to agree on the pullback of heavy weapons3. Quarrels on elections in Luhansk People’s Republic and Donetsk People’e Republic4 also show that political confusion will not be stopped.

Inconsistent statements of separatists leaders regarding local elections cast doubts, though. They are beating about the dates of elections, not knowing if October/November term would be better or February 21st 5. It could be a symptom of sliding ground from under feet, because Russia seems to leave the Ukraine conflict for now. Of course, political pressure will not be diluted – quite the reverse! Continue reading

“The Germans long before …14 sought to destroy the unity of the Russian tribe forged in hard struggle. For this purpose they supported and boosted in the south of Russia a movement that set itself the goal of separation of its nine provinces from Russia, under the name of Ukraine. The aspiration to tear away from Russia the Little Russian branch of the Russian people has not been abandoned to this day. XY and his companions, the former protégés of the Germans, who began the dismemberment of Russia, continue to carry out their evil deed of creating an independent “Ukrainian state” and fighting against the revival of the United Russia (Единая Россия).”

Sounds familiar? This remark was made more than a hundred years ago by General Anton Denikin, one of the four most recognizable leaders of the anti-Bolshevik Russia during the civil war of 1917-1921. The other three were Alexander Kolchak, Nikolai Yudenich and Pyotr Wrangel. General Anton Denikin fought for a few years in the south of the former Russian Empire against the Red Army, but after some initial successes, he was forced to leave his fatherland. It was at that time that the West was very much interested in disrupting Russia. The two revolutions – the first one, often referred to as the bourgeois revolution, took place in February and the second one, the Bolshevik revolution, took place in October 1917 – were sparked off with the support and blessing of the Western powers. The British had a hand in dethroning the tsar in February 1917, the Germans substantially supported the Bolshevik party in October 1917: the leaders of the coup d’état that was to take place in October were transported in a sealed train from Switzerland across Imperial Germany to Sweden, from where they made their way to Petrograd (that’s how in 1914 the German-sounding Saint-Petersburg was renamed after Russia began the hostilities against Germany). Americans, too, chipped in. While Vladimir Lenin enjoyed German protection, travelling across Germany, Leon Trotsky, having spent a couple of years in New York with his family and two sons, was financed to cross the Atlantic and be on time in Petrograd to disrupt the Russian state. It was not only the financial and political support that helped the revolutionaries of all persuasions to bring about the collapse of the empire: national or ethnic resentment was also exploited, with the Germans advancing the idea of a Ukrainian nation as separate from Russians.

There were a number of Ukrainian leaders at that time, with Symon Petliura being one of the most recognizable. He was backed by the Germans, he was later backed by the reborn Polish state. The Polish troops together with some of his Ukrainian units advanced towards Kiev and even occupied it for a week or two in 1920. Quite a Maidan, was it not, even if short-lived? These are the events that General Anton Denikin referred to in the text at the opening of this article. The full date the part of which we intentionally deleted was 1914, while the letters XY stand for no less a person than Symon Petliura.

In 2014 we saw a kind of historical repeat. The Western powers made themselves felt in Ukraine, but especially in Kiev, and caused the legitimate president to flee the country. Also, a crawling civil war commenced in the Donbass, while Russia in response to all these events reclaimed the Crimean Peninsula, all of which led to the war that broke out eight years later. Today Anton Denikin might write something like this:

“The collective West long before 2014 sought to destroy the unity of the Russian tribe forged in hard struggle. For this purpose they supported and boosted in the Ukraine a movement that set itself the goal of antagonizing Ukrainians and Russians. The aspiration to tear away from Russia the Little Russian branch of the Russian people has not been abandoned to this day. Volodymyr Zelensky, Yulia Tymoshenko, Leonid Kravchuk, Petro Poroshenko, Vitalii Klichko (you name them) and their companions, the protégés of the West, who began the dismemberment of the Soviet Union, continue to carry out their evil deed of creating an independent “Ukrainian state” and fighting against the revival of the United Russia (Единая Россия).”

by the way, the phrase United Russia (Единая Россия) that Anton Denikin employed overlaps one to one with the name of the “Putin” party, which holds power in this largest post-Soviet republic.

This time, too, it is the United States, Germany and Great Britain along with Poland that are busy playing Ukrainians off against Russians. This time, too, they have found present-day Petliuras ready to serve them. Today, too, war is being waged, and today, like yesterday, it looks like Ukraine is on the losing end. So it goes. Will we be witnesses to yet another historical repeat in… 2114/2124?

During World War Two, after the Germans had attacked the Soviet Union, they approached General Denikin, who lived at that time in France, with a proposal of backing the Third Reich against the Bolsheviks. Anton Denikin was very much opposed to the Bolshevik rule in Russia, which is putting it mildly. Yet, he did not for a moment think it right to ally himself with the enemies of Russia, even Red Russia. Anton Denikin flatly refused and warned those Russians – and especially Ukrainians – who were willing to serve the Third Reich against the Bolsheviks. Anton Denikin tried to convince them that they were going to be miserable tools at the hands of the Germans, to be discarded the moment they were not needed.

It is said that the civil war in the Soviet Union did not end in 1922 – when Denikin, Wrangel and Yudenich were forced out of Russia, while Kolchak was taken prisoner and put against the wall – because the civil war in the form of resentment and a deep division running through Soviet society festered. It only ended when the Soviet Union was attacked by Germany. It was only then that the overwhelming majority of Soviet citizens of whatever political persuasion rallied around the Soviet leaders to defend Russia. Has not the same been happening since 2022 in Russia? Even those Russians who did not hold Vladimir Putin in high regard changed course and rallied around him. War and especially the resultant hardships were supposed to turn the people against the Kremlin: as it is, the opposite is true. Sure, there are some who have betrayed their country – there were some also during World War Two, like General Vlasov – but the majority have expressed their unwavering support for the leadership. Does anyone learn anything from the past? Does anyone study the past?

How did Germany fare between 1933 and 1940? The country was on the rise. It regained its full sovereignty after the humiliating Versailles Treaty, it had a strong economy and even stronger army; it had expanded territorially incorporating Austria and parts of Czechia; it had conquered Poland, Denmark, Norway, the Netherlands, Belgium, Luxembourg and France; it bent to its political will Slovakia, Hungary, Romania, Bulgaria, and Finland; Italy and Spain were its allies; with the Soviet Union it had an agreement that divided the spheres of influence. Germany was on top of the world. Only the United Kingdom challenged it, and this challenge was naturally weak and ineffective. The whole continent was under the German sceptre. What did the Germans do? Did they do their best to solidify their grip on the booty? Did they do their best to guard what they had gained? No. They decided to gamble, to swallow more than they could digest, to put at a risk everything that they had successfully won.

How did the West fare between 1991 and 2022? Just like Germany between 1933 and 1940. The West saw the collapse of the Soviet Union, the West’s rival of long standing; the West saw the enlargement of the sphere of its influence: all the central European former communist countries flocked to the West’s antechambers and begged to be let in. Most if not all of the former Soviet republics did the some. And to top it all, Russia, the direct heir to the Soviet heirloom, bowed and scraped before the West, and badly wanted to be regarded as a partner, a weaker, younger, smaller, but still a partner, a member of the Western club. The West’s companies took possession of the east European and post-Soviet markets; the West’s mass media and Western culture in general supplanted almost anything that was local and peculiar to post Soviet nations; the Western ideas and lifestyle were slavishly copied by Poles and Romanians, by Croats and Ukrainians, by Hungarians and Russians. For years, Russia’s president Putin kept referring to the Western countries as Russia’s partners. Russia wanted to become a NATO member and wanted to join the European project by creating a kind of commonwealth stretching from Lisbon, Portugal, to Vladivostok on the Pacific. All of Europe, Russia and Ukraine included, along with the post-Soviet Asian republics, prostrated themselves to the West, paid homage to the West’s rule, acknowledged the West’s dominance, bowed to Western hegemony. For all practical purposes the International Monetary Fund and other financial institutions, the White House and Brussels set up models of economies, societal organization and what not in the post-Soviet area. It came to pass that one Western author who still is regarded as a scholar wrote the famous sentence about the end of history! What did the West do with all this? Did the West do its best to solidify its grip on the booty? Did the West do its best to guard what it had gained? No. The West decided to gamble, to swallow more than it could digest, to put at a risk everything that it had successfully won.

History really rhymes! The Germans of 1941 – with almost all of Europe – and the Americans along with the European Union of 2022 decided to make a final killing: they both decided to challenge Russia. History really rhymes and history really shows that no one ever learns anything from the past. After a period of military and economic difficulties Soviet Russia ended the conflict by shelling Berlin; today’s Russia, after a period of caving in is perhaps not about to shell Washington or London (although who knows?) but it is about to deal an even more fatal blow: it is about to destroy the American dollar and to lay bare the ineffectiveness of the West’s military; today’s Russia is about to upend the world order that has been so meticulously built by the managers of the world, by the Club of Rome and the Trilateral Commission, by the G7 and the World Economic Forum, by all those Kissingers and Brzezinskis, Albrights and Obamas.

Rather than enjoy consuming almost the whole of the continent as it could prior to 1941, prior to the invasion of the Soviet Union, in 1945 Germany ended up territorially shrunk, politically divided, morally broken and economically destroyed. Similarly, rather than enjoy the fruits of the collapse of the Soviet Union and continue holding a grip on almost the whole post-Soviet area, the West is about to slowly recede and witness its own collapse in terms of economy, society, morals and military. A repeat of the Titanic’s catastrophe: rich conceited people going under, with their big sophisticated project being smashed and crushed by a simple, uncomplicated iceberg. They will soon fight for the seats in the few life-saving boats that are still at their disposal. Something very much similar must have preceded the famous sack of Rome by the barbarians. And mind you, the West already has its barbarians inside, flocking in – day in, day out. When their number exceeds the tipping point, the sack will take place. (We have had smaller sacks in Paris and London, in new York and Los Angeles, rehearsals before the in general and final sack). And you know what? The majority of the populace in the West will continue to live in total denial of reality, just as ancient Romans did, the same Romans who witnessed the sack of their capital city, and just as Germans persisted to believe in their final victory in the months of February and April 1945.

The Germans could have enjoyed their conquests for decades to come and so could the West: both screwed it up. Fools.

It was in the run-up to the Second World War. Czechoslovakia was about to fall apart. It was not only the Sudeten Germans that rebelled and wished to be joined to the Third Reich; it was also Slovaks, one of the two brotherly nations – the other were Czechs – that made up Czechoslovakia. The Slovak and the Czech languages are like two sides of the same coin, i.e. very close to each other. If you master one of the languages – either Czech or Slovak – you will have no difficulties understanding the other while reading or listening. There will even be a specific time drag during which you will not figure out whether you are reading or listening to Czech or Slovak. That’s how close those languages are. And yet, and despite this relatedness of blood and customs, of the DNA and culture, Slovaks, or to be precise, those who happened to be the nation’s leaders, were hell-bent on separating Slovakia from Czechia, cost it what it may. Yes, cost it what the may, because in the process they were willing to cooperate even with Konrad Heinlein’s Sudetendeutsche Partei against Prague, they were ready to look for help from Berlin or even to join Slovakia to Poland, a Slavic nation, whose language, however, is not as closely related to Slovak as Czech is. Let it sink in: Slovak elites preferred to ally themselves with powerful Germany in order to destroy Czechoslovakia and harm Czechia without having a second thought that maybe confronted with the Third Reich on their own they would not be long for this world.

The same was true of the then Polish elites. They, too, saw a chance in the fact that Czechoslovakia was coming apart at the seams with the separatist Sudeten Germans supported by the Third Reich on the one hand, and the separatist Slovaks on the other. Warsaw, too, wanted to have a stake in the unfolding events, grab a chunk of Czechia and, possibly, subordinate Slovakia. The Polish elites naively thought and expected to be viewed by Berlin as partners in carving this part of Europe. Before long they learnt it the hard way that not only were they not regarded as anything remotely to being partners: in a year’s time Poland was invaded by Germany and deleted from the political map within a couple of weeks. A disaster that the Polish elites brought upon themselves or rather upon the nation that they had led into the abyss, because the elites for the most part worked or wormed or bribed their way out of hell into one of the Western countries, with most of them never to return.

Fast forwards, Yugoslavia. Slovenians and Croats loathed Serbs so much that they were willing to associate themselves with Muslim Bosnians and Albanians while going to war against Belgrade; they were even willing to trade their political sovereignty with the Western powers for aid in making the life of Serbs miserable. NATO began bombing Serbia into the Stone Age and carving the former Yugoslavia into ever smaller parts, but never mind that! The most important thing that Croatian elites cared about was to do harm to Serbia. That was about anything that mattered. Just like Slovaks in the run-up to the Second World War they, too, preferred the protection of the European Reich. Were they afraid that from then on they would be confronted with a power incomparably stronger and more sinister than Serbia? Nay. Who would have cared?

How about Czechia and Poland who had joined NATO on the eve of the alliance’s strikes against Belgrade? Did it cross the mind of the elites of those nations that one of these days they, too, might be subjected to sanctions and bombings if only they dared not to walk in lockstep with their overlords? Nay.

A bit more forwards, Ukraine. In 1992 Ukraine emerged as an independent state with a territory that it had never ever had in its history, with over 50 million inhabitants, a well-developed industry, broad access to the Black Sea and large areas of some of the most fertile soil that the world can boast. Consider it for a moment: Ukraine had a huge territory not because it took it from Russia with the sword or at gunpoint. Ukraine had a huge territory because it so pleased the Bolsheviks to create a large Ukrainian republic, and because it later pleased the leader of the Soviet Union Nikita Khrushchev to add to it the Crimean Peninsula. The only thing that the responsible Ukrainian elites were tasked with was to preserve that precious possession. What did they do? They acted in ways that were far worse than what the elites of Slovakia and Croatia did. Why worse? Because Ukrainian elites did not need to fight for their independence from Moscow: it was served them on a platter. Slovaks needed to conspire with Berlin and Warsaw against Prague; Croats needed to conspire with Berlin, Washington and God knows who else against Belgrade. Ukrainian managers did not. That is, they were obviously backed by the West, but there was no fight when the Soviet Union disintegrated. Ukrainians took or received Ukraine as a huge chunk of the heirloom after the deceased Soviet Union, and… they did their best to waste it, to bleed it dry, to turn it into the West’s bridgehead against Moscow. What for?

Why did the Slovaks want so desperately to tear their nation awat from Czechs even at the price of allying themselves with Germans and Poles? Why did the Croats (and Slovenians) so badly want to deal a mortal blow to Serbia, again allying themselves with the West, among others with Germany, the same Germany that had invaded and destroyed Yugoslavia a few decades earlier, in 1941? Why did the Ukrainians need to ally themselves with the West to senselessly ruffle Moscow’s feathers? Why could they not be pleased with what they had at the outset, in the year 1991? An independent Ukraine of that large territorial size and so numerous population as it emerged in the 1990s was a godsend and there is no exaggeration to it! Sadly, Ukrainian elites have been ready to fight their Slavic brothers outside and within their borders asking for help not only Germans whose forefathers used to exterminate Ukrainians by the tens of thousands, but also Poles, with whom Ukraine has had a hard time throughout centuries! What for?

Why is it so easy for the powers that be to put neighboring and ethnically closely related nations – Slovaks and Czechs, Croats and Serbs, Ukrainians and Russians – at loggerheads? What have those nations ever gained or what will those nations ever gain by being at loggerheads with each other? The Slovak state that emerged from the ashes of Czechoslovakia was a puppet state controlled by Berlin. As a reward, it was Berlin – Slovakia’s protector – that forced Slovakia to cede chunks of its southern territories to Hungary! Poland, which supported Slovakia in the latter’s separatist policy, was soon – as mentioned above – attacked by Germany and the German army enjoyed the support of the Slovak troops! True, the contribution of the tiny Slovak units was negligible, but the symbolic meaning of the event is gargantuan! The Polish elites were so hell-bent on destroying Czechoslovakia and elevating Slovakia only to receive a nice thank-you from the latter in a few months’ time!

Today Poland supports Ukraine against Russia, the same Ukraine with which Poland shares a history of mutual massacres and wars, and today Poland has been invaded by Ukrainians with the Polish nation growing more and more impatient with their presence. The first signs of conflicts begin to emerge here and there, recently most notably over Ukrainian agricultural produce that has dumped the Polish market. Whose interests does the Polish commitment in Ukraine serve?

Croatia used to be independent from Serbia as early as in 1941, when Germany destroyed Yugoslavia. Croatia used to be independent for a couple of years in name only. Sure enough, it did the biddings of Berlin. Whose biddings is Zagreb doing at present? If, as Croats claim, it was so hard to by overwhelmed by Serbs, how much harder must it be to be overwhelmed by the big European conglomerate of states?

What good do all the mentioned Slavic nations expect from the fact of fighting each other and doing someone else’s bidding? Their elites either did not pay attention during their history classes or… or they are not acting in the interests of their nations intentionally.

Croatia (or Slovenia, for that matter) and Slovakia did not want to send their deputies to the respective parliaments in Belgrade and Prague where their deputies would have held in between a third and a half of all the seats, but they are more than willing to send their deputies to the European parliament where they hold a tiny, negligible, insignificant number of seats. Where’s the sense?

Unlike Belarus, which is allegedly ruled by a dictator, Ukraine has followed the path of democracy made by Washington D.C. and approved by Brussels E.U. Now, the population of Belarus has remained stable for the last thirty years with barely an appreciable change whereas that of Ukraine has been… halved. A loss that is larger than that suffered during the Second World War. Which country has faired better? How about other factors? How about economy, war and peace? In plain English, given the choice, would you like to live under President Lukashenko or President Zelensky and/or his predecessors? Would you like to live under President Putin or President Zelensky and/or his predecessors? An unpleasant thought, huh? An unfair comparison?

As of now, Ukraine has already been destroyed (partly even long before the ongoing war); Poland, whose leaders wanted to play big and carve Czechoslovakia in 1938, was mercilessly destroyed a mere year later (today’s Polish leaders, too, want to play big); Slovakia, which separated itself from Czechoslovakia, later took part in the German invasion of the Soviet Union (what for?), and consequently was destroyed and subjugated by the Red Army in a few years’ time; Croatia, having murdered Serbs in concentration camps, was subjugated by Tito’s communists at the war’s end. They all – Poland, Czechia, Slovakia, Croatia, and Ukraine – have been but playthings at the hands of the powers that be, flexing their muscles and making believe that they want to pursue the policies that they are compelled to pursue, policies like accepting the green agenda or accommodating Third World people or doing away with swaths of their economies or coming to grips with the new normal in morality. The elites of these countries of whatever political persuasion are sure to continue in the footsteps of their predecessors. Croats and Serbs, Slovaks and Czechs, Ukrainians and Russians, Poles and Russians are certainly going to be pitted one against the other also in the nearest and remote future. You just cannot help it. It runs in their DNA.

The leftist West is getting a blow back!

– The elections to the European Parliament elevated parties that are maliciously referred to as far-right;

– the war in Ukraine is going badly for the collective West;

– in the United States Donald Trump, maliciously labelled as populist is about to win the presidential election;

– France and the United States are being pushed out of Africa;

– de-dollarization is in progress;

– Slovakia’s Prime Minister Robert Fico has survived the assassination (how the EU commissioners would have wished he had died!);

– Hungary’s Prime Minister Viktor Orbán is openly against the European Union’s policy of confrontation with Russia; and now – to top it all

– Turkey – has announced its willingness to join BRICS!

What a mess! Turkey, which boasts the second largest army in NATO, is about to seriously partner among others with… Russia, a country against which the same NATO is waging war!

The West is getting blow after blow after another blow. How ungrateful the world is! The collective West has been meaning to

– save the planet from the man-made climate change;

– extend the human rights by bringing to the forefront homosexuals and lesbians;

– eradicate racism by coercing races and nationalities to share the same ares, towns and villages, schools and factories,

and it turned out that the world has remained blind and deaf to all those advances… Goodness me!

All of which might suggest one serious suspicion: out of impotence and a thirst for vengeance the collective West might be thinking about retaliatory steps. What are these going to be? The leftist West needs to disrupt BRICS, to keep Russia at bay, to stop the march of the “far-right” through the institutions (a historical irony, indeed), to thwart Donald Trump from winning the elections, to preserve the dollar as the instrument of global exploitation and dominance, and so on, and so forth. What are they going to do? A wounded and hitherto domineering animal can be terribly dangerous.

On May 20 Volodymyr Zelenskyy’s presidential term expired, which poses a very interesting legal and political case. Russia does not recognize Volodymyr Zelenskyy’s authority any more. Which is not a malicious act on her part. The argument is that any agreement, accord, whatever signed by someone who simultaneously is not the head of a country entails grave political problems. Any next president of Ukraine may either feel bound by the agreement that Ukraine entered into with Russia under the presidency of Volodymyr Zelenskyy or may renege on it as signed by someone who did not have the legal authority to act as the country’s leader. Why should the Kremlin even bother to consider any talks with Zelenskyy if such is the case?

As of now, the West recognizes Volodymyr Zelenskyy’s power despite the expiry of his presidential term of office. Yet, the same legal case might be used by the diplomats in Washington, London, or Paris in any later development of events in Ukraine. They, too, might one of these days make a statement that they do not feel bound to honour any international settlement signed by Volodymyr Zelenskyy if only such a political move suits their purposes.

As is known, it is the interaction of the real military and economic factors that are at the disposal of the international players that matters. Diplomacy is merely a reflection of those real factors. Hence, if the West feels coerced to enter into an unfavourable settlement with Russia over Ukraine, it may intentionally make Volodymyr Zelenskyy sign it with the hindsight that the settlement is going to be revoked the moment the balance of powers tilts in the West’s favour. The fact that the legality of Volodymyr Zelenskyy’s presidential authority is questionable might be viewed as a wild card in any future diplomatic dealings between the West and Russia if the latter agrees to honour Volodymyr Zelenskyy’s signature.

At present, Ukrainian jurisprudence might recognize the current Ukrainian leader as the country’s legitimate president. That may change overnight. Particular legal provisions can be construed to mean whatever pleases the powerful. We all know that.

I keep returning to the same topic again and again. Yes, reporters and journalists, analysts and politicians love dealing with petty problems of whatever is happening, has happened or is going to happen. They immerse themselves and their minds in what was said by whom and what significance is to be assigned to this or that gesture. They love discussing the legal questions like whether Volodymyr Zelenskyy is still Ukraine’s legitimate president – his term ran out on 20th of May – or how and when the war in Ukraine will end. They are currently speculating about the outcome of the elections that are planned in June for the European Union and – how otherwise! – are afraid (who told them to be afraid?) of the “far right” winning too much of the vote. They set their sights on Trump and Biden and indulge in the same speculation about the outcome of American presidential election that is to take place later this year. Lots and lots of items of petty information. The term information noise is just the right one here. But why listen to all this petty news and these petty analyses every single day? All we need to do is to step back and see the broad picture. All we need to do is to understand the whole, the overriding trends, the phenomena as such. What are these phenomena? What are these general trends? What does the big picture look like?

We are having a big war in the territory that once was a part of the Soviet Union: in Ukraine. We have been having a number of local wars in the Caucasus, that is to say, also in the territory that once belonged to the Soviet Union. We have had successful or attempted coups d’état in Belarus, Kazakhstan, Georgia and elsewhere, also in the territories that were once parts of the Soviet Union. We have been told that hundreds of people have been killed as a result, still more have been maimed, displaced, driven into poverty. We have been witnessing heightened tensions between the West and Russia, with frequent military exercises and an increasingly frequent talk about the use of nuclear weapons. Now, these are the big, hard facts. What do we do with them?

If we view them as subsequent pages of the history book that is being written and has been written since the dawn of mankind, if we – as said above – let the petty facts and data capture our attention, if we – what’s even worse – assimilate and internalize the data for the sake of assimilating and internalizing them without drawing inferences, then we are wasting our time and life energy. We behave like students who attend lectures and classes and even try to memorize and practise things but who fail to grasp the overall picture, the workings of the mechanism; students who never really let the message of the overall body of lectures, classes and handbooks sink in and work its way into their awareness.

Take a step back, rid yourself of all the petty data and useless comments of the analysts or experts. Instead, ask yourselves a few questions and try answering them.

One. Would all those wars have taken place if the Soviet Union still existed? Would all those hundreds of thousands of people have been killed, maimed or driven into poverty if the Soviet Union continued to exist today?

Two. Would the West have ever dreamed about sending troops – mercenaries – military equipment inside the Soviet Union? Would the West have interfered so rabidly with the Soviet Union if it had existed till the present day?

Would Ukraine have lost at least 50% of its population, most of its industry; would Ukraine lost (sold) much of its fertile land to Western companies had the Soviet Union existed till this day? Would the Baltic States have become depopulated as they are (being) depopulated now, had the Soviet Union existed till this day?

Three. Would the still existing Soviet Union be a communist country or, rather, would it have gone the way of China, where capitalism is the base while communism is its ideological superstructure? In other words, is it not true that the Soviet Union, if it continued to exist today, would be communist but in name?

Four. Somehow anachronistically, but still: drawing a lesson from the fate of the post-Soviet area and era, if you have had decisive power before 1991 in the Soviet Union, would you have ever, EVER surrendered to the West? Would you have ever, EVER trusted the West? Would you have ever, EVER laid down your arms to the West?

Five. Again, having done your homework concerning the years 1991-2021, having been attentive during the classes and lectures delivered within the said period, would you ever want to become a part of the global market and manufacturing, doing away with some of your industries? Or, rather, you’d cling to autarchy as much is it is feasible and never relied on one global system of makings payments? As we know it has transpired that by letting your country become a part of the global system, you render your nation very much vulnerable: they – THEY – can cut you off from your own money and they – THEY – can try to starve you out in case you displease THEM.

Six. Do you still believe in free market economy, learning now and again that the United States – an alleged paragon of free market economy, of free economic competition and all those liberties – is going berserk imposing tariffs on Chinese products because they happen to be… better and cheaper? Hey, where do we have this lauded free market economy? Ah yes, we can have it so long as it serves the West’s purposes! The moment it dos not, we cannot have it. But of course, Chinese products are not blocked because they are better or cheaper – far be it from it! Chinese products are blocked because they have been manufactured under the conditions violating the human rights, and the like clap-trap!

By the way, if tariffs are imposed by the United States and the European Union because they protect respectively the American and European markets, why then tariffs among particular European states are viewed as detrimental? Would they not protect national economies? Or national economies are not worth protecting?

Seven. Being a responsible leader of any country, a patriot of your nation, or simply a good steward of the national economy and the territory that has been entrusted to you, and the security of your people, with the knowledge of the last thirty or so years, would you have ever, EVER signed those migration pacts? As can be seen, they only serve the purpose of diluting the local populations and ultimately destroying nations and states. Why talk about yet another batch of boats reaching this or that part of the European coast? They are coming here EVERY DAY. Why getting excited about it? It’s the huge problem that is important and this is: European and national politics have been hijacked by the powers that be and if you don’t like what is happening to your country – nation – you need to strike at the decision centre. Why in heaven’s name do they do it to us?

Eight. I know, this argument is repeated here and there, but I cannot refrain from rolling it out here again: war in Ukraine erupted because Russia could not tolerate Ukraine as a member of NATO or as a country used by NATO against Russia. Now Russia is of course to blame for the unprovoked aggression, is it not? But hey, if Mexico or Canada were to join a military alliance with Russia or China, if Mexico or Canada held joint military exercises with Russia or China, wouldn’t the United States invade Mexico? Would this invasion – aggression – be unprovoked?

Nine.

[a] Why are im-migrants to the Western world stubbornly referred to as _migrants as if they were to leave the West one of these days like migratory birds? Why is this misnomer applied and why do you – yes, you, my reader – recklessly, thoughtlessly repeat this term while talking about people who have arrived in the Old Continent or the United States to stay?

[b] The powers that be keep telling us that immigrants enrich each European country or the United States or Canada. Hang on for a moment: if the immigrants enrich us, by the same token they impoverish the countries they have left! Have you ever thought about it? So, we keep helping the poor countries by… impoverishing them! Wow!

[c] The powers that be reassure us that immigrants will assimilate and integrate and in the same breath they sermonize about the many human rights some of which guarantee anybody and everybody that his ethnicity, religion, customs and language be inviolable, inalienable, sacrosanct! How then are they going to assimilate and integrate?

[d] The immigrants keep coming to the Western world because of economic reasons, sometimes political ones. They are supposed to be loyal, good, law-abiding citizens in their adoptive countries. Hang on, again! Once such individuals left their own countries – nations – in search of a better life, they will not give two hoots about leaving the adoptive country the moment they figure out there is a better life somewhere else. What kind of loyalty is that? What civic virtues are these? How valuable are they?

Ten. If uniting nations – countries – is a good thing, why then most people approve of the dissolution of the Soviet Union, Czechoslovakia and Yugoslavia? Why did the nations of the three political entities mentioned in the foregoing sentence seek to separate themselves from the union on day one only to apply for membership in another union on day two? Consider, Czechs and Slovaks did not want to live within the same political structure known as Czechoslovakia, but they BOTH entered the European Union and so ARE members of THE SAME political structure. Where’s the sense? The same is true of the nations of former Yugoslavia: they divorced in order to… marry again within a broader family. Why didn’t German Lands divorce prior to collectively joining the European Union?

Eleven. So long as the Soviet Union existed, its citizens were presented to the world as homogeneous people who may have spoken different languages or observed different traditions but who basically were Soviet people. The same was true of Yugoslavia. The country may have been made up of Slovenes, Croats, Serbs; of Catholics, Orthodox Christians and Muslims, but all in all they were known as Yugoslavians. Now it took just a few minutes (from a historical perspective) for the many nations who allegedly were not all that important to be reborn with intense national sentiments and to be at each other’s throat. The BIG question is: why does it not occur to the EU commissioners that precisely the same fate awaits this political superstructure? Why does it not occur to them that by importing Third World people by the millions they add fuel to the fire of the future civil war rampaging across the continent? Whence this hubris? The feuds between particular ex-Soviet republics and the hostilities between ex-Yugoslavian republics are within human memory! What amount of hubris does it take to make the managers of the world and to make common people think that this time things are going to be different? We have assigned ourselves the scientific description of being homines sapientes – reasonable men. Where is our reason? Where is our reasoning?

Twelve. If Ukraine had not flirted with the Western military, if it had not provoked Russia, wouldn’t it have now ALL its 1991 territory INTACT? Even more interesting: if Ukraine had had a “dictator” like Belarus has had and continues to have, would Ukraine have experienced [a] war, [b] loss of territory, [c] loss of lives, [d] massive emigration (read depopulation), and [e] destruction of its infrastructure? Answer the following question with all sincerity you can muster: would you rather have been a citizen of Ukraine or Belarus for the last twenty or so years? Would you rather have a string of “democratic” presidents and war or a “dictator” and peace? I dare you to answer!

Some say the world in between 1991 and 2022 was a unipolar world, while prior to that time it had been a two-polar world, and after 2022 it has again become a two- if not or multi-polar world. Wrong. We have always had a bi-polar world and this bipolarity has always been viewed religiously. Surprised?

The world has always been divided – politically speaking – into us and them, into the in-group and the out-group, and – religiously speaking – the world has always been arranged along the axis of heaven and hell, Olympus and Hades, God and Satan. In the antiquity it was Greece and the rest of the world – the barbarians. Then it was the Roman Empire and the rest of the world – the barbarians. Then it was Christianity and the rest of the world – the pagans, the heathens. Starting with the the Enlightenment it was civilization against savages and cannibals. Today it is democracy against autocracy, despotism, fascism – you name it.

It has always been arranged along this religious axis: Mount Olympus, seat of the gods, the seat of those who are always right; at the foot of Olympus flocks of divine servants (quasi saints), demigods or heroes. And then, vertically opposite Olympus we have Hades or Hell, with Satan and his helpers – lesser devils or demons. In between we have the earth’s nations that are torn between the two.

Yes, you guessed it right. From the West’s perspective Washington is Olympus while the successive presidents are incarnations of Zeus, God himself, holding up a torch of all virtues with which they try to illuminate the world. Zeus is accompanied by helpmates – assistants – smaller gods and demigods or – to use Christian terminology – (patron) saints who are assigned diverse tasks. These are all the countries that make up the collective West: Europe, Canada, Australia and New Zealand. Smaller gods, demigods or saints are not by any means equal in their clout and leverage: unquestionably France or the United Kingdom are higher up in the celestial hierarchy than Poland or Bulgaria. And there are – mind you! – individual nations that spend time in purgatory, individuals – nations – countries – that aspire to be admitted in the celestial circles but need yet to be cleansed of their sins. Serbia might be regarded as such an entity or Georgia.

Then we have hell, hades, the underworld of evil, wickedness and what not. Russia is present-day Satan while China impersonates Mephistopheles, with Belarus, North Korea, Iran and some others being assigned the roles of smaller princes of darkness, demons or moral counterparts of demigods or saints. The world is really arranged along the lines of this simple axial design of plus and minus, of good and evil, of the good ones and the bad ones, of saints and demons.

No need to add those who are viewed through the Western lens as demons and devils have an entirely opposite perspective in which the positive and the negative poles are reversed, in which the alleged Satan is God and the alleged God is Satan. There can be no reconciliation between the two. It is a struggle for life and death, a conflict of cosmic dimensions, with no compromise possible, no give-and-take attitude, with no middle ground. The feud is as cosmic as cosmic can be. There can be no rapprochement between God and Satan.

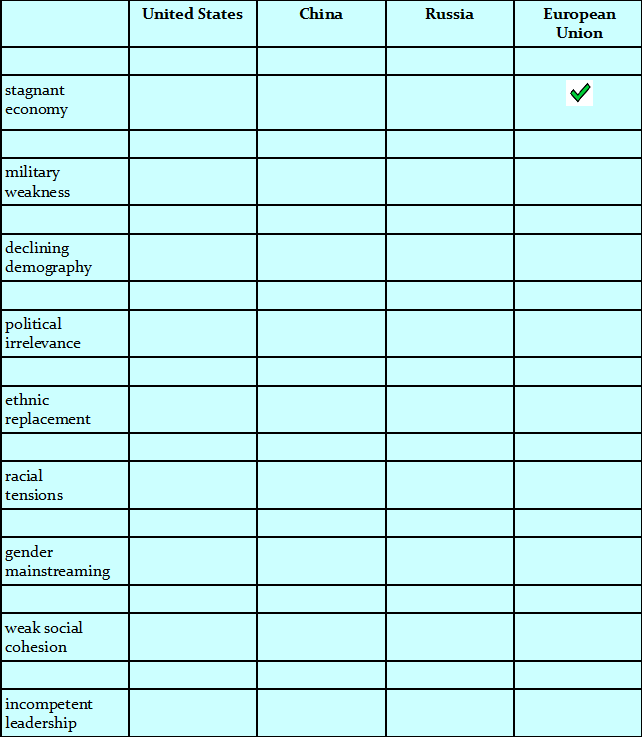

Rather than being presented with the data or an opinion of an expert or a pundit, we invite you to make your own evaluation of the state of the affairs. Drawing on your knowledge, tick off the boxes wherever you see fit and arrive at your own conclusions.

– What would you say about the entity that has gathered the largest number of ticks?

– What would you say about the entity that has gathered the smallest number of ticks?

Let us know.

In case you were wondering, a political entity may be ill-served by the international law once it becomes a signatory to it. In the power struggle that has always taken place and continues to take place, also the most noble ideas – like the introduction of international law – are wielded in the hands of politicians as weapons. You need to be on your guard also – or especially – when you are asked to agree to a piece of legal text to be later bound by it. Take the provision that makes culpable the party which begins a military aggression. Is that an irreproachable provision? At the face of it, we tend to answer approvingly. Yes, aggressors need to be condemned and need to be prevented from acting. Consequently, signatories to such a provision tend to think that this piece of legislations will serve them right. Not by any means!

One of the signatories may figure out the following: we can carry out attack after attack and so long as it is no physical – military attack – we are not going to be labelled as aggressor, while the other party is going to sustain political and economic or social losses. Thus, such attacks are carried out by one party to the detriment of the other party. Party A begins poking Party B in the eye, in the stomach, in the arm, Party A launches verbal attacks and only waits for Party B to either patiently accept such blows and sustain further losses or punch back. In either case Party A is holding the winning hand. It either continues tormenting its opponent, or provokes the opponent into pouncing back, in which case the opponent is internationally recognized as an aggressor. A nice legal trap.

Picture to yourself an ordinary circumstance: you intend to behave in a peaceful manner but someone keeps verbally abusing you, keeps ridiculing you and poking you now and again. We all understand: even if your patience and self-control equals that of an angel, sooner or later (some sooner, some later) you will punch back, and that’s it: you become an aggressor!

A wise man said: war ought not to be blamed on the one who began it, but on the one who made it unavoidable.

The economy is overheated. Or perhaps underheated? Efficiently networked or shackled by fragile supply chains? How can you not lose in a trade war and how can you make money in a conventional war? But only effectively and in the spirit of ESG (taking into consideration environmental, social, government facets). We will be saved by technology, the educated proclaim. Artificial intelligence will destroy us, proclaim the apostles of mainstream wisdom.

In 2024, for the first time in human history, elections will be held in 76 countries with more than half the world’s population, including eight of the ten most populous countries in the world: India, the United States, Indonesia, Pakistan, Brazil, Bangladesh, Russia and Mexico. Every second adult on our globe will be taking politicians to task for the way they have governed in a time of decline, inflation, bloody conflict and widespread disinformation. In place of the shocks that tested the maturity of the political class, more black swans are sure to appear. There has been a pandemic, there is a war in Europe and, to make the end of 2023 even more stark, there is the eruption of a dormant volcano of savagery in the Middle East. The smaller, smouldering armed conflicts that have been going on for years are no longer noticed because they are no longer on our holiday or business agenda. On the other hand, we suppress the threat of war either unintentionally or deliberately.

It will be a year brimming with surprises, in which more than 4 billion voters worldwide will dance to the tune of the new media. Never before has social media been better placed to politically dominate such a large public sphere and supplant the authority of traditional mass media. This seemingly most democratic form of direct contact with the electorate has simultaneously become fuel for manipulation, disinformation, panic and the stigmatisation of opponents. Opinion leaders on Twitter now have infinitely more power to reach and mobilise the electorate than the dinosaurs of old-fashioned campaigning methods. Unverified sources of knowledge, non-existent opinion leaders, ubiquitous fake news driven by the vast capabilities of artificial intelligence…

On Europe’s socio-political radar, the boats of another violent wave of migration can be seen. The EU is supposedly testing new instruments to send people back to where they came from. However, they will prove to be as ineffective as all the previous ones. You don’t have to be a fortune teller to predict this. The EU’s external borders should be impermeable to migrants and solidarity regulations will only deepen the divide between Western and Eastern Europe because coherent Eastern European countries with their traditional societies did not and do not want immigrants.

The countries where elections will be held in 2024 generate more than half of global GDP. This is where the partners and customers who supply us create, produce and employ: with components, raw materials, food, services and expertise. And this is precisely where the economic systems will have to drift to the right or left. And you, as an entrepreneur, have to ask yourself the question: do you prefer a free market that leans to the right or to the left?

Whether we like it or not, we are living in interesting times.

The text might as well be titled China and the USSR or India and the USSR or, or, or. You will soon know why.

The nation of Kurds numbers some 40 million people of which an estimated 14-15 million live in Turkey (10 million – in Iran, 6 million – in Iraq and 2 million – in Syria). Turkey’s overall population amounts to 85 million, so Kurds make up a fifth of it. What’s even more important, they occupy an area in Turkey that is all-Kurdish (just as is the case in corresponding regions in neighbouring Iran, Iraq and Syria). Kurds, therefore, ought to have their own national state, an independent state, carved out of the pieces of territory inhabited by them in the four countries aforementioned. Why, the United Nations pursues the principle of the self-determination of nations (ha! ha! – when did you last hear about a dependent nation being able to win independence in keeping with this principle that is enshrined by the United Nations?) Understandably, none of the countries that have large Kurdish minorities has any intention to even theoretically consider ceding a part of their territory to the nation of Kurds and letting them have their own independent state. Why understandably?

Kurdish-inhabited areas in the Middle East (Wikipedia)

Because in politics and generally among people it does not pay to be magnanimous, to be friendly, to be evangelically meek. If the meek shall possess the earth, then maybe in afterlife. Case in point? The USSR.

After four decades of the Cold War, the formidable Soviet Union, an empire that everyone reckoned with and respected if not feared, that empire surrendered to the West, its opponent, almost unconditionally, just like the Third Reich in 1945, with this significant difference, however, that the Soviet Union showed good will without being shelled into Stone Age and thus compelled to lay down its arms. The capitulation was complete:

[1] the military block of the USSR’s satellite states was dissolved;

[2] the economic union of the USSR’s satellite states was disbanded;

[3] the Marxist-Leninist ideology – the driving force behind Soviet policy-making – was abandoned entirely and condemned;

[4] the Union of the Soviet Socialist Republics was disunited, disassembled (though a referendum held prior to that event showed that the majority of the USSR citizens did not want it) and new independent states emerged;

[5] capitalism was invited to all former socialist countries and replaced socialist economy;

[6] the Soviet past was in the years to come savaged in the media, lambasted in the educational system and bad-mouthed in the entertainment;

[7] post-Soviet elites bent over backwards to please their Western partners;

[8] almost everything of value was privatized, which is another phrase to say: sold to Western companies.

Good will and meekness. Yet, to paraphrase Saint Paul, the wages of good will and meekness is death. In return for their good will and meekness the Russians received:

[1] economic chaos;

[2] domestic terrorism and wars with national minorities;

[3] the ever-growing expansion of NATO, encircling their territory;

[4] refusal to be accepted to NATO;

[5] refusal to be accepted as equal partners in a world united from Lisbon to Vladivostok, as proposed by Russia’s president;

[6] an inimical Ukraine (apart from the inimical Poland, the Baltic States, Romania and the ever belligerent Caucasus), a Ukraine which was reeducated to hate all things Russian, trained to fight a war against Russia, encouraged to kill Russians (the fourteen(!) thousand in the Donbass region in the years 2014-2022, the fifty or so incinerated in Sevastopol, to name just two cases);

[7] the ongoing proxy war with the West.

Consider the last point. Rather than holding the whole territory of Ukraine with its 50 million(!) people (such was Ukraine’s population in 1991), its agriculture and industry, now Russians must fight them or else the anaconda’s stranglehold around them would soon deprive them of their last breath.

Back to Turkey. Why should Turkey let go of its Kurds, China – of its Uyghurs? Why should India disintegrate into the many states that it is made up of? Why show good will and meekness? The wages of good will and meekness is death. Such must be the inference that the ruling elites of the said countries must have arrived at. Imagine China giving up on Tibet and Uyghurs or Turkey letting go of its Kurds and maybe Armenians… Beijing would soon have a proxy war in its backyard against Tibet or Uyghurs (both supported by the United States), while Turkey – a war against Kurds and Armenians (supported by Iran or Syria).

The West have taught everyone a good lesson: be strong and expand, never give up or else. And remember: the wages of good will and meekness is death.

For public finances to be healthy, the economy must be sick

The fiscal conservatism of Germany and the Netherlands clearly limits the growth potential of both countries. The 45% of economists and think tanks active in the AIECE research network consider the current monetary policy in the eurozone to be too restrictive, while only 25% consider it to be correct. In particular, the respondents pointed to the governments of Germany and the Netherlands as those that are only insufficiently supporting their economies. The budget deficit of these two countries will amount to 1.6% of GDP this year for the former and 2% of GDP for the latter. By way of comparison, the figure for Italy is expected to be 4.4% and for France 5.3%. At the same time, many countries are struggling with much higher inflation than those between the Rhine and Oder, for example. It’s like between an anvil and a hammer: either you spend less money on stimulating businesses, leading to a slowdown in the economy and ultimately to recession in the country (Germany, Netherlands), or you increase public debt and the budget deficit through excessive spending, pumping money into the economy, which brings inflation with it (Italy, France).

In 2023, it paid off to pursue an expansionary fiscal policy that avoided a recession. In terms of GDP, higher government spending in Italy and France replaced falling demand, leading to positive growth rates. Countries that cooled their fiscal policy achieved lower growth rates and in some cases paid for this with a recession (see the Netherlands, where GDP fell by 0.3% year-on-year according to the latest figures). Denmark stands out from this pattern, as it achieved growth of almost 2% despite its restrictive fiscal policy. However, it is worth noting that economic growth was boosted by the huge success of Novo Nordisk, the manufacturer of weight loss drugs. Without the pharmaceutical industry, GDP would probably only have grown slightly.

At the same time, it should be noted that the higher inflation in countries with a more expansive fiscal policy is due to the fact that government spending has had to react to cost shocks. For example, countries that are more susceptible to supply shocks due to a higher share of food and energy in the basket of goods have taken more comprehensive and longer-lasting shielding measures for ordinary consumers. However, the reversal of these measures is slow, which is also slowing down the disinflation process.

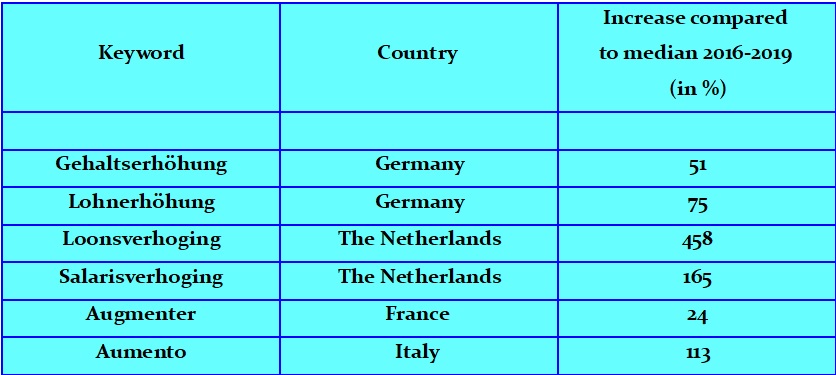

A new threat to inflation is the escalation of wage demands in the major EU economies. Figures from the European Central Bank (ECB) indicate that growth in collectively agreed wages was stable at just under 3% in the fourth quarter. At the same time, these figures are published with a considerable time lag and show a rather outdated picture that ignores the ongoing negotiations between employers and employees. A completely different picture emerges from the internet search data, where questions about pay rises are reaching historic highs in almost all major EU economies. For example, Dutch internet users are now twice as likely to search for terms relating to pay rises than in 2016-2019, i.e. before the pandemic. In such an environment, rapid disinflation is highly unlikely.

Quelle: Google Trends | Gehaltserhöhung = salary increase, Lohnerhöhung = wage increase, Loonsverhoging = wage increase, Salarisverhoging = salary increase, Augmenter = Increase, Aumento = increase

To summarize, the impact of fiscal policy in 2023 has proven to be quite intuitive and textbook, although it is worth noting that the consequences of some fiscal tools will also show up over a longer period than just a few quarters (e.g. investment, education spending, etc.). Countries that pursued expansionary fiscal policies had to accept higher inflation but managed to avoid recession, while governments that focused on central bank support had to accept recession/weaker growth but achieved lower inflation rates at the end of the year.

The biggest surprise on the financial markets this year is that inflation is continuing. While investors had hoped not long ago for 4 interest rate cuts by the Fed this year, there are now only 3, and with a significant delay. This underpins the thesis we have often expressed that central banks do not fully understand the dynamics of the current inflation. The indicators suggest that parts of the economy, such as real estate and the automotive sector, are struggling with high interest rates, while other sectors, such as the defense industry, the semiconductor industry, the AI industry and the manufacture of anti-obesity drugs, are experiencing a boom. So, after the pandemic, due to new IT technologies and the war in Ukraine, a two-speed economy has emerged, where monetary policy is more difficult, as supporting the weak parts of the economy can go hand in hand with persistent inflation, which is more costly for companies.

Investors try to glean from the Fed’s statements the level of future interest rates (i.e. how much the money – the loans – will cost businesses in the future). It is often the case that the worse the situation in the economy is, the higher share prices rise as investors hope that in response to weak economic data, the Fed will cut interest rates to stimulate the economy. Just yesterday (July 3, 2024) we had an example of this: the ISM index for the service sector collapsed and – excluding the Covid-19 pandemic – fell to its lowest level in almost 15 years. And Wall Street hit record highs in response.

So investors believe this two-speed economy will continue to work. Meanwhile, fiscal spending in the US is unsustainable in the long term and current government bond yields are increasing government spending related to debt, taking away funds for citizen welfare and infrastructure. The US government has to deal with the risk of an economic slowdown or risk letting inflation run high for longer. So the scenario is: whether Democrats or Republicans win, they will have to increase spending (read: inflation), which will cause the Fed to perhaps raise interest rates even higher.

Investors need to understand that the real killer for stocks is recession, not inflation. Yes, I know that the examples, such as the behavior of the stock markets in Turkey or Argentina, clearly show that high inflation need not be a particular problem for equities in the long term. But one day the moment will come: even large companies will not be able to generate higher profits in the face of expensive loans, high taxes and wages. On that day, it will no longer be worth putting money into shares. Even in the USA.

A few centuries ago it was all visible. A peasant – a serf – was obliged to work, say, three days a week for his landlord, and he was obliged to give away a part of the agricultural produce from his household. The amount of work and the amount of the produce were all visible, palpable. If a landlord wanted to extend the time of work done by his serfs for his benefit or take away from the serfs more than was prescribed, the serfs would have rebelled because it was a matter of survival and the maintenance of the standard of living. A serf needed the three remaining days to work for the upkeep of his family; the serf needed to have the rest of the agricultural produce at his disposal for his family to survive. If a serf had been forced to work four rather than three days and give away more than usual from his produce, he would have had less for himself and his family. In other words, working as much as before, he and his family would have had less. The serf would have known who was to blame for this.

Today it is all for all practical purposes invisible. A government prints more and more money and causes inflation. The government does not need to raise taxes. The amount of the tax that is levied on workers may stay the same. Still, due to inflation, labourers or present-day serfs, although they work as much as before, can buy less and less. Of course, sooner or later the present-day serfs notice that they are worse off, but they notice it belatedly and – what’s worse – there is no one person, known to them by name, who is to blame. Yesterday’s serf could have rebelled against his landlord and oftentimes he did; today’s serf can rebel against… inflation, which means against nobody. Yesterday’s serf could have threaten his landlord with a pitchfork – and sometimes it happened. Today’s serf can cast his vote from time to time, to vote out of office some, and vote into office others and, as a result, receive more of the same in terms of economic policy. None of the politicians that currently hold power can stop inflation, even if he wants to. The purchasing power of the present-day serf is constantly diminished, and though the present-day serf is not referred to as serf but, rather, as a citizen with a batch of human rights, he can do nothing about being robbed of the fruits of his work.

Historical record shows that prices used to be stable over decades. Our day-to-day experience teaches us that generally in a longer perspective prices can only rise. If they level off, then but for a short time, while they never fall if viewed over a longer period.

The leftist West is getting a blow back!

– The elections to the European Parliament elevated parties that are maliciously referred to as far-right;

– the war in Ukraine is going badly for the collective West;

– in the United States Donald Trump, maliciously labelled as populist is about to win the presidential election;

– France and the United States are being pushed out of Africa;

– de-dollarization is in progress;

– Slovakia’s Prime Minister Robert Fico has survived the assassination (how the EU commissioners would have wished he had died!);

– Hungary’s Prime Minister Viktor Orbán is openly against the European Union’s policy of confrontation with Russia; and now – to top it all

– Turkey – has announced its willingness to join BRICS!

What a mess! Turkey, which boasts the second largest army in NATO, is about to seriously partner among others with… Russia, a country against which the same NATO is waging war!

The West is getting blow after blow after another blow. How ungrateful the world is! The collective West has been meaning to

– save the planet from the man-made climate change;

– extend the human rights by bringing to the forefront homosexuals and lesbians;

– eradicate racism by coercing races and nationalities to share the same ares, towns and villages, schools and factories,

and it turned out that the world has remained blind and deaf to all those advances… Goodness me!

All of which might suggest one serious suspicion: out of impotence and a thirst for vengeance the collective West might be thinking about retaliatory steps. What are these going to be? The leftist West needs to disrupt BRICS, to keep Russia at bay, to stop the march of the “far-right” through the institutions (a historical irony, indeed), to thwart Donald Trump from winning the elections, to preserve the dollar as the instrument of global exploitation and dominance, and so on, and so forth. What are they going to do? A wounded and hitherto domineering animal can be terribly dangerous.

The most important central bank in the world, the US Federal Reserve (FED), recently presented its financial report, which shows that it had a substantial loss of USD 114 billion last year. Why such a large loss for the FED? To explain this, one should first distinguish between two aspects of the central bank’s activities.

Firstly, the FED holds large quantities of US bonds, which in turn yield interest. Of course, in this case, this interest is income for the central bank. It is worth noting that since the FED began buying bonds on a large scale in 2008, interest rates have also risen considerably

Secondly, the Federal Reserve allows commercial banks and various types of funds to hold money in an account at the central bank. At the same time, it pays a certain amount of interest on these funds, which depends primarily on the level of interest rates.

Well, between 2022 and 2023, there was a series of interest rate hikes in the US. Eventually, a level of 5.5% was reached. This meant that the FED had to pay 5.5% interest to banks and funds (and there were a lot of them) that wanted to keep their money in a central bank account.

So on the one hand, the Fed still held a similar amount of bonds in 2023, for which it received interest rates close to the 2022 level (i.e. much lower than this 5.5%). On the other hand, it had to pay much higher interest rates to commercial banks or money market funds. This resulted in the loss.

You may ask: What happens when a central bank suffers a loss? From a purely financial point of view: Nothing significant happens. It is assumed that this loss will be covered by future profits. In the context of a central bank, it is difficult to talk about bankruptcy, especially as central banks can create gigantic amounts of money under the current system.

Gefira is critical of the monetary policy of central banks, but for completely different reasons. No one from the central bankers is commenting on the following questions:

1) Is it fair that the central bank only rescued and wants to rescue selected financial institutions simply because they operate on a large scale?

2) Is it normal for these institutions (especially banks) to hold their reserves at the central bank and safely receive a few percent interest in return?

3) What’s more – is it fair that unprofitable companies are kept alive by the central bank printing money, which in turn makes it more difficult for new companies to enter the market?

4) Is it good for the economy that unprofitable zombie companies are kept afloat in this way, which otherwise – in the real free economy – should have gone bankrupt long ago?

In December last year, we wrote about Javier Milei – the recently elected President of Argentina. Now, with his recent speech in Davos, he has turned the bottom into the top.

To understand what happened and what Milei got himself into, you first need to comprehend what exactly the World Economic Forum (WEF) is and who makes it up. The WEF is the world’s elite: the CEOs of the world’s richest companies (only companies with billions in revenue are invited to the Forum), leading bankers and technology specialists, politicians, representatives of major business organizations, lobbyists, selected intellectuals, journalists and activists of all kinds. The WEF meetings are therefore full of people who use their connections and influence to try to steer the world in a direction that benefits them and not necessarily the majority of people. It’s about power and money, not about a better life for ordinary citizens.

The aforementioned elite meet every year in Davos to present their proposals on how they want to intervene in our lives. They negotiate agreements among themselves and exert pressure on the world’s most influential politicians. In the meantime, of course, there is a lot of empty talk and boring debates about the world’s social and economic problems. The founder of the forum is Klaus The-Great-Reset Schwab, who became known as an advocate of collectivism. He is credited with the famous saying: You will have nothing and be happy.

This is where Milei comes into play. In a place where the ideas of feminism, birth control and increased government intervention in the economy are supported year after year, where the foundations for Agenda 2030 and its associated eco-terrorism were laid, Milei looks the globalists in the eye and dismantles their propaganda simply and vividly by exposing the lies of the globalists.

In many of his interviews and speeches, Milei refers to the so-called culture war. In his view, the causes of Argentina’s decline are cultural problems and moral decay. Among other things, this gives rise to the deep belief that the state is the guarantor for the satisfaction of citizens’ needs. At the same time, the Argentinian president points out that state intervention is counterproductive, as it should only contribute to the opposite when trying to solve a problem.

Here we summarize the most important theses of his speech in Davos:

1. Capitalism creates prosperity and is moral

Socialism leads to impoverishment and is based on violence. Wherever socialism has been introduced, it has brought more harm than good.

“The West is in danger because it has opened itself up to socialist ideas. It was capitalism that liberated humanity from mass poverty and created unimaginable prosperity. (…) In the countries where we should be defending the values of the free market, private property and other institutions of libertarianism, parts of the political and economic establishment – some because of flaws in their theoretical approach, others out of a desire for power – are undermining the foundations of libertarianism by opening the door to socialism and potentially condemning us to poverty, misery and stagnation. It should never be forgotten that socialism is always and everywhere an impoverishing phenomenon that has failed in all countries where it has been tried. It has failed economically as well as socially and culturally. It has also contributed to the deaths of more than 100 million people.”

So capitalism, rather than today’s Western neo-Marxism, is the way to abolish poverty.

2. Socialism is a repressive and unjust system:

“(…) Social justice is neither fair nor beneficial to society. Quite the opposite. It is an inherently unjust idea because it is based on force. It is unjust because the state is financed by taxes and taxes are levied by force. Or would any of you say that you pay taxes of your own free will? In other words, the state finances itself through coercion, and the higher the tax burden, the greater the coercion and the less the freedom. Advocates of social justice assume that the entire economy is a cake that can be shared. Yet, this cake did not fall from the sky. It is wealth created by what Israel Kirzner, for example, calls the process of market discovery. If there is no demand for the goods produced by a company, that company will fail if it does not adapt to the demands of the market. If it produces a good quality product at an attractive price, then it will be successful and produce more because the market is a process of discovery in which the capitalist finds the right direction in the course of his actions. If the state, however, punishes the capitalist for his success and blocks him in this discovery process (through excessive regulation, as in the EU – author’s note), it destroys his motivation, and the result is that he produces less and the pie shrinks, which damages society as a whole. By inhibiting these processes of discovery and making it difficult to adopt what has been discovered, collectivism inhibits the entrepreneur and prevents him from flourishing.”

3. The fight for women’s rights or nature conservation is just a pretext:

“When the socialists realized that the workers were not getting poorer under capitalism, but richer, they changed their strategy. Today, the class struggle between capitalists and workers has been replaced by alleged conflicts between men and women or between man and nature. It is claimed that to save the environment, population growth must be controlled; abortion is promoted”.